Download it here.

This report finds that

- The United Kingdom plays an even greater part in the provision of locally adapted (“localised”) services than the UK percentage of all audiovisual services established in the EU28.

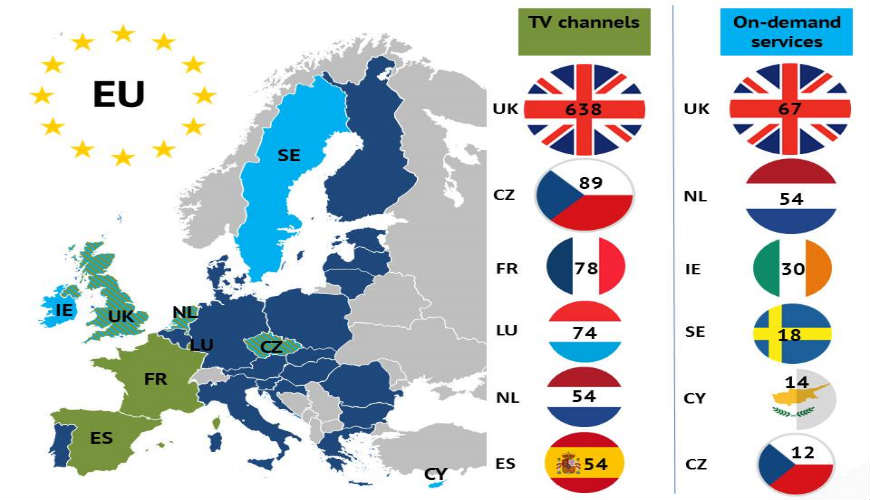

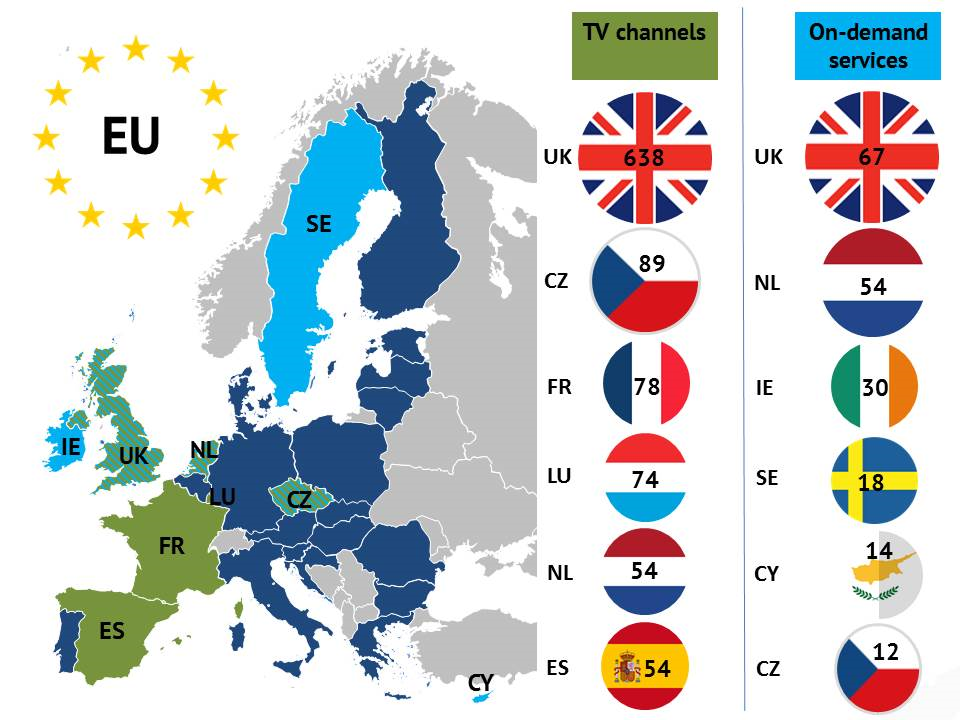

- Over two thirds of linear and pay-on-demand media services established in the EU, and targeting foreign markets, were concentrated in just three countries (UK, NL, IE for pay-on-demand services; UK, CZ, FR for TV channels)

- A total of 61 different languages are being broadcast across the EU.

