Download "Top players in the European audiovisual industry – ownership and concentration / 2021 Edition" here

This brand-new report: Top players in the European audiovisual industry – ownership and concentration - 2021 Edition has just been published by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg.

The report aims to shed light on the structure of the AV industry in Europe in terms of revenues as well as other performance indicators specific to key audiovisual market segments. The analysis provides snapshots of the top AV players and explores concentration, statute, and origin of ownership by revenues, pay TV subscriptions, SVOD subscriptions, number of TV channels, number of on-demand services, TV audiences, number of TV fiction titles produced and number of cinema screens. It also provides transversal views for players active in more than one market segment.

All top lists are available for download in an excel format within the report and the majority of the rankings include more than the first 20 leading players of each specific AV market presented in the report pages.

The report finds that at the end of 2020:

- The top 100 audiovisual companies in Europe by operating AV services revenues showed resilience to COVID-19

- M&A activity has been pushed up by the streaming rush and the pandemic crisis

- US interests in the European AV industry follow an upward trend

- Top AV players in Europe are eclectic as regards their portfolio of leading activities

- SVOD remained the most concentrated AV market in Europe in terms of subscriptions

- PSBs accounted for one third of global viewing consumption in Europe

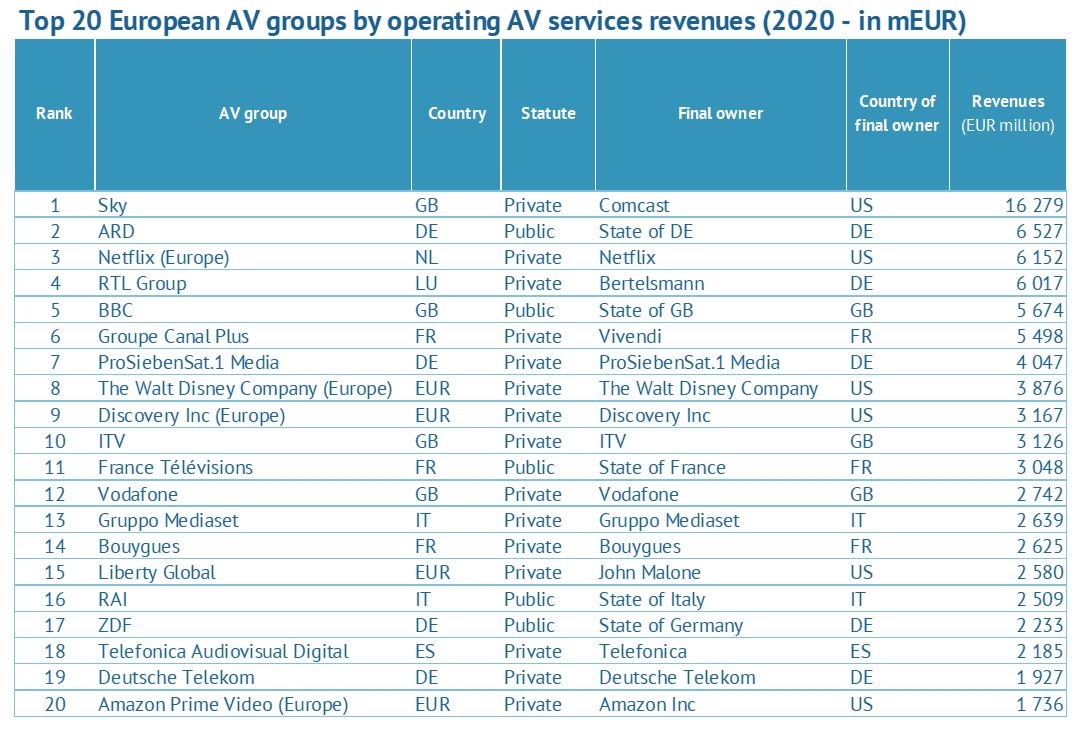

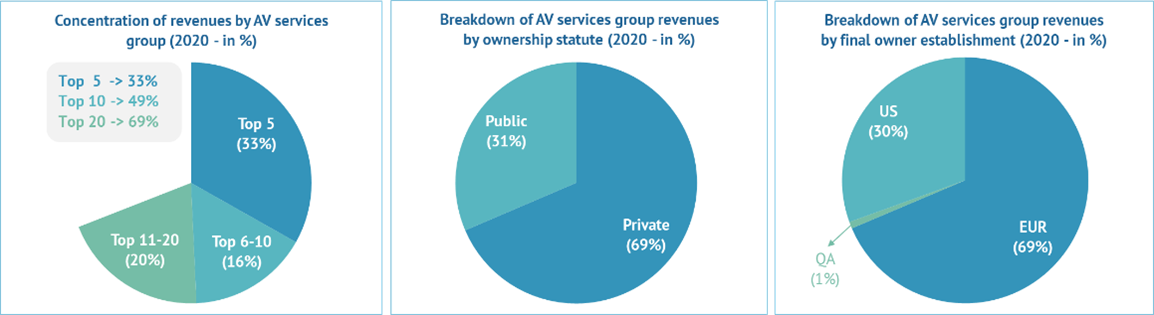

The cumulated operating AV services revenues of the top 100 audiovisual companies in Europe (+7.7% over 2016 at the end of 2020) grew slightly more than average inflation and the overall market. The growth was driven solely by the private sector (+12% over the same period), with over 75% of the incremental revenues cumulatively delivered by pure SVOD players alone (Netflix, Amazon and DAZN, for which separate data on European operations was available). By contrast, the revenues of the traditional players have stagnated, with businesses relying on advertising being more severely affected and PSBs weight dropping by 3% over the five-year period (down to 31% in 2020).

Source: European Audiovisual Observatory

