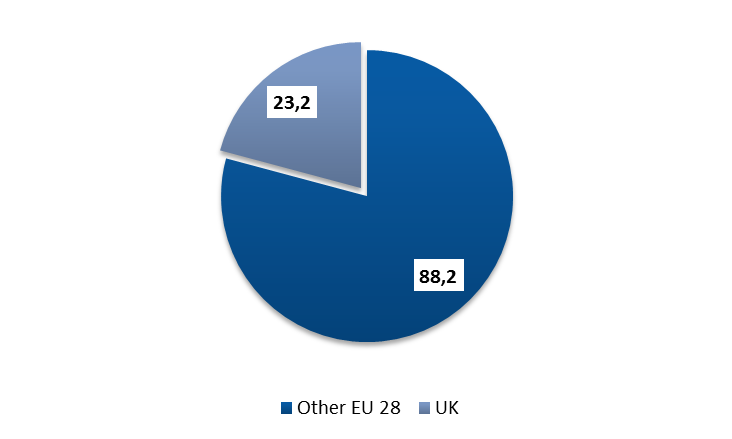

- The UK represents a massive 21% of the European TV market

- 1,203 TV channels out of 3,005 in the EU (28) are based in the UK

- The UK is the second largest exporter (after France) of film titles exported to other EU28 countries for projection in cinemas and broadcast on TV.

Download it here

Brexit in context: The UK in the context of the EU audiovisual market. This new BREXIT report by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, provides a European-eye view of the UK’s weight within the EU’s audiovisual markets. It provides key figures on the co-productions between the UK and other EU28 countries, the import and export of films between the UK and the other EU28 countries as well as data on the circulation of audiovisual services between the UK and the European Union. This report will be presented at the Observatory’s Brussels conference this autumn: The impact of Brexit on the audiovisual industry: a European point of view. This public conference will take place on Tuesday 27th of November in Brussels. Register here for free.

A. The United-Kingdom is, together with Germany, the largest audiovisual market in the EU28.

With 12% of TV households, the UK accounts for 21% of the EU28 audiovisual market.

The European Union Audiovisual market (2016, bn EUR)

Source: Ampere Analysis, EBU/MIS, film agencies, WARC, IHS

The UK market is slightly more dynamic, on average, than the EU28 as a whole, due to the solid performance of pay-tv and also because the UK is the most-developed EU28 market by far for on-demand services. Indeed, the average annual growth rate between 2011 and 2016 was 2.1% for the UK vs. 1.7% for the EU28. The UK ranks No. 4 in terms of number of TV fiction hours produced, underpinned by a focus on high-end drama with a strong export potential.

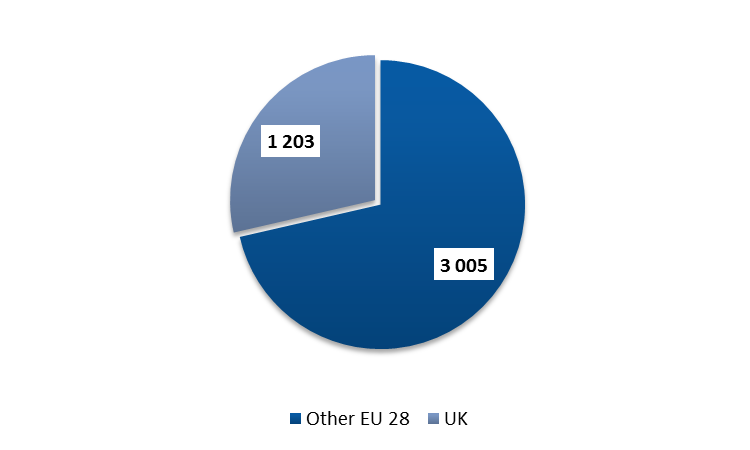

B. The UK is the main hub for TV channels established in the European Union

29% of EU28 TV channels are established in the UK

TV channels established in the European Union (end 2017)

Source: European Audiovisual Observatory/MAVISE. Excludes local channels. Includes linguistic versions

