Download it here

This new report finds that:

- On a per episode share basis, European TV content accounts for 24% of all episodes found in TVOD catalogues and 21% of all episodes found in SVOD catalogues.

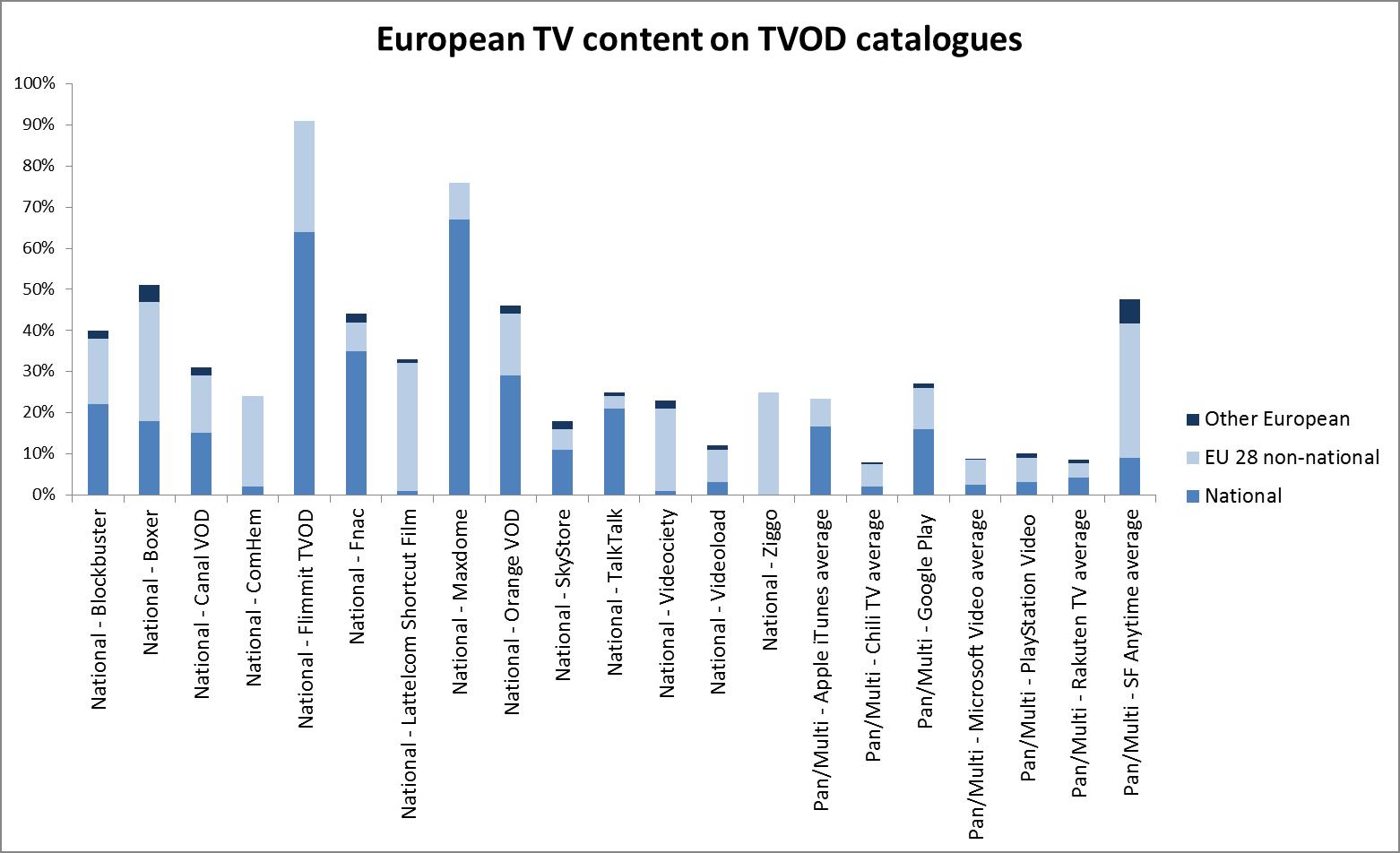

- National TV series episodes represented the majority of European TV episodes on pay per view VOD (TVOD) services (63%). They represent a minority of 19% of European episodes on subscription VOD (SVOD) services.

