Download "Audiovisual Media Services in Europe - 2024 edition"

The latest edition of the report “Audiovisual Media Services in Europe – 2024 data” has just been published by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg.

This report maps the European audiovisual sector by providing concrete data on the supply of services, their programming, coverage and ownership. It was authored by Jean-Augustin Tran, Analyst from the Observatory’s Department for Market Information.

Key findings:

- The European audiovisual sector features a total of 12 955 audiovisual media services and video-sharing platforms (as of Dec. 2024) available in wider Europe (defined as EU27, Albania, Armenia, Bosnia and Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, the Republic of Moldova, Norway, Serbia, Switzerland, Türkiye, the United Kingdom and Ukraine). Around three quarters of these services are linear services (9 536 TV channels) and one quarter are non-linear services (3 419 VOD services and video-sharing platforms).

- The European audiovisual services sector continues to grow. The number of audiovisual media services and video-sharing platforms available increased in wider Europe by 2% between Dec. 2023 and Dec. 2024. The number of on-demand services grew faster (4%) than the number of TV channels (1%). The growth of TV channels is partly driven by FAST channels.

- Overall, US groups have a substantial influence on the European audiovisual sector, with significant portfolios and market presence compared to their European counterparts. One in four (25%) of all private TV channels (excluding local TV) are US-owned and almost one in ten (9%) of all on-demand services in Europe belong to a US company. US TV channel portfolios are significantly larger than European ones, with 70% of channels in the top 10 TV groups owned by five US companies.

Public and private ownership

Audiovisual media services and VSPs are privately owned most of the time: 91% of the total are owned by private companies. Compared to TV channels, we note that VOD and VSP services are more likely to be privately owned (10% of TV channels are publicly owned as opposed to 4% public ownership of VOD and VSP services).

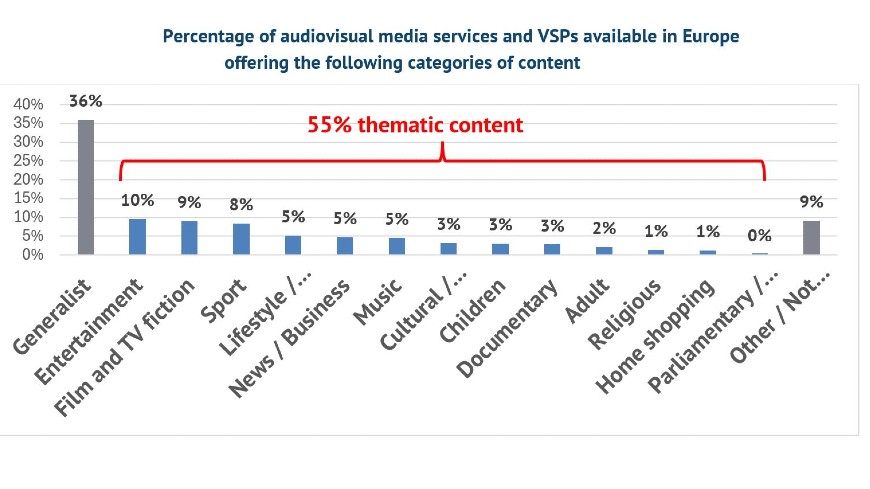

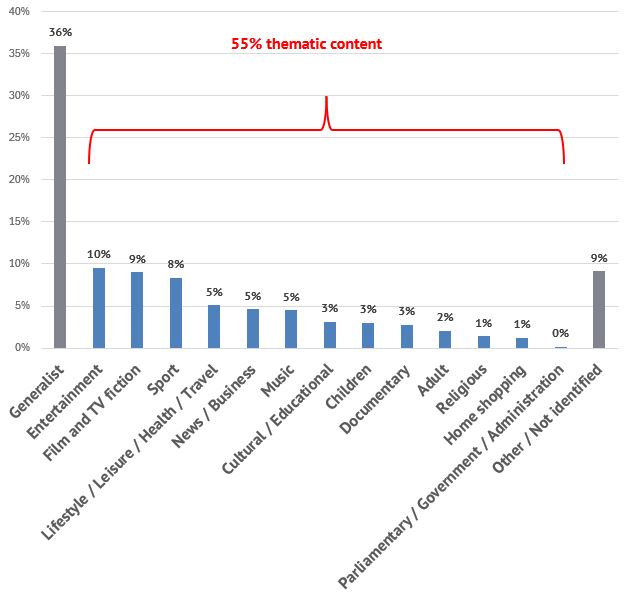

The category of content is quite different when comparing public TV channels and public VOD/VSPs. While public channels specialized in films and TV fiction are almost non existent, 14% of public VOD services specialize in films and TV fiction. It seems that public service media have developed their online presence as an outlet to offer more thematic content to targeted audiences in order to adapt to digital consumption and audience fragmentation.

Footprint

TV and on-demand services targeting Europe but established outside of Europe make up just 2% of all services available. Conversely, there are very few exports out of Europe. Typically, most audiovisual services in Europe serve national markets, meaning that the country of establishment and operational scope of a service provider are identical.

However, the European AV sector is characterised in part by a certain degree of intra-European supply movements. The share of services available in Europe with a multi-national or pan-European coverage is a combined 23% for television and 13% for on-demand services.

Percentage of audiovisual media services and VSPs available in Europe offering the following categories of content | Dec. 2024