All publications

Top players in the European AV industry - Ownership and concentration - 2023 edition

The protection of minors on video sharing platforms: age verification and parental control

Film and TV content in TVOD, SVOD and FOD catalogues - 2023 edition

IRIS Special 2023-2: Algorithmic transparency and accountability of digital services

Writers and directors of film and TV/SVOD fiction 2015-2022 figures

Female professionals in European TV/SVOD fiction production 2015-2022 figures

IRIS Plus 2023-3: Fair remuneration for audiovisual authors and performers in licensing agreements

Fair remuneration for audiovisual authors and performers in licensing agreements - National case studies

AVMSDigest: The promotion of European works

Audiovisual services spending in original European content - a 2012-2022 analysis

Audiovisual fiction production in Europe - 2022 figures

IRIS Special 2023-1: Public interest content on audiovisual platforms: access and findability

IRIS Extra 2023: Media law and policy in selected Black Sea region countries

IRIS Plus 2023-2: Territoriality and release windows in the European audiovisual sector

Writers and directors of film and TV/SVOD fiction - 2015-2021 figures

Focus 2023 - World Film Market Trends

IRIS Themes - Vol. III - Freedom of Expression, the Media and Journalists. Case-law of the European Court of Human Rights (2023 edition)

IRIS Plus 2023-1: Accessibility of audiovisual content for persons with disabilities

Film and TV content in TVOD, SVOD and FOD catalogues - 2022 edition

IRIS Special 2022-2: Prominence of European works and of services of general interest

Female audiovisual professionals in European TV fiction production - 2021 figures

Mapping of national rules applicable to video-sharing platforms: Illegal and harmful content online – 2022 update

Mapping report on the rules applicable to video-sharing platforms: Focus on commercial communications

Fiction film financing in Europe: A sample analysis of films released in 2020

Top players in the European AV industry - Ownership and concentration - 2022 edition

IRIS Plus 2022-3: User empowerment against disinformation online

IRIS Extra 2022: Sanction law against Russian and Belarusian audiovisual media

IRIS Plus 2022-2: Investing in European works: the obligations on VOD providers

IRIS Special 2022-1: New actors and risks in online advertising

Focus 2022 - World Film Market Trends

Overview tables - Promotion of European works

Female audiovisual professionals in European TV fiction production – 2020 figures

IRIS Themes - Vol. III - Freedom of Expression, the Media and Journalists. Case-law of the European Court of Human Rights (2022 edition)

The implementation of EU sanctions against RT and Sputnik

Fiction film financing in Europe: A sample analysis of films released in 2019

Overview tables of governance safeguards of PSM in Europe

Film and TV content in VOD catalogues - 2021 edition

IRIS Plus 2022-1: Governance and independence of public service media

IRIS Special 2021-2: Transparency of media ownership

IRIS Plus 2021-2: Media regulatory authorities and the challenges of cooperation

Top players in the European AV industry ownership and concentration - 2021 edition

Animation films and TV series in Europe – Key figures

Mapping of national rules applicable to video-sharing platforms: Illegal and harmful content online

IRIS Special 2021-1: Unravelling the Digital Services Act Package

IRIS Extra 2021: Regulation of social media in Russia

Female audiovisual professionals in European TV fiction production

Focus 2021 - World Film Market Trends

IRIS Bonus 2021-1: Reports on diversity and inclusion in the European audiovisual sector - an overview

IRIS Plus 2021-1: Diversity and inclusion in the audiovisual sector

Audiovisual media services in Europe: Supply figures and AVMSD jurisdiction claims - 2020 edition

IRIS Themes - Vol. III - Freedom of Expression, the Media and Journalists. Case-law of the European Court of Human Rights (2021 edition)

Audiovisual fiction production in the European Union - 2020 edition

The circulation of European films in non-national markets - key figures 2019

Fiction film financing in Europe: A sample analysis of films released in 2018

Post-Brexit rules for the European audiovisual sector

IRIS Special 2020-2: Artificial intelligence in the audiovisual sector

IRIS Extra 2020: Foreign agents in Russian media law

Film and TV content in VOD catalogues - 2020 edition

IRIS Special 2020-1: Media pluralism and competition issues

Modelling audiovisual sector revenue flows in the EU - working paper

European high-end fiction series. State of play and trends

IRIS Plus 2020-2: The European audiovisual industry in the time of COVID-19

IRIS Plus 2020-1: Copyright licensing rules in the EU

Female directors and screenwriters in European film and audiovisual fiction production

