Download “Investments in original European

content - 2011-2021 analysis” here

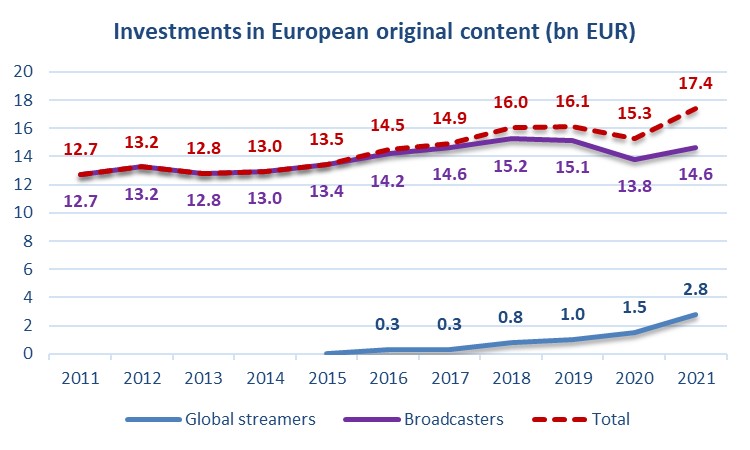

This brand-new report: “Investments in original European content - 2011-2021 analysis” has just been published by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg. The report analyses the evolution of financing of original European content by broadcasters and global streamers since 2011. “Original content” refers to all categories of original works (fiction, documentaries, game shows, talk shows etc.). “European” refers to EU27 + UK + Norway. Take-aways include:

- Total investments in original European content sharply increased with the entry of the global streamers in the European market. These investments by streamers were accompanied by an interesting knock-on effect: facing new competition and new standards for TV shows, private broadcasters also increased their investments while public broadcasters faced budget constraints.

- The streamers’ investments in European original production grew faster than their acquisitions.

- In 2021, Netflix accounted for about half of global streamers’ investments in Europe, but other streamers have started to catch-up.

- Spain is comparatively the main beneficiary of the streamers’ investments, and the role of the United Kingdom as the leading market for the production of original European content has been confirmed.