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has just published a brand new report “Audiovisual Media in Europe: Localised, targeting and language offers”. Based on data gathered in the Observatory’s MAVISE database, this report provides an overview of the European audiovisual media landscape by looking at the origin of linear and pay-on-demand audiovisual services and their circulation from three complementary angles. The first focuses on localised services, reflecting a trend whereby an increasing number of services are adapted to different national markets either in the form of? TV channels in different linguistic versions or pay-on-demand services with local language user interfaces to increase viewership and subscriber numbers. The second angle looks at the impact that services specifically targeting other countries have on national licensing regimes. The third angle highlights the consumer perspective, concentrating on the various broadcasting languages of TV channels available to viewers in their home countries in a reflection of the language diversity in European markets.

The significance of localised audiovisual media services established in Europe

- At the end of 2017, one third of all audiovisual media services established in the EU28 existed as localised versions, representing a substantial weight in the overall audiovisual market. The percentage of localised pay-on-demand services was somewhat higher (35%) than that of localised television channels (32%). Over half of localised audiovisual media services were concentrated in just three countries: the United Kingdom, the Czech Republic and France accounted for 61% of localised TV channels while 53% of localised pay-on-demand services were based in the United Kingdom, the Netherlands and Sweden.

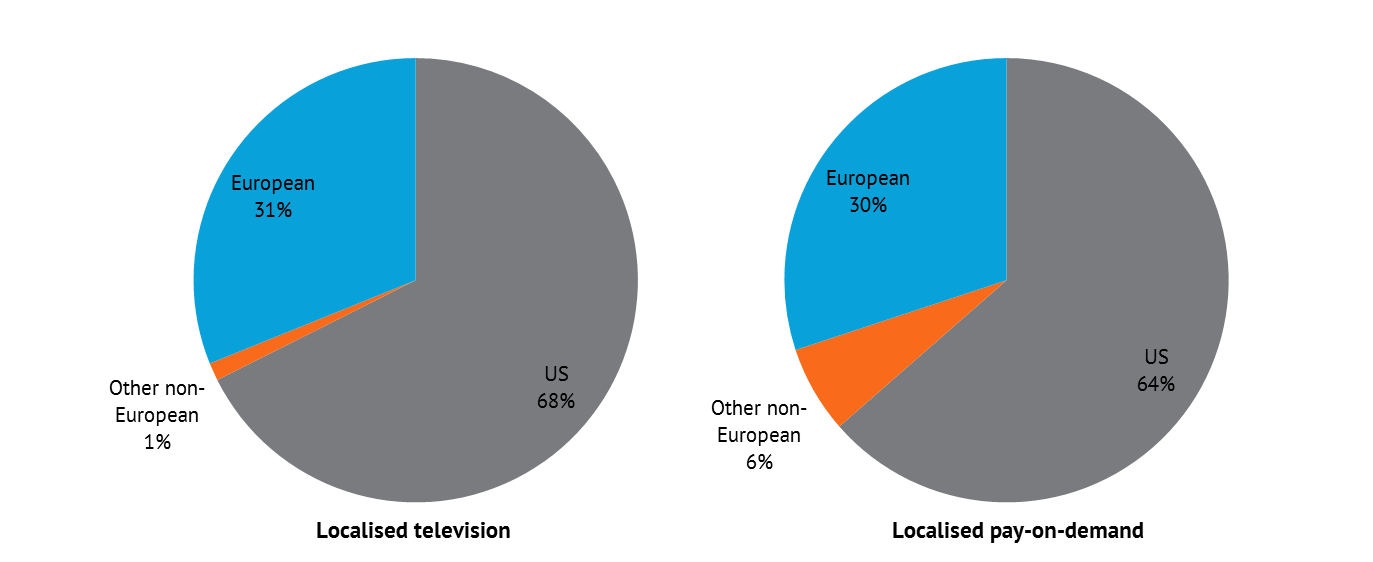

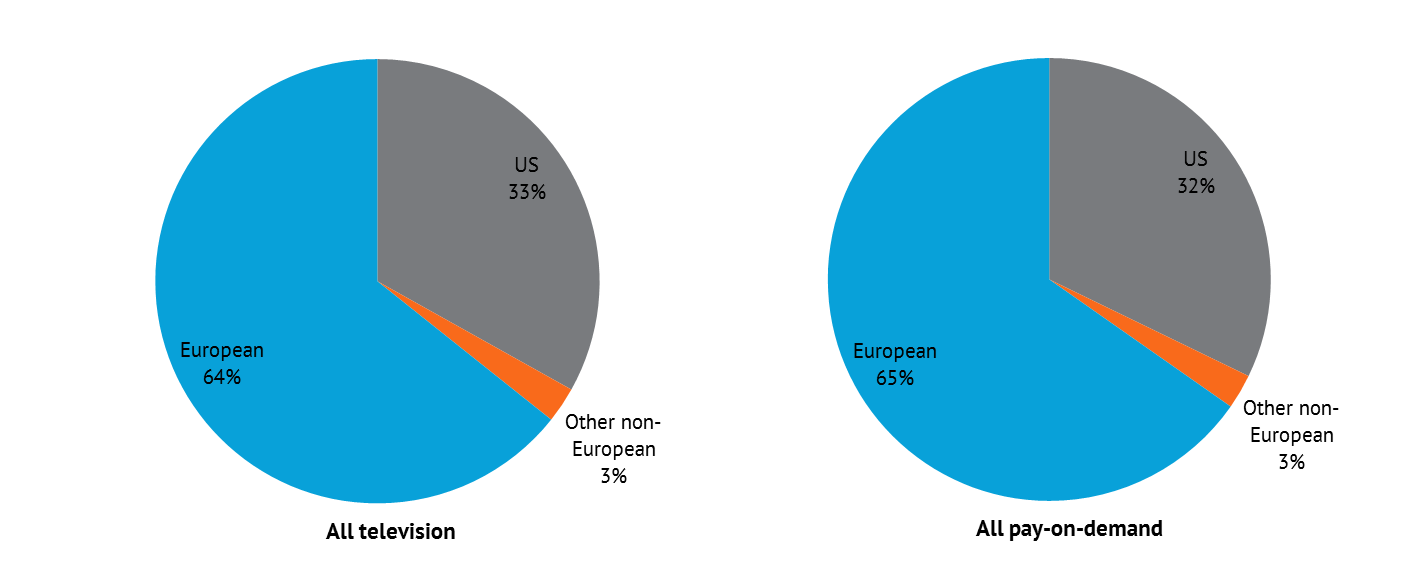