Focus 2020 - World Film Market Trends

Mapping of the regulation and assessment of the nationality of European audiovisual works

IRIS Themes - Vol. III - Freedom of Expression, the Media and Journalists. Case-law of the European Court of Human Rights (2020 edition)

Audiovisual fiction production in the European Union - 2019 edition

The circulation of European films outside of Europe – key figures 2018

Supply of audiovisual media services in Europe: MAVISE insights - 2019

Fiction film financing in Europe: A sample analysis of films released in 2017

IRIS Plus 2019-3: Territoriality and financing of audiovisual works: latest developments

This new report finds that:

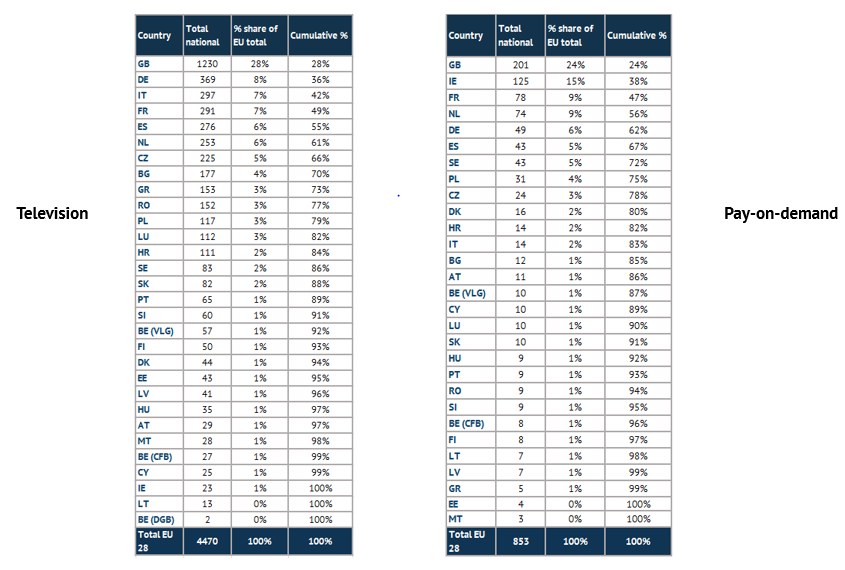

- The United Kingdom was still by and large in 2018 the most prominent audiovisual market in greater Europe (EU28 plus countries listed in the foonote)[1] with 1 230 TV channels and 201 pay-on-demand services established in the country, many of which were targeting other European audiovisual markets.

- The UK was also found to be the biggest contributor to the overall audiovisual services supply in the EU28. Around one quarter of all TV channels (28%) and pay-on-demand- services (24%) were established there.

- At the end of 2018, there were 11 123 TV channels (including 5 039 local channels) and 2 917 on-demand services[2] available in greater Europe.

- A total of 5 880 TV channels were established in greater Europe (excluding local channels), of which 4 470 were based in the EU28 and so were 968 pay-on-demand services (i.e. 853 in the EU28). Overall 4 838 TV broadcasting licences (excluding local licences) were issued (i.e. 3 555 in the EU28).

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has just published a brand new publication “Audiovisual media services in Europe: Market insights”. Based on data analyses of 2018 data from the MAVISE database, this publication provides an overview of the European audiovisual media landscape from three different perspectives. The first focuses on the supply of audiovisual media services in Europe, presenting figures for television and on-demand services available and established in the European markets. The second perspective looks at the access and distribution of AV services in Europe, noting the dominance of pay business models in the sector. The third perspective highlights the growing footprint of targeting audiovisual media services in Europe that serve non-domestic markets.

1. The United Kingdom is still the largest audiovisual market in greater Europe

- The United Kingdom was still by and large the most prominent audiovisual market in wider Europe with 1 230 TV channels and 201 pay-on-demand services established in the country, many of which were targeting other European audiovisual markets.

- The UK was also found to be the biggest contributor to the overall audiovisual services supply in the EU28. Around one quarter of all TV channels (28%) and pay-on-demand- services (24%) were established there.

- At the end of 2018, there were 11 123 TV channels available in Europe[3] of which 5 039 were local TV channels. Further, there were 2 917 on-demand services[4] available in Europe including services established outside of Europe which target the European markets; among these were

- 1 624 catch-up TV services, 1 081 pay-on-demand services and 212 free on-demand services.

