Download it here.

This report finds that:

- Four out of five TV channels in a given country in Europe had a market share of 2% or less[1].

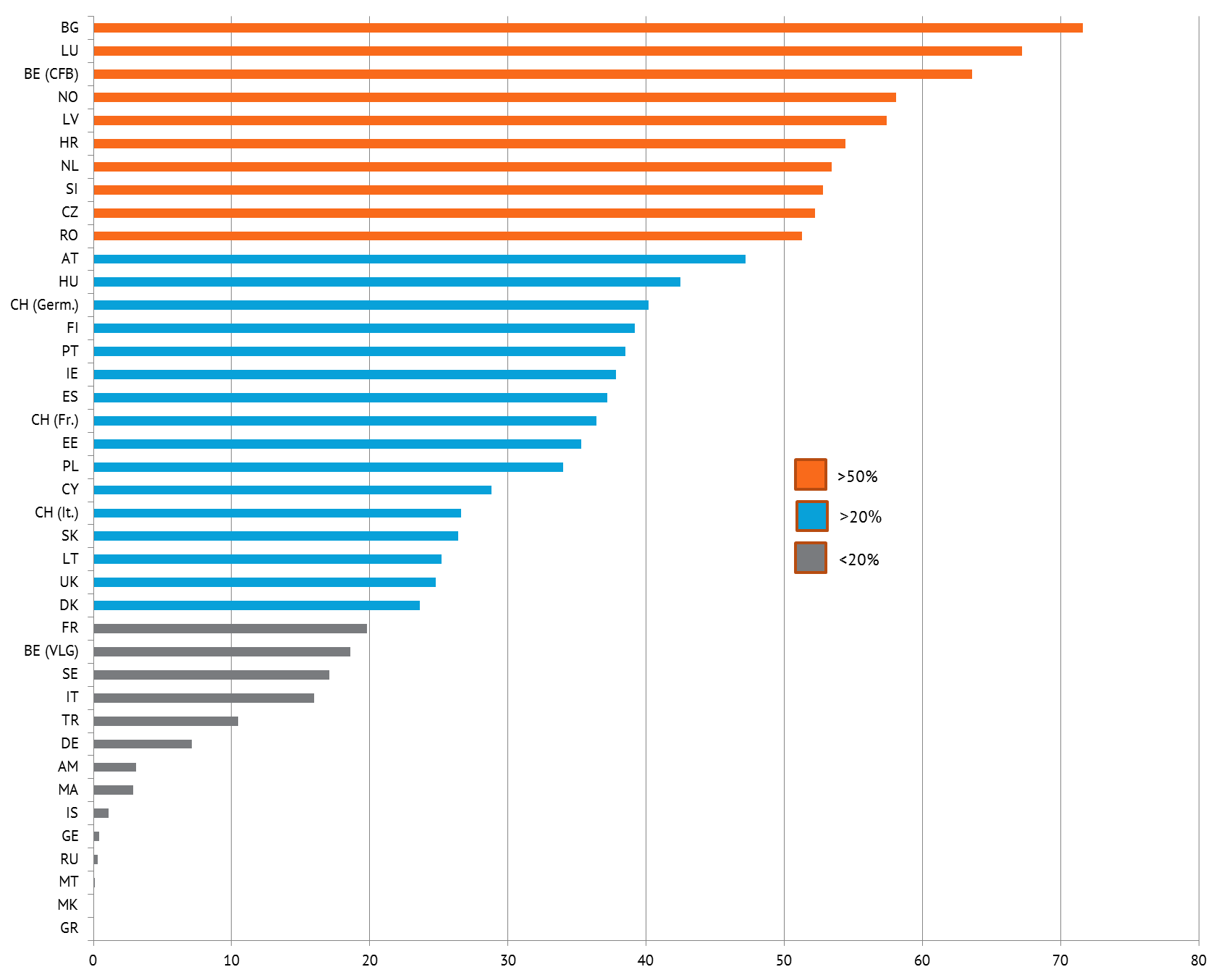

- In 26 European audiovisual markets, non-domestic players accounted for more than 20% of national audience shares and in ten countries for more than 50% of national audience shares, with US groups the most dominant.

- The industry mergers of British media group Sky with Comcast and 21st Century Fox with the Walt Disney Company extended the footprint of US groups in European audience markets to unrivalled levels.

