- EU gross box office fell slightly to EUR 7.04 billion in 2016, while admissions rose to 991 million – highest level in the EU since 2004

- Family animation hits The Secret Life of Pets and Finding Dory topped the EU charts

- Market share for European films slightly down to 26.7%

- EU film production grew to 1 740 feature films

- Digital screen penetration in the EU reached 93%

EU cinema attendance approached the 1 billion barrier in 2016 while GBO dropped slightly

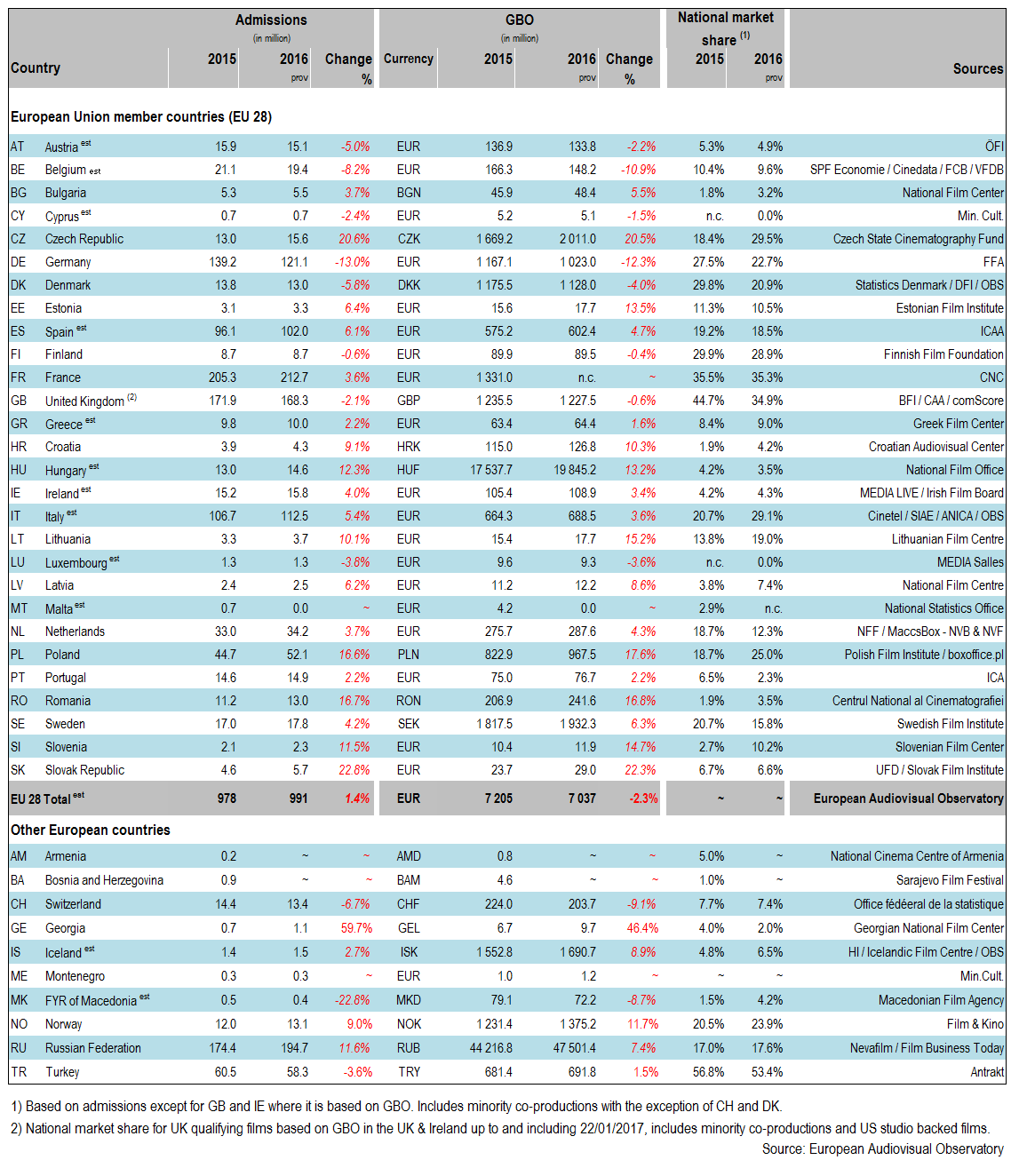

An estimated total of over 991 million cinema tickets were sold in the 28 EU member states in 2016. This is 13.3 million more than in 2015 and marks the highest level registered in the EU since 2004. Cumulative gross box office revenues measured in euros, however, declined slightly by 2.3% from 2015’s record high but remained above the EUR 7 billion level for the second consecutive year amounting to an estimated EUR 7.04 billion. Not adjusted for inflation, this is the second highest level on record. The drop in GBO reflects a decline in average ticket prices in selected markets including Italy, Spain and Belgium, as well as declining box office results in Germany and – amplified by the depreciation of the British pound – the UK. The overall average ticket price in the EU consequently fell for the first time in the past five years, decreasing from EUR 7.4 to EUR 7.1. GBO growth across the EU was less homogeneous than in 2015 as GBO – measured in local currencies – grew in 19 and decreased in 8 of the 27 EU markets for which provisional data were available. Geographically speaking, strong GBO growth was registered in France, Spain (+EUR 27.1 million, +4.7%), Poland (+PLN 145 million, +17.6%), Italy (+EUR 24 million, +3.6%), the Czech Republic (+CZK 342 million, +20.5%) and Slovak Republic (+22.3%). Instead, GBO declined significantly in only a few markets, particularly Germany (-EUR 144 million, -12.3%) and Belgium (-EUR 18 million, -10.9%).

Outside the EU, GBO in the Russian Federation increased by 7.4% to RUB 47.5 billion driven by renewed growth in cinema attendance to 194.7 million tickets sold, confirming its position as the second largest European market in terms of admissions. Despite a small decline in admissions, GBO also continued to grow in Turkey, up 1.5% to TRY 692 million, the highest level in the past few decades.

Family animation films The Secret Life of Pets and Finding Dory topped the European Union charts in 2016