- Among non-European content, US content represents the vast majority on TVOD (92%) but a smaller share on SVOD (66%).

The increased consumption of TV content on VOD services has prompted the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, and DG Connect of the European Commission to undertake a ground-breaking new report on the origins of TV content in VOD catalogues in the EU. This report – The Origin of TV content in VOD catalogues in Europe – was authored by Gilles Fontaine, Christian Grece and Marta Jimenez Pumares, respectively Head of and Analysts within the Observatory’s Department for Market Information.

The report covers 90 VOD country catalogues corresponding to 23 national VOD services/catalogues and 12 pan-European and multi-country services that sum up to 67 different catalogues:

- SVOD services with Amazon in 2 countries, C More in 5 countries, Horizon in 4 territories, Netflix with 27 country catalogues and Voyo in 2 countries.

- TVOD services with: Apple iTunes in 3 countries, Chili TV in 5 countries, Microsoft in 11 territories, Rakuten in 5 countries, SF Anytime with 3 catalogues, Google Play Series with one catalogue and Sony Playstation in one country.

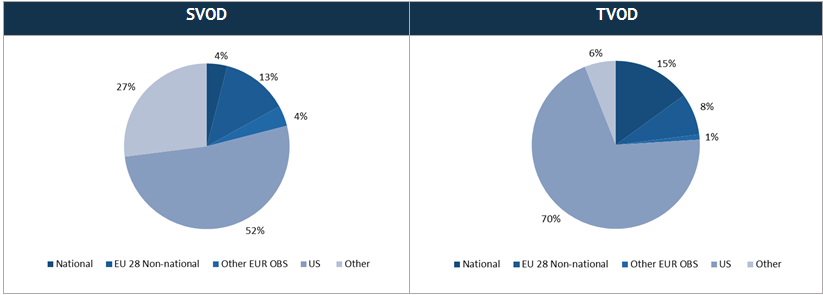

1. Breakdown of European TV content on TVOD versus SVOD

On a per episode share basis, European TV content account for 24% of all episodes found in TVOD catalogues and 21% of all episodes found in SVOD catalogues (Fig. 1)

Figure 1 – Comparison of the origin of TV episodes in SVOD and TVOD, in %

Source: European Audiovisual Observatory

National works represented the majority of European TV episodes on TVOD services (63%) but a minority of on SVOD services (19%). This shows the priority given by TVOD services to TV content well known to their customers and therefore with a strong commercial appeal, i.e. primarily national content, whereas SVOD services, due to their business model, can favour the discovery of new content. (Fig. 2 and 3)

Figure 2 – Origin of European content in SVOD catalogues, in share of identified cumulated episodes, in %

Source: European Audiovisual Observatory

Figure 3 – Origin of European content in TVOD catalogues, in share of identified cumulated episodes, in %

Source: European Audiovisual Observatory

Among non-European content, US content represents the vast majority in TVOD (92%) but a smaller share in SVOD (66%). SVOD follows a long tail strategy and proposes more diverse content.

2. Breakdown of TV content on Netflix and iTunes

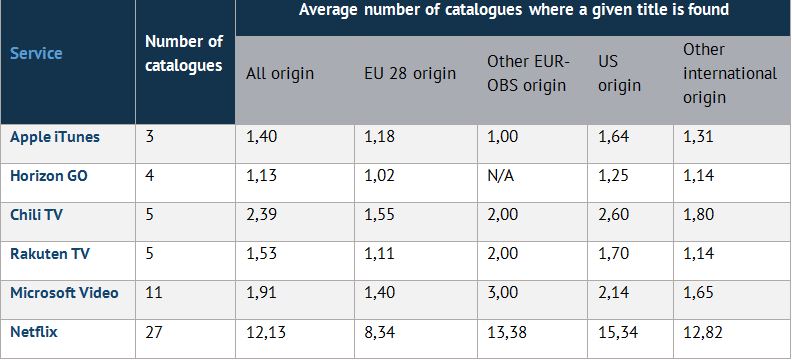

To what extent are the national catalogues of a pan-European or multi-country service similar? The Netflix and Apple iTunes catalogues are relatively homogeneous: on average, a given Netflix TV title or a given Apple iTunes title are available on average in half of the respectively 27 and 3 catalogues. SVOD pan-European services do indeed contribute to the circulation of programmes. (Table1)

