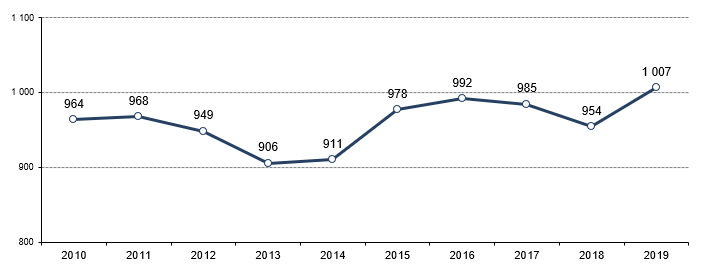

On the occasion of the 70th Berlin International Film Festival, the European Audiovisual Observatory releases its first estimates for European cinema attendance in 2019. After two years of decrease, the Observatory estimates that total admissions in the European Union increased by 5.5% thus breaking through the 1 billion barrier. This is 52.6 million admissions more than in 2018, making the best result registered in the EU since 2004. Taking into account non-EU territories, admissions in Europe also showed an upswing, increasing from 1.25 billion in 2018 to 1.31 billion, a record for at least the last two decades.

Cinema attendance in the European Union 2010-2019 provisional

In millions; estimated; calculated on a pro-forma basis for the 28 EU member states

Source: European Audiovisual Observatory

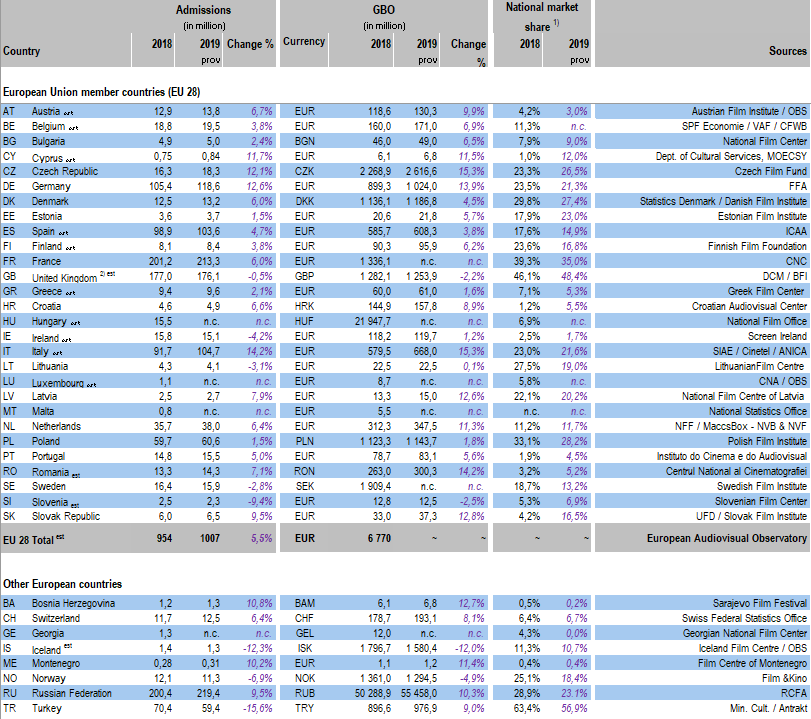

In contrast to 2017 and 2018, the growth in admissions was comparatively homogeneous in 2019: cinema attendance increased in 19 and decreased in only five of the 25 EU markets for which provisional data were available, while remaining comparatively stable in one country. Geographically speaking, the growth in 2019 was primarily driven by a strong year-on-year recovery in Germany (+13.3 million, +12.6%), Italy (+13.1 million, +14.2%), France (+12.1 million, +6.0%)- which achieved its second best year on record since 1966, and Spain (+4.7 million, +4.7%). Out of the five major EU markets, only the United Kingdom registered a decline in cinema attendance compared to 2018 (-9.0 million, -2.2%) with a total of 176.1 million tickets sold. However, this is still the second highest admissions level in the UK since the 1970s, following a record-breaking 2018. Admissions also reached record levels in Poland (+0.9 million, +1.5%), the Netherlands (+2.3 million, +6.4%), Czech Republic (+2.0 million, +12.1%) and Romania (+1.0 million, +7.1%).

Outside the EU, the Russian market once again crossed the 200 million threshold, recording a total of 219.4 million admissions in 2019 (+9.5% on the previous year). This sets a new record in recent history and confirms Russia’s position as Europe’s largest cinema market in terms of admissions, ahead of France. In contrast, Turkey registered a decrease in cinema attendance, with admissions down from 70.4 million in 2018 to 59.4 million in 2019.

It is too early to analyse EU admissions by film origin, but the first available figures suggest that the upswing in cinema admissions was primarily driven by a year-on-year increase in admissions to US films. Unlike previous years, 2019 saw the release of several megahits, each generating more than 30 million admissions at the EU box office. Top ranking films in the EU in 2019 include The Lion King (US), Avengers: Endgame (US), Frozen 2 (US) and Joker (US / CA).

Compared to 2018, national market shares of EU films increased in 11 and declined in 13 of the 24 EU markets for which 2019 data were available. The UK recorded a 48.4% market share for UK qualifying productions (including US studio-backed, UK-made titles). This was the highest national market share among EU markets, though independent UK productions captured only 14.6% of the market. Ranking second was France with a national market share of 35.0%, ahead of Poland, with 28.2%. Other EU markets with high national market shares include Czech Republic (26.5%), Denmark (26.0%), Estonia (23.0%), Italy (21.6%) and Latvia (20.2%). Outside the EU, Turkey confirmed its leading position in terms of national market share with Turkish films capturing 56.9% of admissions in 2019.

Key Cinema Data in European Countries 2018–2019 provisional

1) Based on admissions except for ES, GB, PL and IE, where it is based on GBO. Includes minority co-productions with the exception of CH, DK and SE.

2) National market share for UK qualifying films based on GBO. Includes minority co-productions and US studio-backed films.

Source: European Audiovisual Observatory

Notes:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- Data for EU markets include the United Kingdom.

- All 2019 figures are provisional.

Our next cinema figures will be released just before the Cannes Film Festival.

To be added to our press listings, send an email to: alison.hindhaugh@coe.int