[1] This includes TV channels whose 2017 audience data indicated a minimum daily market share of at least 0.1% as measured by Eurodata TV Worldwide. Figures are based on averages in a given country and include double counts between countries.

This brand new report “The internationalisation of TV audience markets in Europe” is published by the European Audiovisual Observatory. Based on data analyses of 2017 TV audience data by Eurodata TV Worldwide, this report explores the increasing internationalisation of the European television sector from three different angles. The first focuses on the concentration and fragmentation tendencies in the various European national audience markets, identifying the decline in audience shares among top players and an audiovisual market characterised by a large number of TV channels with relatively small market shares. The second angle looks at the market power of non-domestic TV channels in national markets, noting the extent to which foreign groups exert considerable market power in a majority of European countries. The third angle highlights the growing footprint of US groups in the European audiovisual sector by tracking the broadcasting activities of the major groups and comparing their European audience market shares across the various markets.

Concentration and fragmentation tendencies in national audience markets

- There is less concentration in the European audience market due to a continued loss of market share by various players over time. From 2012 to 2017, the average audience market shares of the four leading TV channels in Europe’s national markets fell by 8.2 percent, with an average net loss percentage point difference (PPD) of 5.5. In the EU, the average decline in audiences was even more pronounced (-10.2%; 6.0 PPD for average net losses). Notable exceptions to this trend were Switzerland (Germ.), Denmark and Romania. At the same time, the four main TV groups recorded lower audience losses, indicating that industry consolidation processes slowed the overall trend, enabling groups to better maintain cumulated shares in the European national markets (average decline of 5.1 percent (-4.0% in the EU) and average net loss PPD of 3.6 (PPD of 3.8 in the EU). Notable exceptions to this trend were Russia, Denmark and Lithuania.