Table 1 - Average number of catalogues where a title is available by origin, in units

Source: European Audiovisual Observatory

But in both cases, US titles tend to be available in more catalogues than EU 28 content. US titles are available on average in 15.3 Netflix catalogues vs. 8.3 for EU 28 content; and in 1.6 catalogues vs. 1.2 for EU content for iTunes. The difference may be attributed to the fact that part of the national content included in a given national catalogue is not necessarily appealing for the other countries. These figures still show a significant level of circulation of EU 28 content among the Netflix catalogues.

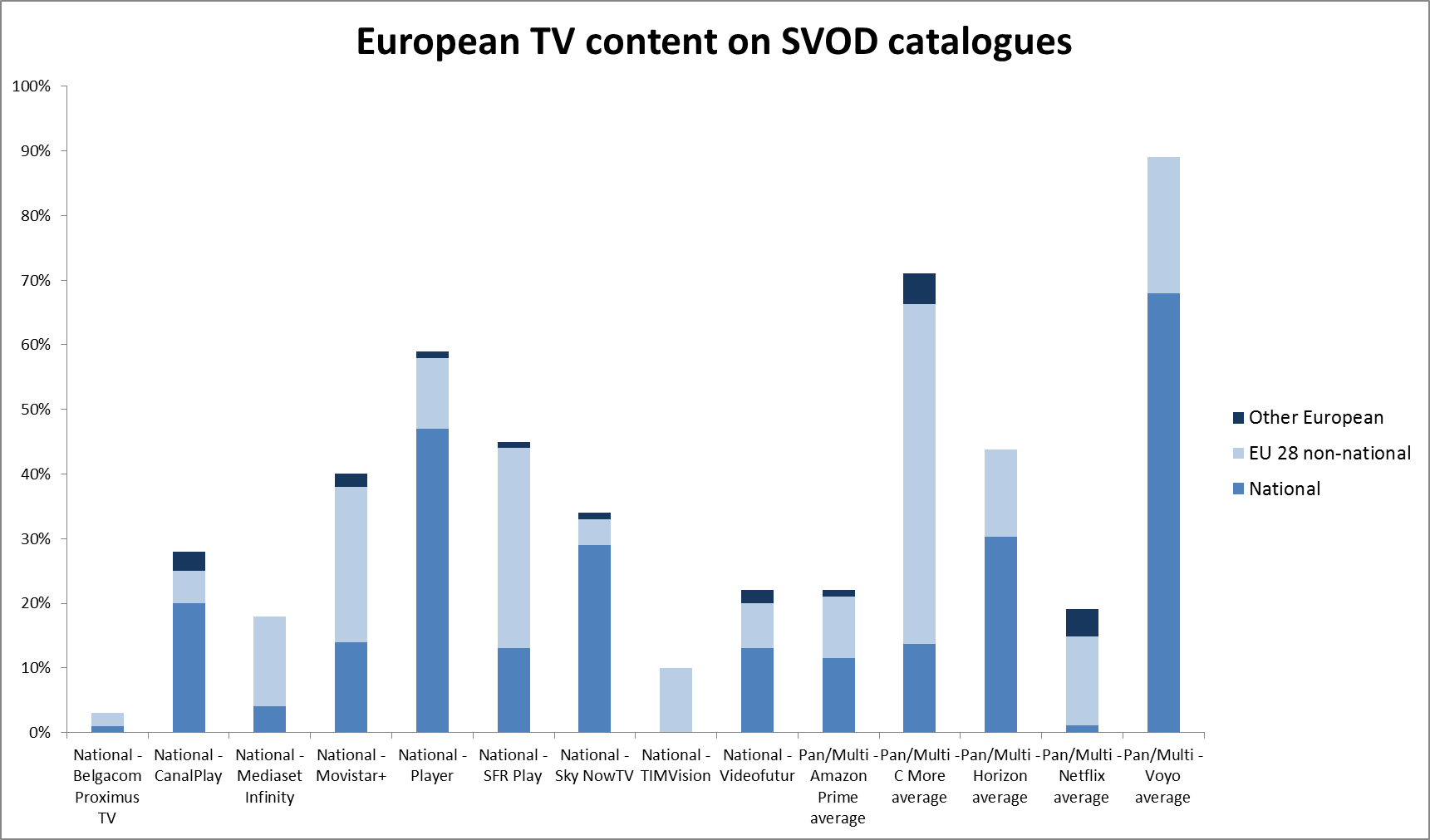

3. The composition of the pan-European and multi-country SVOD catalogues

- Netflix (27 country catalogues) composes a global catalogue, with not only US and European content but a remarkably high share of content from other regions of the world and can be considered therefore as the first worldwide audiovisual network.