Concentration remains similar over the analysed period, with the top 20 players accounting for around 70% of the top 100 European AV groups by operating revenues. Although this percentage is much higher in the private sector (85%), it still shows less concentration when compared to the US market.

The degree of internationalisation was on the rise regarding US interests for the five-year period (+4% up to 31% of the top 100 revenues in 2020) with a preference for prioritising direct as opposed to traditional indirect investments. While the share of US interests was by far the highest in the SVOD market (78%) at the end of 2020, their contribution as (executive) producers of European TV fiction titles remained limited (6% of the total number of TV fiction titles produced in Europe between 2015-2019).

Source: European Audiovisual Observatory

The M&A activity did not really impact the share of the US-backed players or significantly contribute to the overall growth, but it did help bolster the top 100 players’ revenues in Europe. The top 100 developed between 2016 and 2020 against a very dynamic backdrop of consolidations and divestments which was boosted by the SVOD race and to the COVID-19 pandemic. Looking to obtain more premium content at competitive prices, seeking to pair that content with strong distribution, aiming to build strong convergent telco offers, eyeing territorial expansion or refocusing on strongholds were just a few of the rationales followed by players in their quest to strengthen their market positions.

Although active in several AV market segments at the same time, most of the top 100 AV companies in Europe by operating AV revenues appear to be driven by one leading activity, rendering the top 100 heterogeneous as regards their portfolio. The highest-ranking players tend to also hold a strong position in at least one additional activity. Specifically, for broadcasters and TV packagers, diversifying into TV production seems a common strategy as, probably, an answer to the threat of on-demand over-the-top services.

Source: European Audiovisual Observatory

With the top four OTT platforms controlling over 70% of subscriptions, SVOD stands out as the most concentrated audiovisual market segment in Europe, followed by pay TV with 72% of subscriptions cumulated by the top 20 pay-TV operators.

Even if under-represented in terms of volume (9% of TV channels and 3% of ODAS), PSBs accounted for one third of global viewing consumption in Europe and almost all of them were offering at least one on-demand service at the end of 2020.