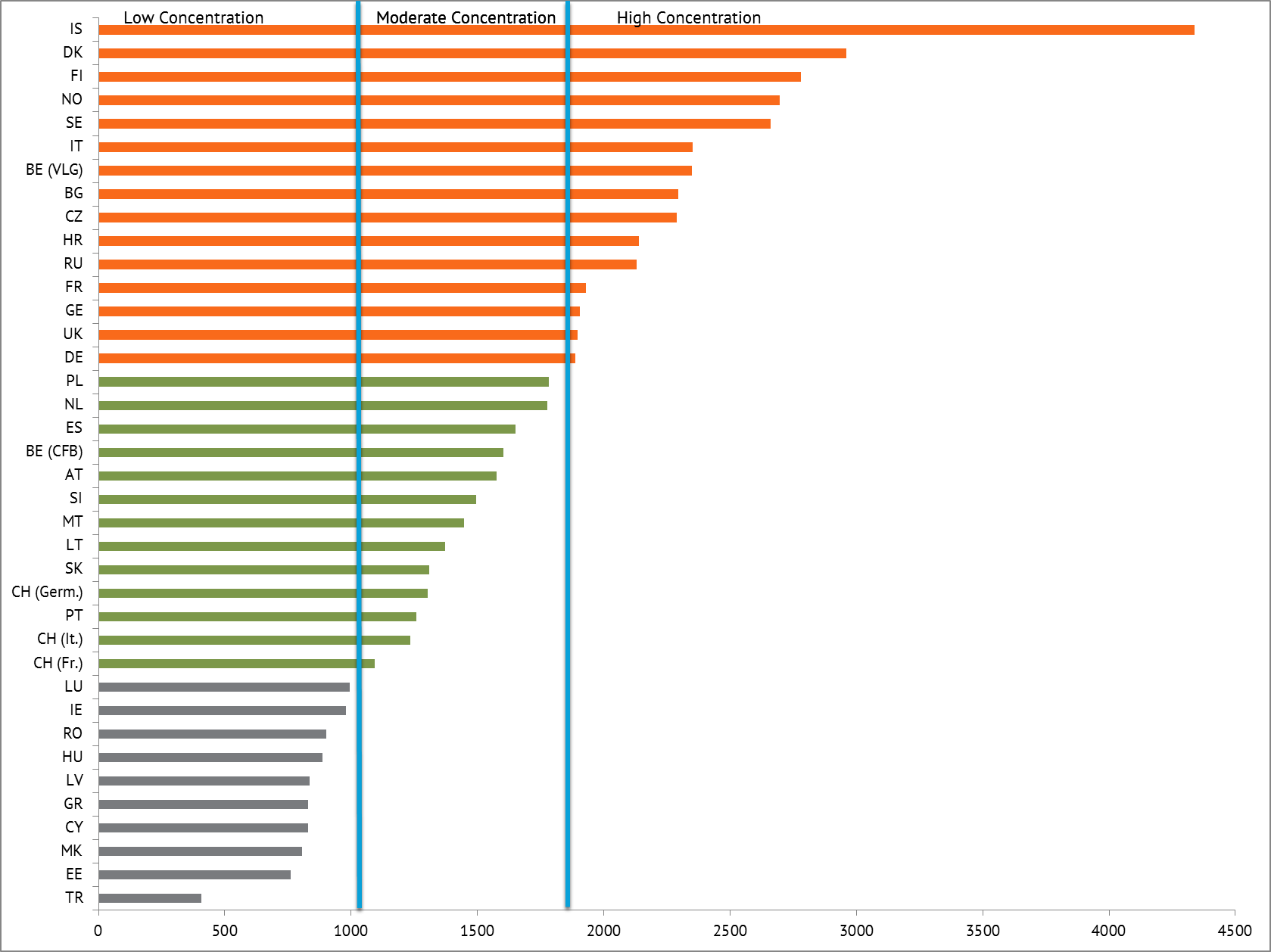

- The audiovisual markets of the Nordic countries are among the most concentrated in Europe. An analysis of 2017 audience data using the Herfindahl-Hirschman Index (HHI) gave Iceland, Denmark, Finland, Norway and Sweden the five highest HHI scores in Europe in terms of shares held by the 4 main TV groups in each country.

- The European audience market is characterised by a large number of TV channels with a relatively small market share, illustrating the degree of fragmentation. In 2017, four out of five (80.0%) TV channels accounted for a market share of 2% or less (comparable figures for the EU), leaving just 5% with a superior market share[2].

Herfindahl-Hirschman Index analysis of audience concentration by country | 2017

[2] Ibid.

The market power of non-domestic TV channels in national markets

- Non-domestic players exert considerable market power in a majority of European audiovisual markets, with some foreign TV groups eclipsing the market shares of domestic ones. In 2017, non-domestic players accounted for more than 20% of the audience share in 26 European audiovisual markets, and in 10 countries foreign TV channels accounted for more than 50% of national audience share. The countries where a significant portion of national market share was held by foreign groups generally comprised smaller audiovisual markets, including Bulgaria in first place, with a 71.6% share, followed by Luxembourg (67.2%) and the French Community of Belgium (63.6%) in second and third place, respectively.

- US groups had a particularly strong market presence in the European audiovisual sector compared to other pan-European groups in non-domestic markets. This was particularly the case in smaller countries, including Slovenia, where US players accounted for 44.1% of national market share, followed by Bulgaria (40.7%), Romania (31.5%), Croatia (31.4%), the Czech Republic (31.3%), Poland (29.1%), Slovakia (25.9%) and Norway (22.5%). Among the larger audiovisual markets, the UK stood out with a significant level of non-domestic market shares held by US groups (23.1%).

- US groups showed the highest degree of internationalisation in terms of the number of non-domestic markets in which they operated. In 2017, the US-based group Discovery was the most omnipresent in the European audiovisual market with a broadcasting presence in 26 different territories. It was followed by Viacom (25), the Walt Disney Company (23; includes 21st Century Fox), AT&T (22; includes WarnerMedia) and Comcast (19; includes Sky), while the Japanese Sony Corporation was active in 13 countries. The most internationalised European group was German Bertelsmann, active in 14 different territories, followed by Swedish group Kinnevik (10) and the BBC (8).

Market power of non-domestic TV channels in national markets | 2017 – In %

International competition for European audiences

- Competition for a share of the European audience market is mainly a national business, dominated by a number of European groups with a domestic focus among the top-ranking players. Most of these groups attain all or large parts of their audience market share in their respective domestic markets. A notable exception is Bertelsmann, whose non-domestic market share in 2017 was greater than their share of the German market.