- Horizon (4 country catalogues) is mainly developed to match the needs of national TV packagers and therefore relies on a high share of national content.

- C More (3 country catalogues): is a regional service for Scandinavia. Its cumulated catalogue containes 74% of European content, a vast majority being non-national. Content from other Scandinavian countries accounts for 33% of this non-national content.

- The two country catalogues of Amazon (Germany and the United Kingdom) included in the sample have very specific characteristics: both services have been initially developed on a national basis and then acquired by Amazon.

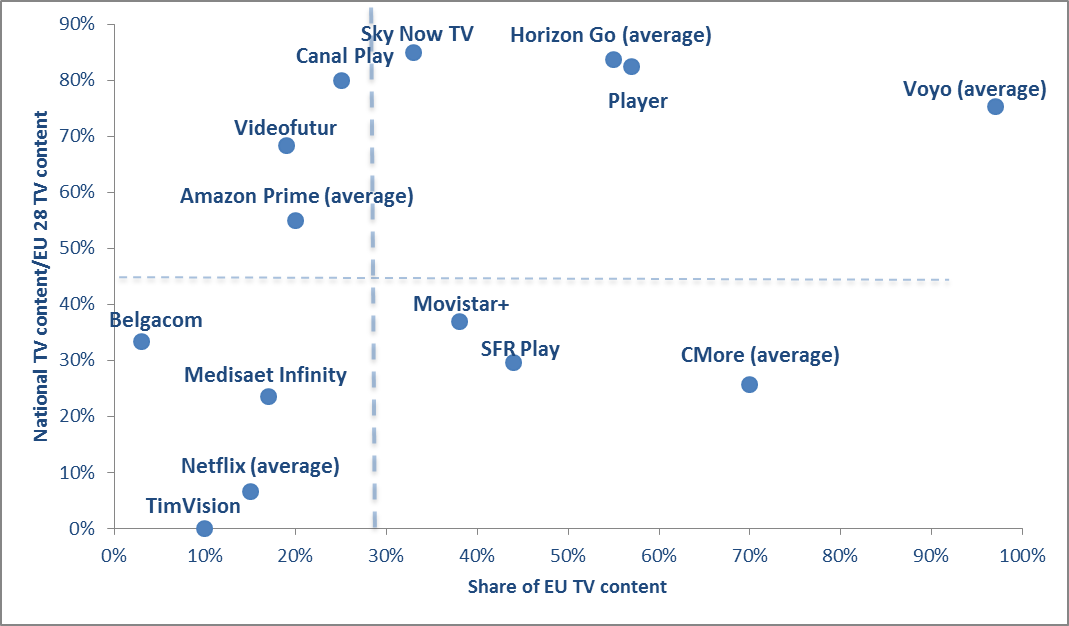

Figure 4 – Mapping of SVOD catalogues by share and origin of European content, in %