-

Download the report here (English)

-

Download the report here (Russian)

This new report finds that:

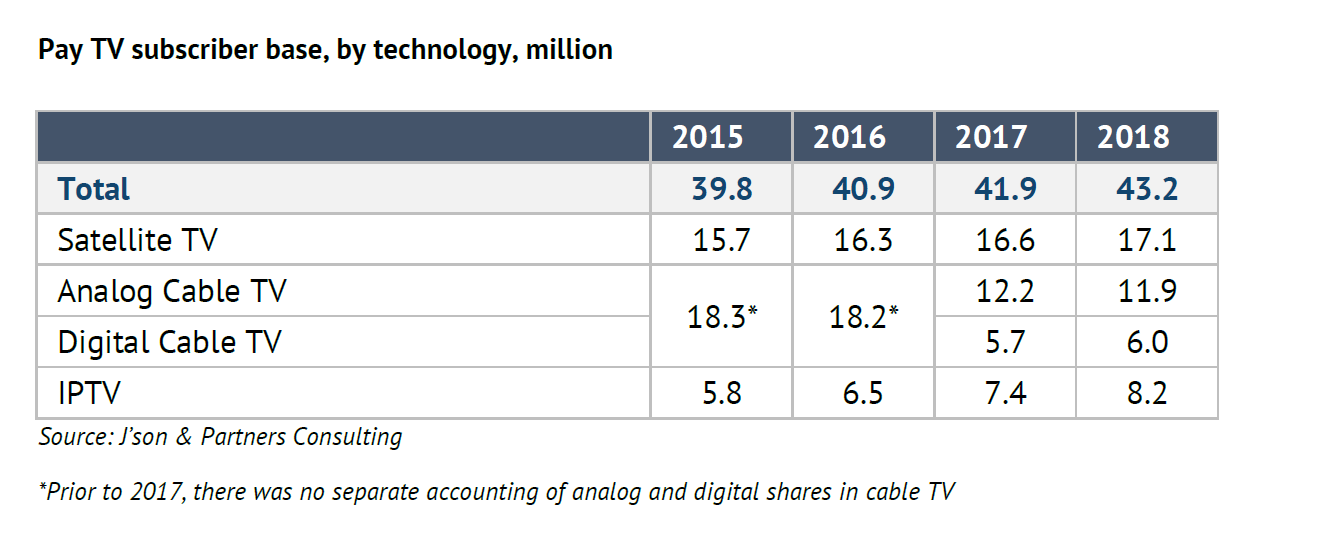

- By the end of 2018, 43.2 million subscribers were using Pay TV services in Russia, a 3.1% increase on 2017.

- 2018 Pay TV revenue in Russia represented 95.3 bn Rub (1.29 bn EUR). This means that growth relative to 2017 was 14.2%.

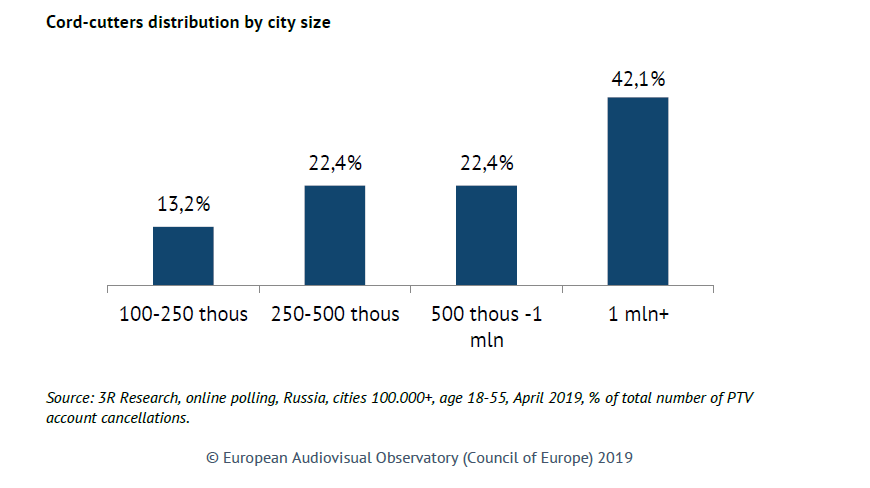

- From 2017 to 2019 the number of cord-cutters in Russia was estimated at 4.3% of the population of major cities and shows no sign of increasing

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, releases an annual report on Russian TV or cinema accompanied by a successful conference. This year’s report on pay-TV and cord cutting was written by J’son and Partners Consulting and presented at the Observatory’s Moscow conference on Tuesday of this week.