- There were 5 880 TV channels established in Europe (excluding local channels) at the end of 2018, of which 4 470 were based in the EU28. European regulatory authorities issued 4 838 TV broadcasting licences (excluding local licences) of which 3 555 were issued in the EU28. Of the TV channels established in Europe 8% were publicly owned while 91% belonged to a private company and 1% had a mixed ownership (similar figures for the EU28); around 28% of TV channels were available in HD format and the same percentage had a catch-up TV service on offer; around 4% of TV channels had a time-shifted version (identical figures for the EU28).

- Of the 968 pay-on-demand services established in Europe 853 were based in the EU28; among these, just 2% were owned by public service broadcasting organisations and 1% had a mixed ownership.

Concentration of TV channels and pay-on-demand services established in the EU28 | 2018 - In number of services and % share

Source: MAVISE database 2018

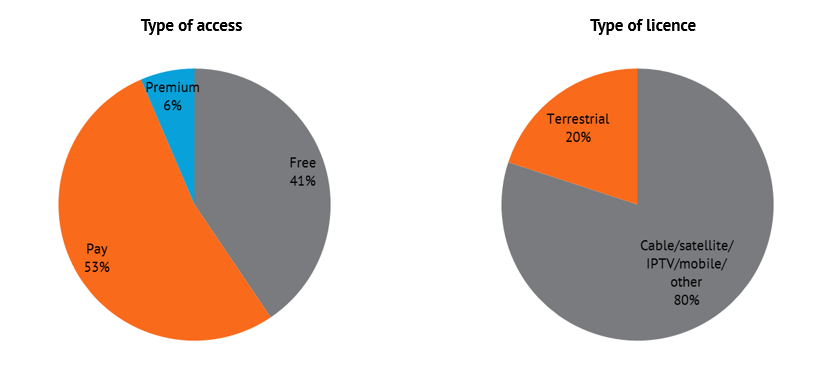

2. Pay business models dominate

- One out of five television services established in the Europe* by 2018 was accessible via digital terrestrial television (20%), and the rest could be accessed via cable, satellite, or Internet protocol television (IPTV).

- Most television channels were pay/or premium services while 41% established in Europe were available free-to-air. The results were similar for the EU28.

- The dominant business model for pay-on-demand services was subscription video-on-demand (SVOD) (59%), which came before transactional video-on-demand (TVOD) (41%).

Breakdown of TV channels established in EUR40 + Morocco by type of access and kind of licence | 2018 - In % share

Source: MAVISE database 2018

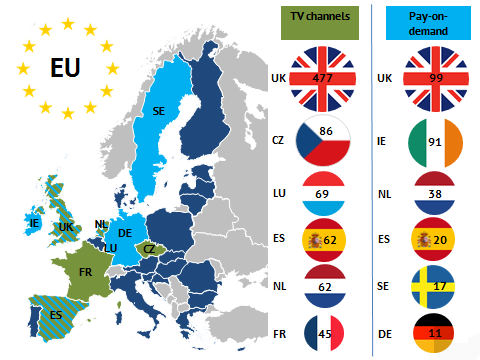

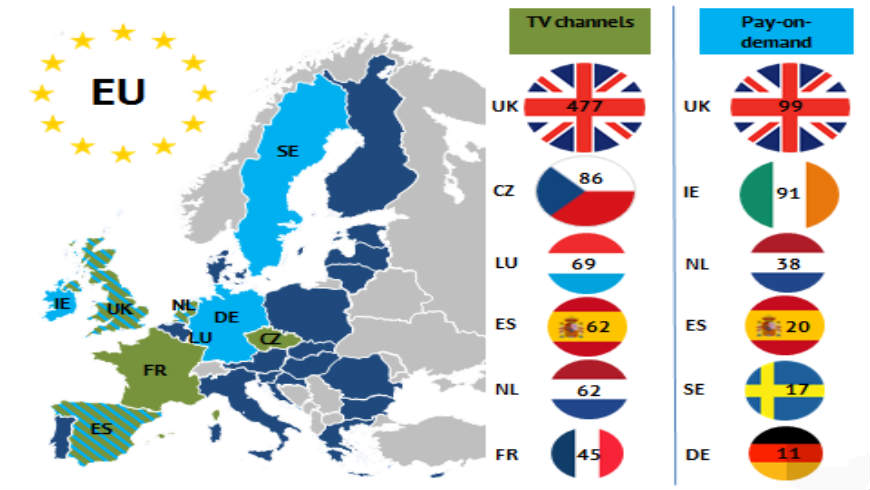

3. Growing footprint of audiovisual services targeting other markets

- As with television (i.e. Europe n=563; EU28 n=477), the United Kingdom was in 2018 by far the major hub for pay-on-demand services targeting foreign markets with a total of 130 services aimed at other European markets of which 99 were serving the EU28 alone.