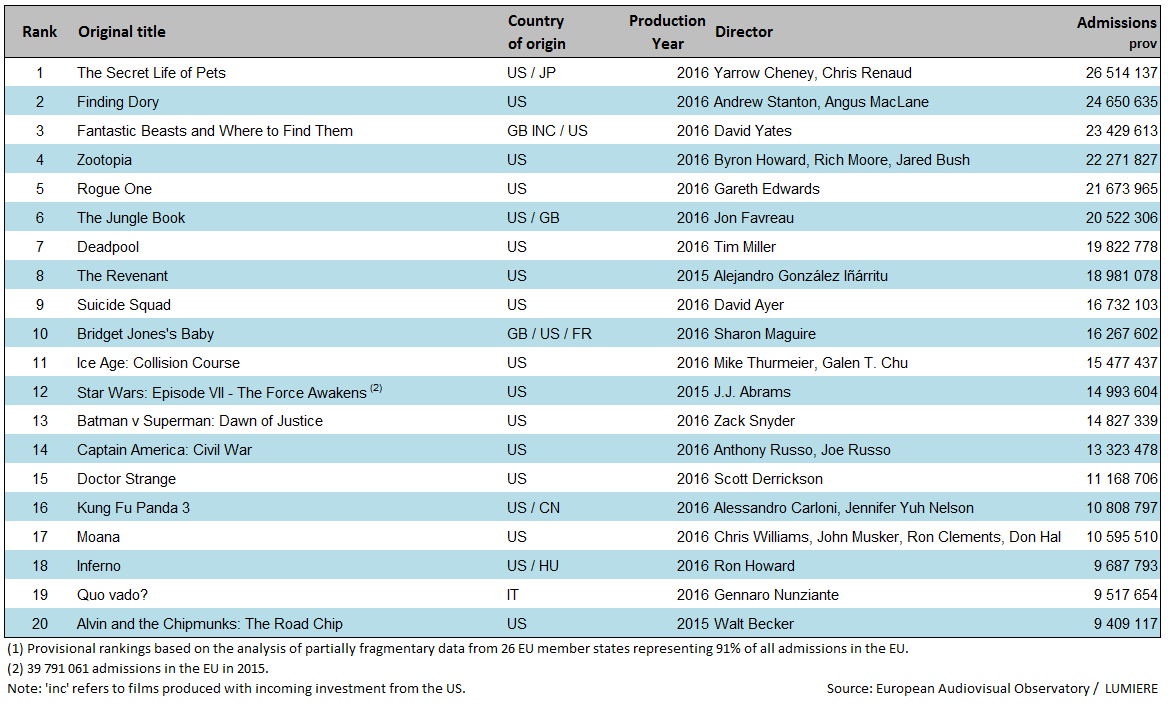

In contrast to 2015, when a rather limited number of US studio titles drove the growth in admissions, 2016 was characterized by the solid box office performance of a comparatively broad range of productions. If in 2015 three individual breakout hits (Star Wars VII, Minions and Spectre) had sold more than 38 million tickets each in the EU, in 2016 no single title reached the 30 million ticket benchmark with the two top performing films, The Secret Life of Pets and Finding Dory selling 26.5 million and 24.7 million tickets across the EU respectively. It is worthwhile observing that family animation films performed particularly well in the EU in 2016 accounting for 8 titles among the top 20. Besides the top two films, other successful animation films included Zootopia (22.3 million admissions), The Jungle Book (20.5 million) and Ice Age: Collision Course (15.5 million). Another significant characteristic of the EU box office concerns the dominance of franchise films with 7 out of the top 10 and 15 out of the 20 top films being sequels, prequels, spin-offs or reboots such as Fantastic Beasts and Where to Find Them (23.4 million admissions), Rogue One (21.7 million), Deadpool (19.8 million) and Suicide Squad (16.7 million).

Leaving aside European films financed with incoming US investment (EUR inc), Bridget Jones’s Baby became the most successful European film selling 16.3 million tickets in the EU in 2016. Italian comedy Quo vado? (9.5 million) was the only other European production to rank in the top 20 as no other European film succeeded in selling more than 5 million tickets in the EU in 2016.

Table 1: GBO, admissions and national market share in European countries 2015 – 2016 prov

Table 2: Top 20 films by admissions in the European Union in 2016 prov (1)

