Download it here

The latest report from the European Audiovisual Observatory finds that:

- Around 140 “news only” TV channels are available in Europe and two out of five are aimed at a specific European territory

- On average, only one in four TV news channels available in a given European market broadcasts in that market’s official language

- 67% of all TV news channels established in Europe are controlled by groups owning only one news channel. This makes the ownership landscape for TV news channels appear rather pluralistic and varied.

TV news channels in Europe: Offer, establishment and ownership

This new report by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, provides an overview of the TV news channel landscape in Europe. Author Laura Ene, Analyst from the Observatory’s Department for Market Information, quantifies the offer of TV news channels in Europe, analysing their typology, assessing their availability, and identifying where they are established. The report also helps to assess the plurality of TV news supply in Europe by analysing the statute of the channels’ controlling entities, their concentration and the specialisation level of their extended media portfolio.

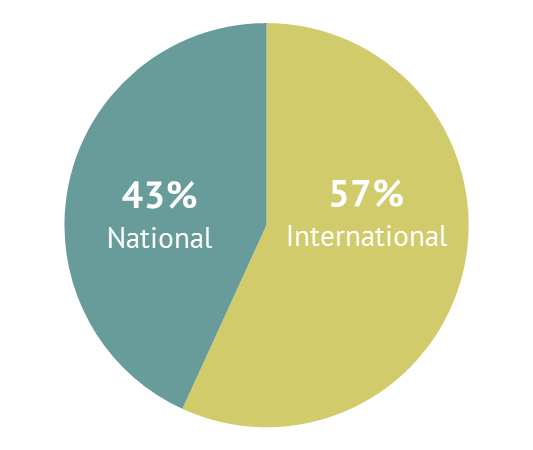

I. The availability of TV news channels in Europe

This new study finds that around 140 “news only” TV channels are available in Europe and two out of five are aimed at a specific European territory. A total of 43% of the news TV channels are national, meaning that their agenda is focused on one specific European territory and aimed primarily at the respective national audience. 57% of the TV news channels in Europe are international, meaning that either their agenda doesn’t have a national focus or their core audience is not European. Euronews, DW, France 24, RT, Al Jazeera and i24News are global networks offering multiple international news channels aimed at transnational markets or global linguistic communities usually through a multi-edition portfolio strategy.

Figure 1. Availability of TV news channels

Source: European Audiovisual Observatory / MAVISE database

Figure 2. The typology of available TV news channels in Europe by editorial focus and core audience

Source: European Audiovisual Observatory / MAVISE database

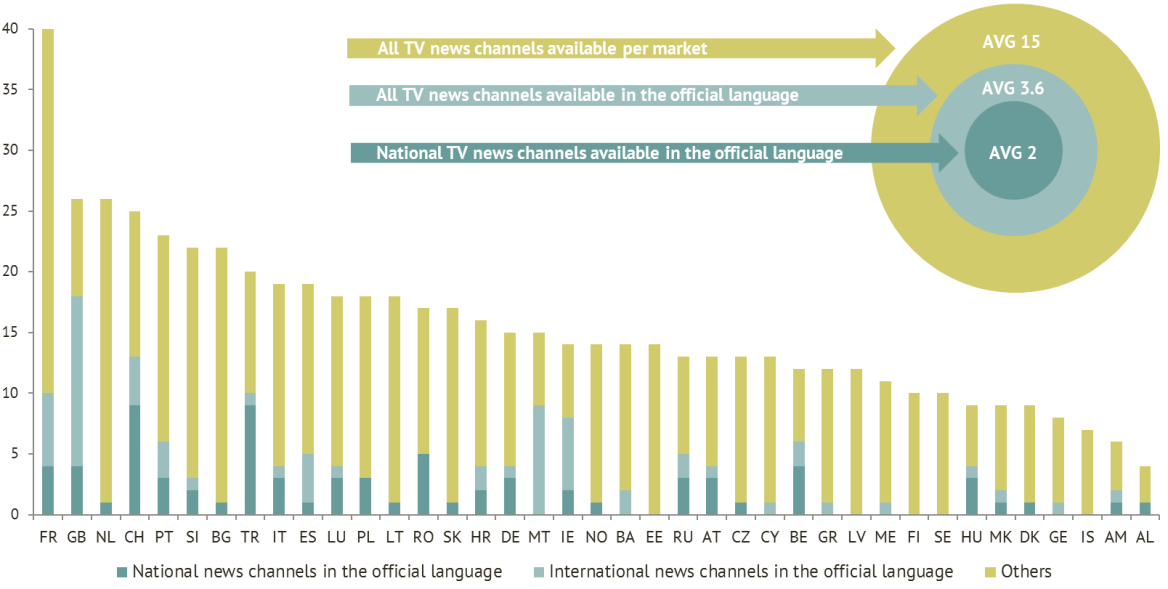

II. Linguistic diversity of TV news channels in Europe

On average, only one in four TV news channels available in a given European market broadcasts in that market’s official language. For the majority of the national markets studied, over 50% of TV news channels broadcasting in the official language(s) of the country are national channels.

Figure 5. Availability of TV news channels at market level in Europe

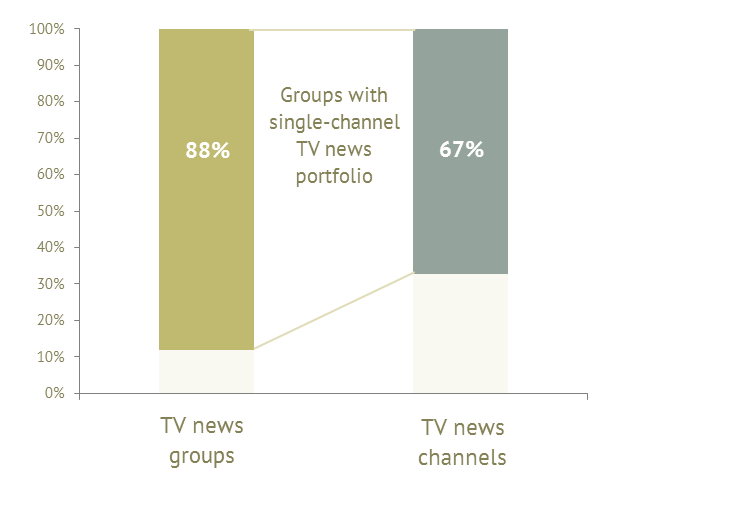

III. Diversity of ownership of TV news channels

67% of all news TV channels established in Europe are controlled by groups owning only one news channel. There are around 80 media groups operating news TV channels in the European territory. 88% of these broadcasting groups own a single TV news channel established and available in Europe. Although the landscape of TV news channels is dominated by private broadcasters, almost one in three TV news channels is supported by the public sector, a much higher share than for other TV channel genres.

Figure 10. Breakdown of media groups by number of news channels controlled in Europe

Source: European Audiovisual Observatory / MAVISE database