- More than one fifth of all TV channels (21%; n=917) and over a third (36%; n=306) of pay-on-demand services based in the EU28 were specifically targeting other EU28 markets. In Europe* 19% (n=1136) of TV channels and 43% (n=413) of pay-on-demand services were serving non-domestic markets. They were predominantly owned by large broadcasting and entertainment corporations, the majority of which are of American origin.

- The United Kingdom, the Czech Republic and Luxembourg accounted for 69% of all TV channels targeting other EU28 markets, and so were 75% of pay-on-demand services based in the United Kingdom, Ireland and the Netherlands.

Top audiovisual media hubs primarily targeting other EU28 markets by country | 2018 - In number of services

Source: MAVISE database 2018

Access MAVISE DATABASE here

1] Europe includes the EU28, Albania, Armenia, Bosnia-Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, Norway, the Russian Federation, Switzerland, Turkey and Morocco

[2] Figures for on-demand services available in Europe include both free and pay service

[3] Ibid

[4] See footnote 1

- Diminuer la taille du texte

- Augmenter la taille du texte

- Imprimer la page

IRIS Plus 2018-3: The legal framework for international co-productions

Fiction film financing in Europe: A sample analysis of films released in 2016

IRIS Plus 2018-2: Brexit: The impact on the audiovisual sector

IRIS Extra 2018-1: The legal framework concerning foreign ownership in Russian media

The exploitation of catalogue films in the EU: Cinema, television and video on demand

Audiovisual media in Europe: Localised, targeting and language offers

IRIS Special 2018-1: Media reporting: facts, nothing but facts?

TV news channels in Europe: Offer, establishment and ownership

Brexit in context: The UK in the context of the EU audiovisual market

IRIS Plus 2018-1: The legal framework for video-sharing platforms

Online video sharing: Offerings, audiences, economic aspects

FOCUS 2018 - World Film Market Trends

TV fiction production in the European Union

The origin of TV content in VOD catalogues - 2017 edition

The origin of films in VOD catalogues – 2017

Measuring access to theatrically screened films in Eastern Europe

IRIS Special 2017-2: Journalism and media privilege

The visibility of films and TV content on VOD

Trends in the EU SVOD market - 2017 edition

IRIS Plus 2017-3: Deposit systems for audiovisual works

The circulation of European films outside Europe - Key figures 2016

IRIS Plus 2017-2: Commercial communications in the AVMSD revision

Capello M. (ed.)

Deposit systems for audiovisual works Print version available on our online shop

IRIS Plus 2017-3, European Audiovisual Observatory

Cappello M. (ed.)

Commercial communications in the AVMSD revision Print version available on our online shop

IRIS Plus 2017-2, European Audiovisual Observatory, Strasbourg, 2017

Cappello M. (ed.)

Media coverage of elections: the legal framework in Europe Print version available on our online shop

IRIS Special, European Audiovisual Observatory, Strasbourg, 2017

Cappello M. (ed.)

Exceptions and limitations to copyright Print version available on our online shop

IRIS Plus 2017-1, European Audiovisual Observatory, Strasbourg, 2017

Ene L.

Media Ownership: Children’s TV channels in Europe - Who are the key players?

European Audiovisual Observatory, Strasbourg, 2017

Fontaine G. (ed.)

Yearbook 2016 - Key trends

European Audiovisual Observatory, Strasbourg, 2017

Fontaine G.

The visibility of films and TV content on VOD

European Audiovisual Observatory, Strasbourg, Novevmber 2017

Fontaine G. and Grece C.

Origin of films and TV content in VOD catalogues in the EU & Visibility of films on VOD services

European Audiovisual Observatory, Strasbourg, November 2016

Fontaine G. and Simone P.

The access to film works in the collections of Film Heritage Institutions in the context of education and research

European Audiovisual Observatory, Strasbourg, May 2017

Fontaine G. and Simone P.