Table 3: Top 20 European films by admissions in the European Union in 2016 (incl. “EUR inc”) prov (1)

US films continue to drive admissions growth as European market share fell slightly

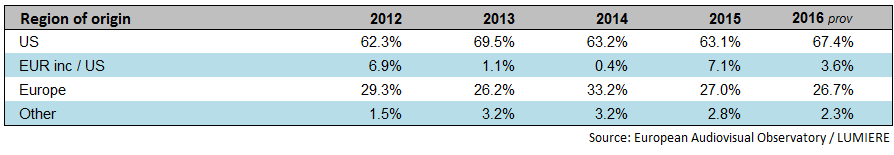

As in 2015, admissions growth was driven primarily by US films as their cumulative admissions increased by an estimated 50 million leading to an estimated US market share of 67.4%, up from 63.1% of the previous year. With Fantastic Beasts and Where to Find Them as the only UK incoming investment film making it into the top 20, the market share of European films produced in Europe with incoming US investment (EUR inc) fell from 7.1% to 3.6%. Admissions to European films remained comparatively stable in 2016 causing the market share of European films to drop slightly from 27.0% to an estimated 26.7%. This is the second lowest level in the past five years. Nevertheless, European films continued to perform well on several national markets, particularly in France (35.3%), the Czech Republic (29.5%), Italy (29.1%) and Finland (28.9%).

Table 4: EU market share by country of origin 2012 – 2016 prov

In % of total admissions. Provisional estimates.

EU film production volume still growing

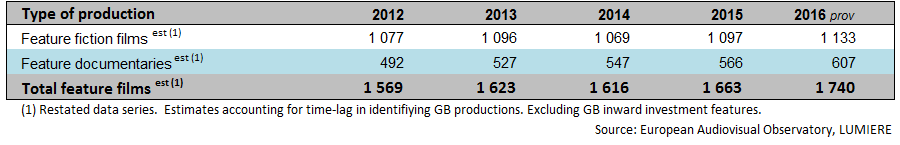

EU production levels showed a moderate upswing that confirms the growth trend of recent years, as the estimated number of European feature films increased from 1 663 to 1 740 productions in 2016 (4.7% up on 2015), marking a new record high. This figure breaks down into an estimated number of 1 133 fiction films (65%) and 607 feature documentaries (35%). The increase in production activity was primarily linked to an increasing number of 100% national films, accounting for 75% of the total fiction production volume in 2016.