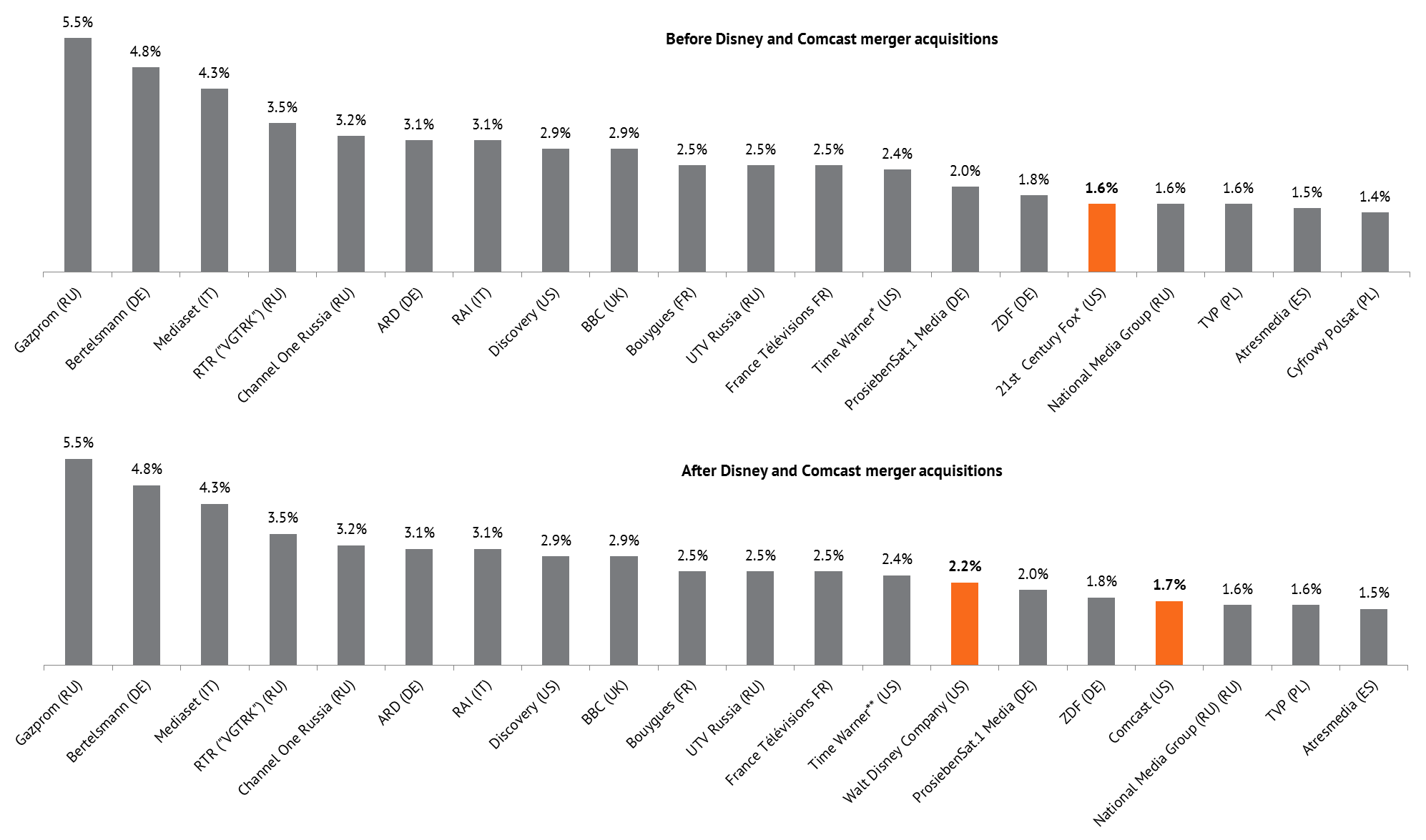

- Following two large-scale industry mergers, the acquisition of British media group Sky by Comcast in November 2018 and that of 21st Century Fox by the Walt Disney Company in March 2019, the fingerprint of US groups in Europe became even greater. Both merger acquisitions pushed their US parent companies into the top 20 league of groups with the largest European audience market shares , increasing the total share of US groups in non-domestic markets from 6.9% to an unrivalled 9.1%

- Even considering national boundaries, public service media groups accounted for a considerable market share in most European markets. These market shares were generally achieved in national TV markets, with non-domestic market shares limited to neighbouring countries with a particular cultural or language proximity. In 2017, seven of the top 20 audiovisual groups by European audience market share were public service media groups and so were one in five of the top 50 audiovisual groups.

Top 20 audiovisual groups ranked by European audience market share | 2017 – In %

Note: * Acquisition of 21st Century Fox by Disney in March 2019; **Acquisition of Time Warner by AT&T in June 2018 and name change to WarnerMedia.

Source: European Audiovisual Observatory / Analysis of Eurodata TV Worldwide data