VOD distribution and the role of aggregators

European Audiovisual Observatory, Strasbourg, May 2017

Grece C.

Trends in the EU SVOD market - 2017 Edition

European Audiovisual Observatory, Strasbourg, November 2017

Grece C.

The circulation of EU non-national films - A sample study: Cinema, television and transactional video on-demand

European Audiovisual Observatory, Strasbourg, November 2017

Grece C.

The presence of broadcasters on video sharing platforms

European Audiovisual Observatory, Strasbourg, October 2016

Grece C.

The online advertising market in the EU - Update 2015 and Focus on programmatic advertising

European Audiovisual Observatory, Strasbourg, November 2016

Kanzler M. and Talavera Milla J.

FOCUS 2017 - World Film Market Trends

European Audiovisual Observatory, Strasbourg, April 2017

Schneeberger A.

Audiovisual services in Europe - Focus on services targeting other countries

European Audiovisual Observatory, Strasbourg, June 2017

Cappello M. (ed.)

Mapping of media literacy practices and actions in EU-28

European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Freedom of Expression, the Media and Journalists. Case-law of the European Court of Human Rights (edition 2016)

IRIS Themes, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Smart TV and data protection Print version available on our online shop

IRIS Special, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Regional and local broadcasting in Europe Print version available on our online shop

IRIS Special, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Media ownership - Market realities and regulatory responses Print version available on our online shop

IRIS Special, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

VOD, platforms and OTT: which promotion obligations for European works? Print version available on our online shop

IRIS Plus 2016-3, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Audiovisual sports rights – between exclusivity and right to information Print version available on our online shop

IRIS Plus 2016-2, European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

On-demand services and the material scope of the AVMSD Print version available on our online shop

IRIS Plus 2016-1, European Audiovisual Observatory, Strasbourg, 2016

Fontaine G. (ed.)

Yearbook 2015 - Key trends

European Audiovisual Observatory, Strasbourg, 2016

Fontaine G. (ed.)

Films on television: Origin, age and circulation

European Audiovisual Observatory, Strasbourg, 2016

Fontaine G. and Kevin D. (ed.)

Media ownership: towards pan-European groups?

European Audiovisual Observatory, Strasbourg, 2016

Fontaine G. and Simone P. (ed.)

The Exploitation of Film Heritage Works in the Digital Era

European Audiovisual Observatory, Strasbourg, 2016

Fontaine G. and Schneeberger A. (ed.)

Panorama Report: Linear and on-demand audiovisual media services in Europe 2015

European Audiovisual Observatory, Strasbourg, 2016

Gorskaya T., Ivanova V., Kustov V., Leontyeva X., Luzhin A. and Trifonova J.

Film Production and Co-Production in Russia, and the Export of Russian Films Abroad

Nevafilm Research/European Audiovisual Observatory, Strasbourg, 2016

Горская T., Иванова В., Кустов В., Леонтьева К., Лужин А., Трифонова Ю.

Кинопроизводство И Копродукция В России. Экспорт Российских Фильмов За Рубеж

Невафильм Research/Европейская аудиовизуальная обсерватория, 2016

Grece C. (ed.)

How do films circulate on VOD services and in cinemas in the European Union?

European Audiovisual Observatory, Strasbourg, 2016

Kanzler M. (ed.)

The Circulation of European Films Outside Europe in 2015

European Audiovisual Observatory, Strasbourg, 2016

Kanzler M. and Talavera J. (ed.)

Focus 2016. Word Film Market Trends. Tendances du marché mondial du film

Edited by the European Audiovisual Observatory

Marché du film / Festival de Cannes, Paris, 2016

Kevin D. and Schneeberger A.

Access to TV platforms: must-carry rules, and access to free-DTT

European Audiovisual Observatory, Strasbourg, 2016

Vorontsova A. and Leontyeva X (ed.)

Focus on the Audiovisual Industry in the Russian Federation

Nevafilm Research/European Audiovisual Observatory, Strasbourg, 2016

Воронцова А., АЦ Vi Леонтьева К. (ed.)

Взгляд На Аудиовизуальную Индустрию Российской Федерации

Невафильм Research/Европейская аудиовизуальная обсерватория, 2016

Talavera J. (ed.)

Public financing for film and television content - The state of soft money in Europe

European Audiovisual Observatory, Strasbourg, 2016

Cappello M. (ed.)