Table 5: Number of feature films produced in the European Union 2012 – 2016 prov

Provisional estimates.

Digital conversion rate in the EU reaches 93%

According to figures provided by MEDIA Salles the digitisation process in the EU is close to completion. By the end of 2016 a total of 22 EU member states had converted 90% or more of their screen base with only two territories registering digital screen penetration rates below 70%: Lithuania (64%) and the Czech Republic (53%). By the end of 2016 there were 29 848 digital screens were, which represents an estimated 93% of the EU’s total screen base.

Table 6: Digital screens in the European Union 2012 – 2016 prov

Provisional estimates.

More detailed information on European as well as international theatrical markets can be found in FOCUS 2017 World Film Market Trends prepared by the European Audiovisual Observatory for the Cannes Film Market.

Notes for Editors:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- All 2016 figures are provisional.

The European Audiovisual Observatory, Council of Europe

Set up in December 1992, the European Audiovisual Observatory's mission is to gather and distribute information on the audiovisual industry in Europe. The Observatory is a European public service body comprised of 40 member states and the European Union, represented by the European Commission. It operates within the legal framework of the Council of Europe and works alongside a number of partner and professional organisations from within the industry and with a network of correspondents. In addition to contributions to conferences, other major activities are the publication of a Yearbook, newsletters and reports, the compilation and management of databases and the provision of information through the Observatory's Internet site (www.obs.coe.int).

European Union admissions rankings (Tables 2 and 3)

The pan-European film rankings shown in tables 2 and 3 are based on data from all European Union countries for which results have been stored in the LUMIERE database as of 21st April 2017. This database on admissions to films released in Europe is available on-line and free-of-charge, and is the result of collaboration between the European Audiovisual Observatory and various specialised national sources as well as the MEDIA Programme of the European Union. LUMIERE provides country-by-country analysis of admissions for about 41 600 films in distribution in Europe since 1996. Partial 2016 data for 26 European countries is now available, including data for the major European Union markets, as well as data for the North American market.

Market shares (Table 4)

The market shares shown in this figure are based on an analysis of results of films released in member states of the European Union for which admissions data for individual films are made available to the European Audiovisual Observatory. In order to draw up such market shares, a single 'country of origin' must be attributed to each film, an attribution that can prove difficult in the case of international productions. In these cases the Observatory's aim is to attribute a country of origin corresponding to the source of the majority financial input and/or creative control of the project. Since 2005 the Observatory has identified specifically films that have been produced in one or more European countries (or elsewhere) with US investment by using the reference 'inc' (incoming investment) in the country of origin attribution. It should be noted, however, that the availability of further information may occasionally lead to changes in the attribution of country of origin and that the origin of a film as attributed in the LUMIERE database may not always be identical with that indicated by national sources.

The provisional data on market shares in the European Union in 2016 shown in table 4 are based on the data on admissions to individual films as collected in the LUMIERE database on 21st April 2017. At this date the coverage rate of the database for admissions in the 26 European Union countries for which data is available was of around 91%. Due to various gaps in data collection and delivery in various countries, coverage of 100% of admissions is currently unachievable.

Number of feature films produced in the European Union (Table 5)

Estimating the total volume of production of feature films in the European Union remains difficult, chiefly due to the risk of double counting of co-productions and to differing national methodologies for the collection of this data. Included in the total for the European Union are feature-length films intended for theatrical exploitation, excluding minority co-productions and US and foreign production in the United Kingdom. For some countries no separate data are available for feature fiction and feature documentary films.

Contacts at the European Audiovisual Observatory:

Alison Hindhaugh (Press Officer)

[email protected] - tel.: +33 (0) 3 90 21 60 10

The European Audiovisual Observatory will be present at the Marché du Film, Cannes

Stand 18.02, Level 01

Palais des Festivals

Tel.: +33 (0)4 92 99 81 07

More detailed information can be found in FOCUS 2017 World Film Market Trends compiled by the European Audiovisual Observatory and published by the Marché du Film.

FOCUS 2017 will be on sale via our website as of 18 May 2017 (see: shop.obs.coe.int/en/17-focus). We will also be selling it on our stand in Cannes.