- Localised audiovisual media services were more likely to be owned by large US media corporations than the average media service established in the EU28. Two thirds of EU-based service providers of localised TV channels and localised pay-on-demand services belonged to a US parent company. Taking into account the total service offer, the percentage of localised TV channels was somewhat higher (68%) than that of localised pay-on-demand services (64%). The ratio was reversed when looking at all audiovisual services established in the EU: services with US ownership made up one third, compared to two thirds with a European parent group.

- While Amazon Prime, iTunes Store, Netflix and HBO Go accounted for only 13% of pay-on-demand services established in the EU28, they represented 38% of services when localised versions were considered. Similarly, while the top TV brands of US groups Discovery, Twenty-First Century Fox, Viacom and AMC Networks accounted for just 5% of TV channels established in the EU28, they represented 15% among localised services.

Breakdown of localised vs. all audiovisual media services established in the EU28 by origin of ownership (2017) – In % share

Source: European Audiovisual Observatory / MAVISE database

TV channels and on-demand services targeting other national markets: United Kingdom main hub

- Over two thirds of linear and pay-on-demand media services established in the EU by 2017, and targeting foreign markets, were concentrated in just three countries: The cumulated numbers of pay-on-demand services based in the United Kingdom, the Netherlands and Ireland accounted for 67% of all services targeting foreign markets, while linear services in the United Kingdom, the Czech Republic and France together comprised 69% of all such services targeting foreign markets.

- Three quarters of all television channels established in the EU and targeting foreign markets were in 2017 divided between five genres: film and TV fiction/series (24%); documentary (15%); sport (13%); children (13%); and entertainment (13%). The predominant genre of pay-on-demand services was film and TV fiction/series, with 86% of all services established in the EU belonging to this category, and generalist services at 8%.