Freedom of Expression, the Media and Journalists: Case-law of the European Court of Human Rights (Edition 2015)

IRIS Themes Vol. III, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Annotated bibliography on copyright enforcement online

IRIS Bonus 2015-5, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Annotated bibliography on territoriality and its impact on the financing of audiovisual works

IRIS Bonus 2015-4, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Public service media remit in 40 European countries

IRIS Bonus 2015-3, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Copyright enforcement online: policies and mechanisms

IRIS Plus 2015-3, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Territoriality and its impact on the financing of audiovisual works

IRIS Plus 2015-2, European Audiovisual Observatory, Strasbourg, 2015

Cabrera Blázquez F.J., Cappello M. and Valais S. (ed.)

IRIS 2015 - Legal Observations of the European Audiovisual Observatory

European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

The protection of minors in a converged media environment

IRIS Plus 2015-1, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Annotated bibliography on the protection of minors in a converged media environment

IRIS Bonus 2015-2, European Audiovisual Observatory, Strasbourg, 2015

Cappello M. (ed.)

Online activities of public service media: remit and financing Print version available on our online shop

IRIS Special, European Audiovisual Observatory, Strasbourg, 2015

Ene L. and Grece C.

Origin of films in VOD catalogues in the EU

DGCNCT Note 4, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Ene L. and Kevin D.

European fiction works on TV channels

DGCNCT Note A3, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Fontaine G.

Trends in linear television revenues

DGCNCT Note B1, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Fontaine G.

The visibility of film on on-demand platforms: Germany, France and the United Kingdom

DGCNCT Note 5, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Fontaine G. and Grece C.

Measurement of fragmented audiovisual audiences

DGCNCT Note 1, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Fontaine G. and Grece C.

Online advertising in the EU - Update 2014

DGCNCT Note 2, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Fontaine G. and Schneeberger A.

Origin and availability of on-demand services in the European Union

DGCNCT Note A2, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Grece C. and Croce L.

The SVOD market in the EU developments 2014/2015

DGCNCT Note B2, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Grece C. and Croce L.

Trends in video-on-demand revenues

DGCNCT Note 3, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Grece C., Lange A., Schneeberger A. and Valais S.

The development of the European market for on-demand audiovisual services

Report prepared by the European Audiovisual Observatory under a contract with the European Commission’s DG Connect, Strasbourg, March 2015

Jimenez M., Kevin D. and Talavera J.

Focus on Animation

Produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015 (Downloadable from the European Commission's website)

Jimenez M., Simone P., Kevin D., Ene L. and Talavera J.

Mapping the Animation Industry in Europe

European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015 (Downloadable from the European Commission's website)

Kanzler M.

The Theatrical Market of European Films Outside of Europe - Key Figures 2014

European Audiovisual Observatory, Strasbourg, 2015

Kanzler M. and Talavera J.

Focus 2015. Word Film Market Trends. Tendances du marché mondial du film

Edited by the European Audiovisual Observatory

Marché du film / Festival de Cannes, Paris, May 2015

Kevin D.

Investments in original content by audiovisual services

DGCNCT Note B3, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Kevin D.

Snapshot: Regional and local television in Spain

European Audiovisual Observatory, Strasbourg, 2015

Kevin D.

Snapshot: Regional and local television in the United Kingdom

European Audiovisual Observatory, Strasbourg, 2015

Lange A.

Fiction on European TV channels (2006-2013)

European Audiovisual Observatory, Strasbourg, 2015

Lange A. (ed.)

Yearbook 2014 - Television, cinema, video and on-demand audiovisual services - the pan-European picture Publication available on our online shop

European Audiovisual Observatory, Strasbourg, 2015

Richter Andrei & Richter Anya

Regulation of online content in the Russian Federation

IRIS Extra, European Audiovisual Observatory, Strasbourg, 2015

Schneeberger A.

Origin and availability of television services in the European Union

DGCNCT Note A1, produced by the European Audiovisual Observatory on behalf of the European Commission, Strasbourg, 2015

Valais S.

Comparative tables on the protection of minors in audiovisual media services

IRIS Bonus 2015-1, European Audiovisual Observatory, Strasbourg, 2015

All Observatory publications are freely available for download from this site except the following:

Subscribe to the Yearbook Online Service or access your account:

Access the Yearbook Online Service here