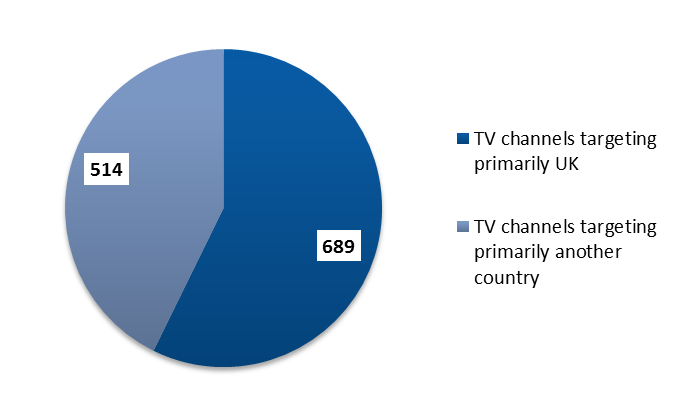

43% of the TV channels established in the UK target primarily another country.

TV channels established in the UK (end 2017)

Source: European Audiovisual Observatory/MAVISE. Excludes local channels. Includes linguistic versions

The UK is by far the main country of establishment in the EU28 for television channels and on-demand services. The UK hosts three of the top 10 EU28 audiovisual groups (Sky, BBC, ITV) also as European subsidiaries of the major US media groups.

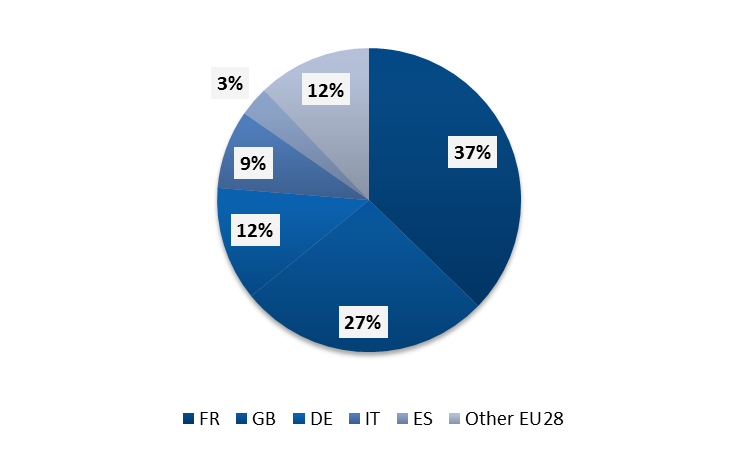

C. The UK is a strong exporter of film towards the other European Union countries

The UK ranks No. 2 (after France) for the number of film titles exported to other EU28 countries in cinema and on TV.

EU28 non-national releases on TV (2015-2016 season)

Source: European Audiovisual Observatory analysis of Eurodata data

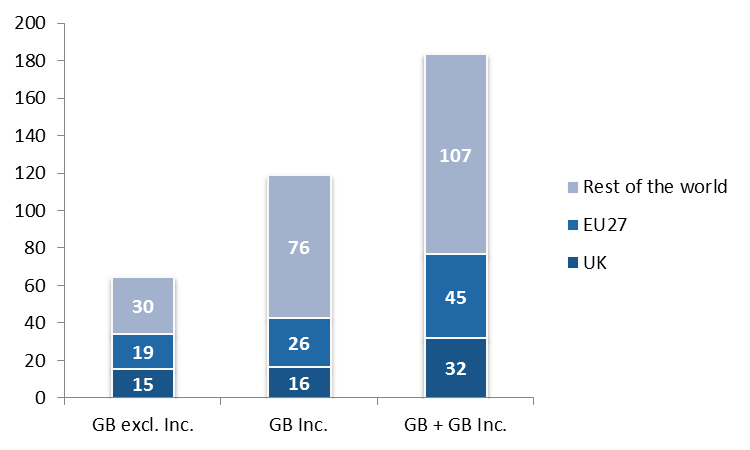

EU27 countries account for 29.0% (excluding GB Inc.) and 24.5% (including GB Inc.) of UK films’ worldwide admissions.

Cinema admissions to UK films (av. 2011-2016, m)

European Audiovisual Observatory/LUMIERE – GB Inc. Films are produced by a UK subsidiary of a US studio.

The UK is a key player in the European film sector. Thanks in particular to a strong domestic cinema market, it produces 16% of all EU28 films, excluding blockbusters films fully-funded by US majors through their UK subsidiaries.

As far as VOD exploitation of European films is concerned, the UK ranks as the runaway No. 1 (ahead of France) for the number of titles exported to other EU28 countries on TVOD.