1. Russian pay-TV market

By the end of 2018, 43.2 million viewers were subscribed to Pay TV services in Russia, 3.1% more than in 2017. Excluding double-counting due to the usage possibility of various different methods of pay-TV connection in one household, the number of households connected to Pay TV was 35-36 million, or 62-63% of the population. Growth over the previous year amounted to 1%. J'son & Partners Consulting estimates that in 2018, Pay TV revenues amounted to 95.3 bn Rub (1.29 bn EUR), up 14.2% compared with 2017.

2. Related services and their impact on the pay TV industry

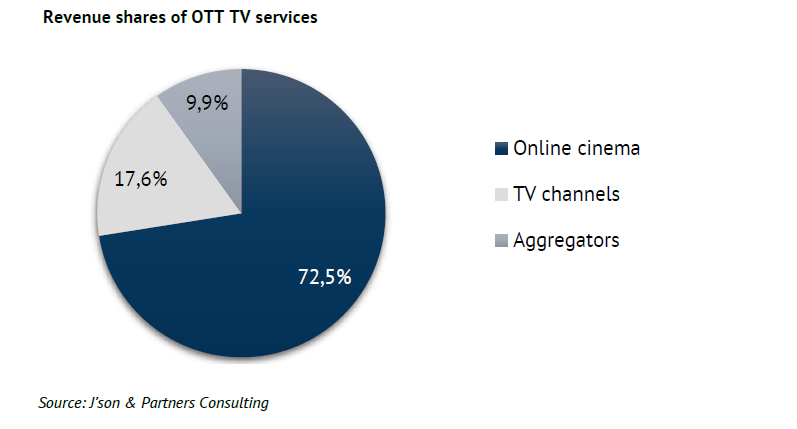

Revenue of OTT TV services reached 8.7 bn Rub (117.4 mln EUR) in 2018 and accounted for 9% of Pay TV market revenues. See the distribution by category in the figure below. The baseline forecast by J’son and Partners indicates that the total revenue of OTT TV services will grow by 15.7% per year (CAGR). By 2023, it could reach 23.4 bn Rub (315.7 mln EUR) and will be only 5 times smaller than the Pay TV market. The subscriber base in 2018 represents 2-2.5 mln. Subscribers: 5-7% of the Pay TV subscriber base.

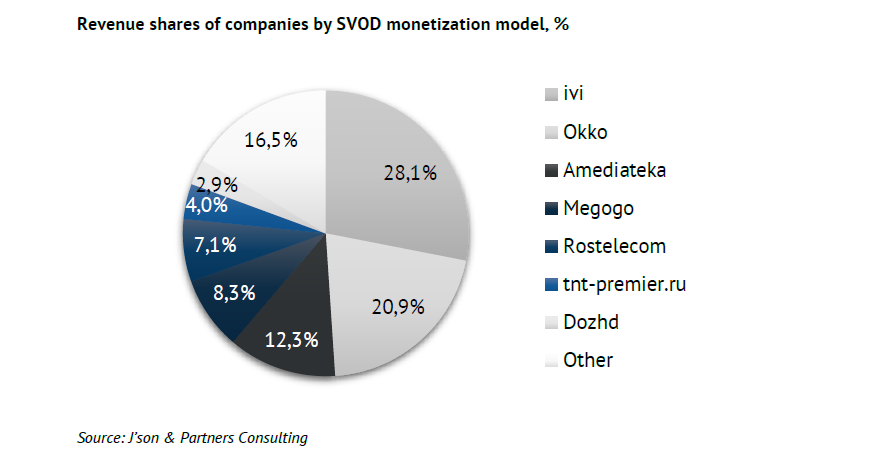

3. The legal SVOD offer in Russia

The total market revenue of legal video services in 2018 was 24,86 bn Rub (335.3 mln EUR). During the period of 2019 to 2022, revenues will continue to grow with an average rate of 24% and in 2022 will be over 58.7 bn Rub (792.1 mln EUR). SVOD revenue in 2018 was 6.03 bn Rub (81.3 mln EUR), representing 24% of the total revenue of legal video services.

4. Cord cutting in Russia

If piracy of video resources can be eliminated successfully, the market revenue of legal video will rapidly increase, primarily by adding subscribers to SVOD services. As of April 2019, the number of cord-cutters (people who have left Pay TV services) represents 4.3% of the population of major cities. This equates to 1.7 million people or 660 thousand households. Most viewers of professional online video seem to be unwilling to have a paid subscription. 17% of them, however, have signed up for one at least once.