- In 2017 there were 21 European countries targeted by at least 20 different linear services (18 EU countries, plus Norway, Turkey, and the Russian Federation), most of which were established in the EU28. Further, six European countries (five EU countries, plus Norway) were targeted by at least 10 different pay-on-demand services.

Central hubs of audiovisual media services established in the EU28 primarily targeting other markets (2017) – In number of services

© Copyright Showeet.com

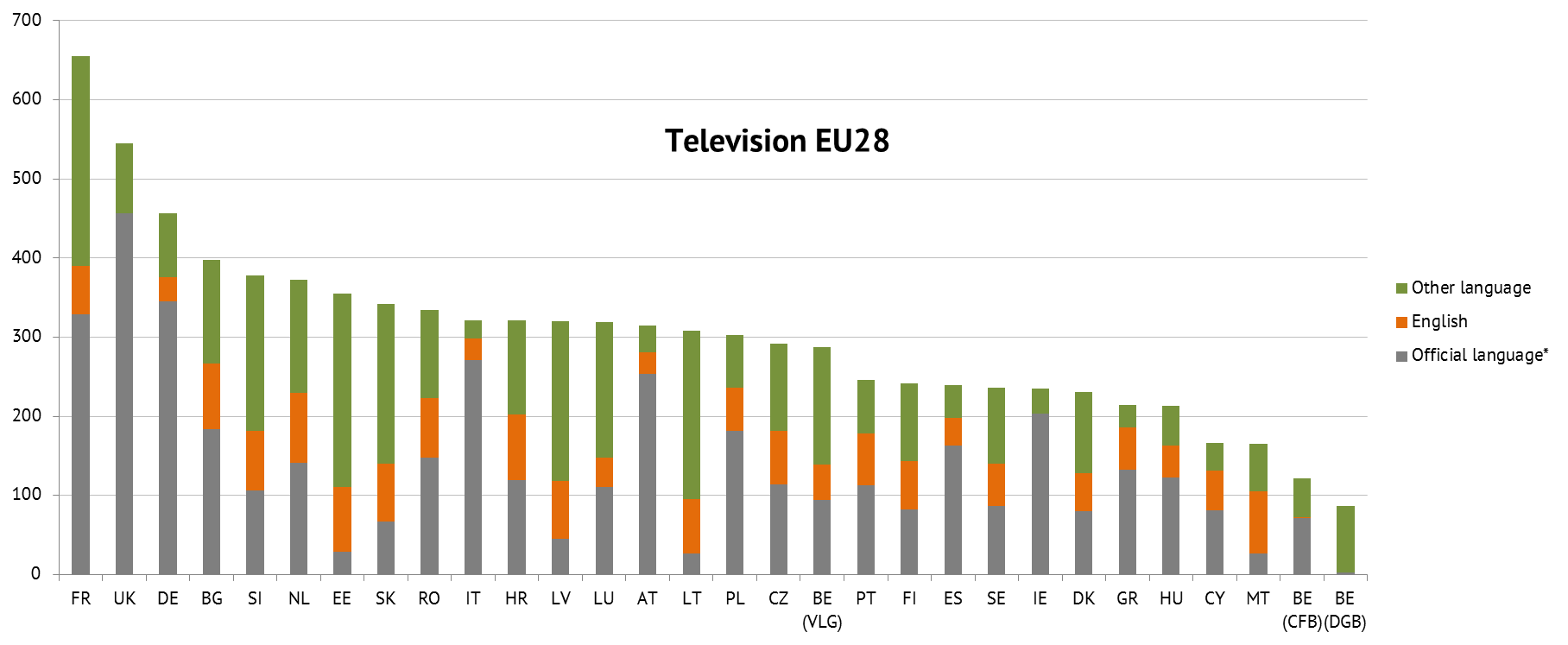

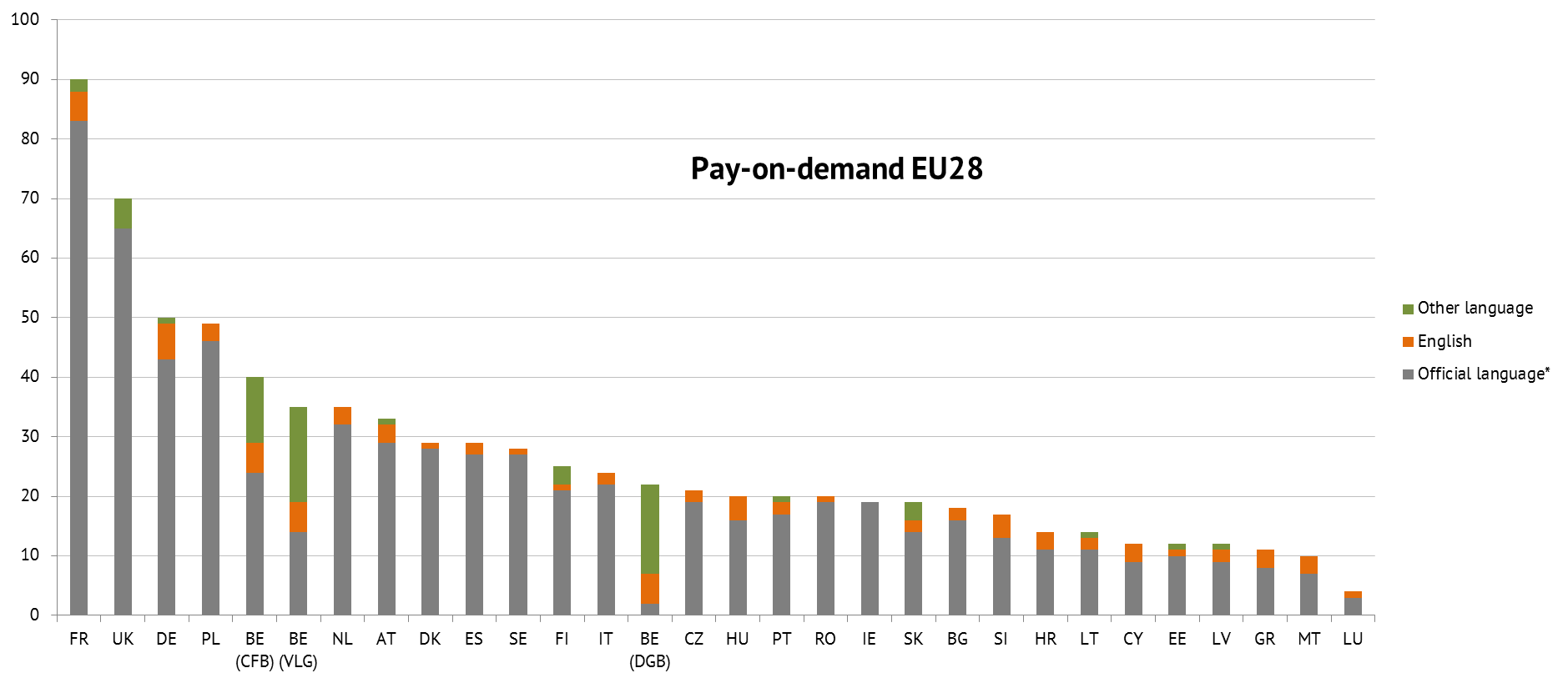

Broadcasting languages in Europe: France is the most diverse market

- A total of 61 different languages were being broadcast across the EU28 at the end of 2017. In 11 other European territories covered by the European Audiovisual Observatory the total number of TV broadcasting languages was 45. Combining both country groups, the number of broadcasting languages rose to 64 in total

- France was the most diverse market with 35 different broadcasting languages available in the country, including Arabic, Turkish and Mandarin Chinese as well as Hebrew, Tamil and Urdu. Other diverse EU markets in terms of broadcasting languages were Sweden (27), Germany (26), Poland (24), Slovenia (23), the United Kingdom (23), Denmark (22), and Estonia and Slovakia (20 each). In other European countries covered by the European Audiovisual Observatory, Switzerland (25), Norway (20), and Turkey (20) also offered a significant number of different TV broadcasting languages

- More than half of all TV channels in Iceland were broadcast in English - the highest share in Europe by territory, closely followed by Malta with 47% of services broadcast in English. The additional six European countries where more than one quarter of TV channels available were shown in English include Cyprus (30%), Portugal (26%), Norway (26%), Croatia (26%), Finland (25%) and Greece (25%).

Audiovisual media services available by language in the EU28 (2017) – In average numbers

Note: *Official language refers to main official language of a country.