Download it here

This new study focuses on release windows in Germany, France, United Kingdom, Belgium and the Netherlands.

It finds that:

- The average window between cinema release and retail TVOD (actually buying the film) is 18.6 weeks and rental TVOD (just hiring it) is 19.4 weeks in the five countries studied;

- For retail TVOD, there is difference of only 3 weeks between the shortest (United Kingdom with 17.5 weeks) and the longest window (Germany with 20.5 weeks);

- By comparison the theatrical – retail TVOD window was 12.3 weeks in the USA in 2018. It has decreased by almost 5 weeks since 2012.

The European Audiovisual Observatory has analysed cinema/TVOD release windows for the first time in this study. Author Gilles Fontaine, Head of the Observatory’s Department for Market Information, looked at 1794 releases in cinemas and TVOD between 2014 and 2018. This sample represents only 15% of all films on first release. However, it represents 40% of total admissions, in other words the study focuses principally on the more successful films in cinemas.

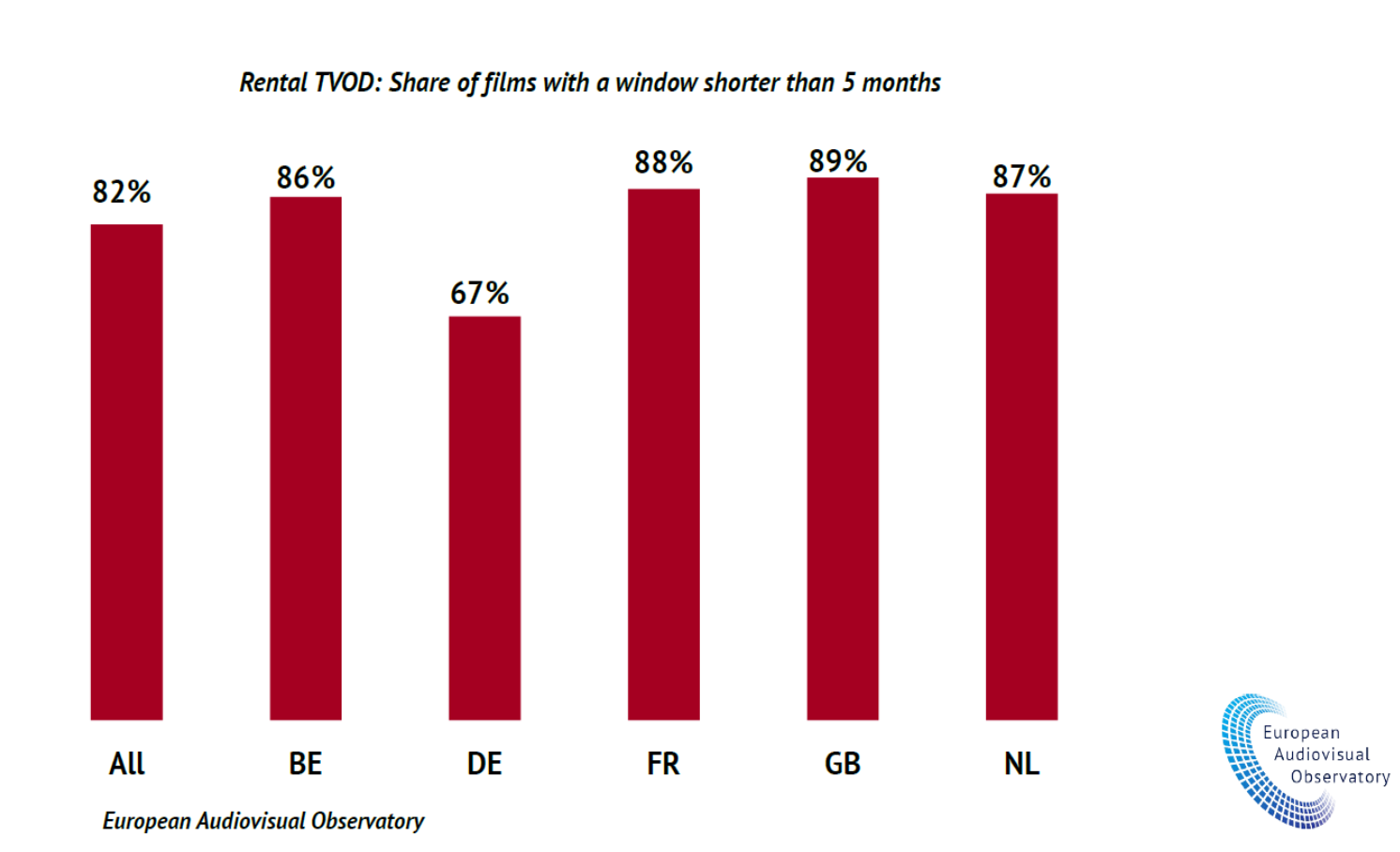

1. 82% OF FILMS ARE AVAILABLE ON TVOD LESS THAN 5 MONTHS AFTER THE CINEMA RELEASE

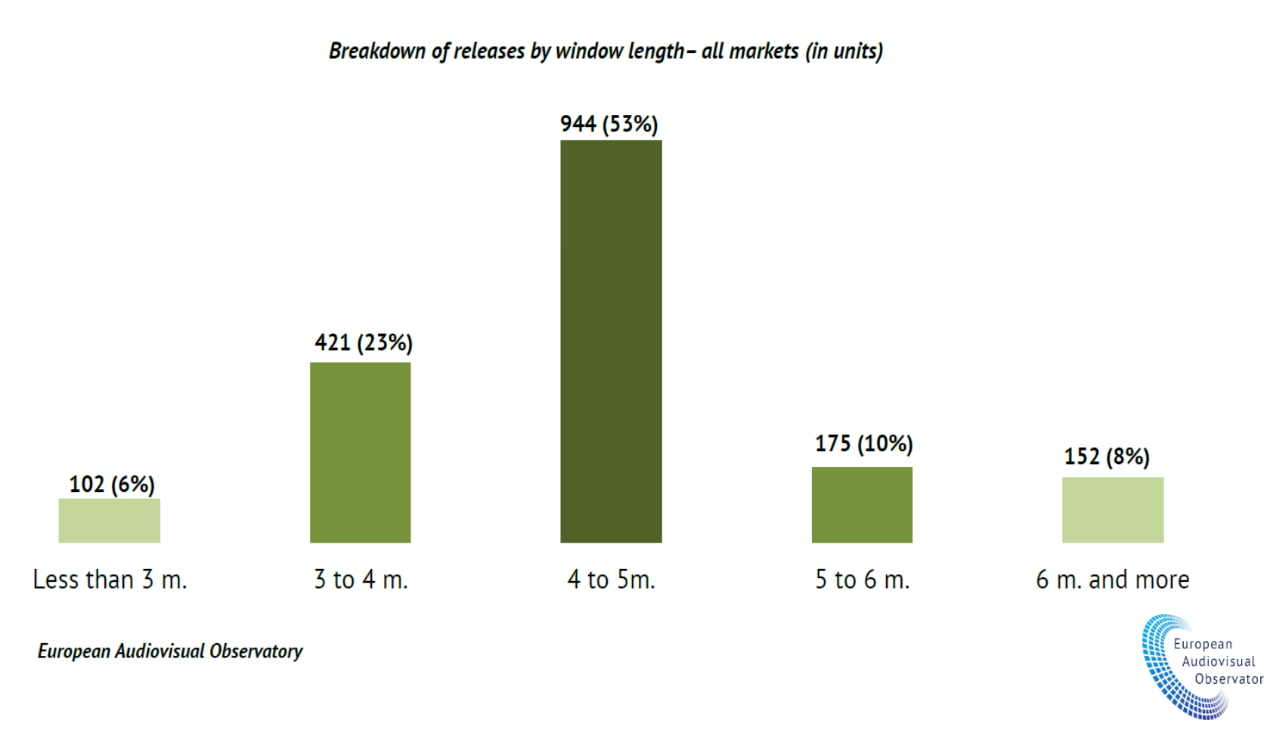

Most of the more successful films are released between 4 and 5 months after their theatrical release. Only 18% of the more successful films are released more than 5 months after the theatrical release.

2. FILMS ARE AVAILABLE LATER ON TVOD IN GERMANY

Belgium, France, United Kingdom and the Netherlands show similar patterns in terms of share of the more successful films released in rental TVOD less than 5 months after the cinema release. The theatrical – TVOD window is regulated in Germany for public funded films (6 months with exceptions), which results in a longer average window.

3. THERE SEEMS TO BE NO CLEAR IMPACT OF THE LEVEL OF ADMISSIONS AMONG THE MORE SUCESSFUL FILMS

Among the more successful films, the level of admissions does not seem to impact the length of the window. A clear exception is the bottom 25% of sample films released in the United Kingdom which benefit from a window that is 4 weeks shorter than the average of films released.

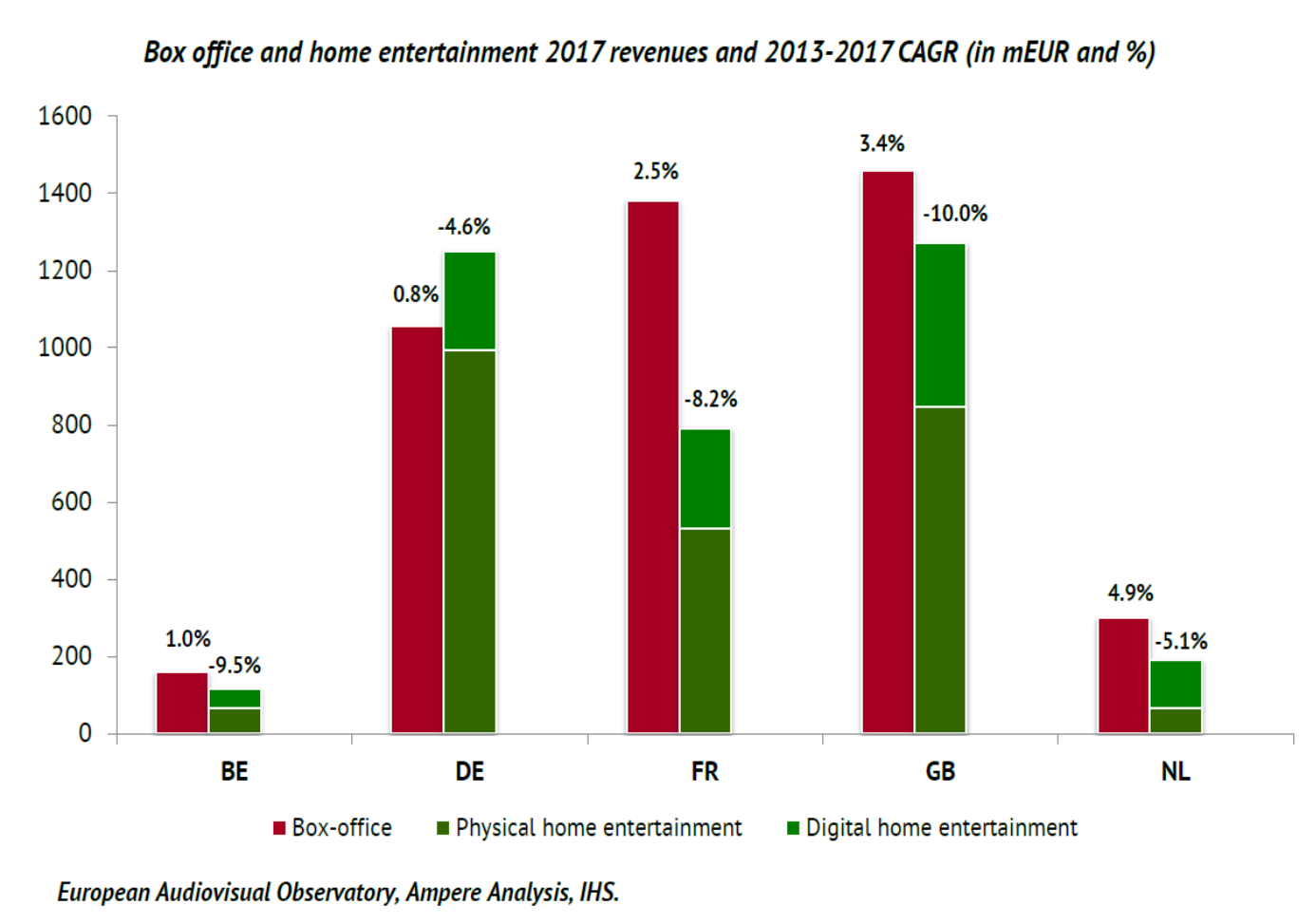

4. TWO SAMPLE COUNTRIES WITH THE HIGHEST BOX-OFFICE GROWTH RATES HAVE THE SHORTEST THEATRICAL – TVOD WINDOWS

Germany is the sample market with the longest theatrical – TVOD window. It combines a struggling box-office with a comparably resilient home entertainment market.

Two sample countries with the highest box-office growth rates – France and the UK - have the shortest theatrical – TVOD windows.