Download "Audiovisual media services in Europe -2023 edition" here

This new report finds that:

- The European AV sector boasts a total of 12 664 audiovisual media services available in wider Europe (Dec. 2022). Europe includes: EU27, Albania, Armenia, Bosnia and Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, the Republic of Moldova, Norway, Serbia, Switzerland, Türkiye, the United Kingdom and Ukraine. Around three quarters of these are linear services (9 349 TV channels) and one quarter are non-linear services (3 315 VOD services and video-sharing platforms).

- Most non-European parent companies of AV services in Europe are US players. Around one in five (18%) of all TV channels (excluding local TV) are US-owned and over one third of all SVOD (39%) and TVOD (33%) services in Europe belong to a US company. For multi-country SVOD and TVOD services, one catalogue is counted as one service.

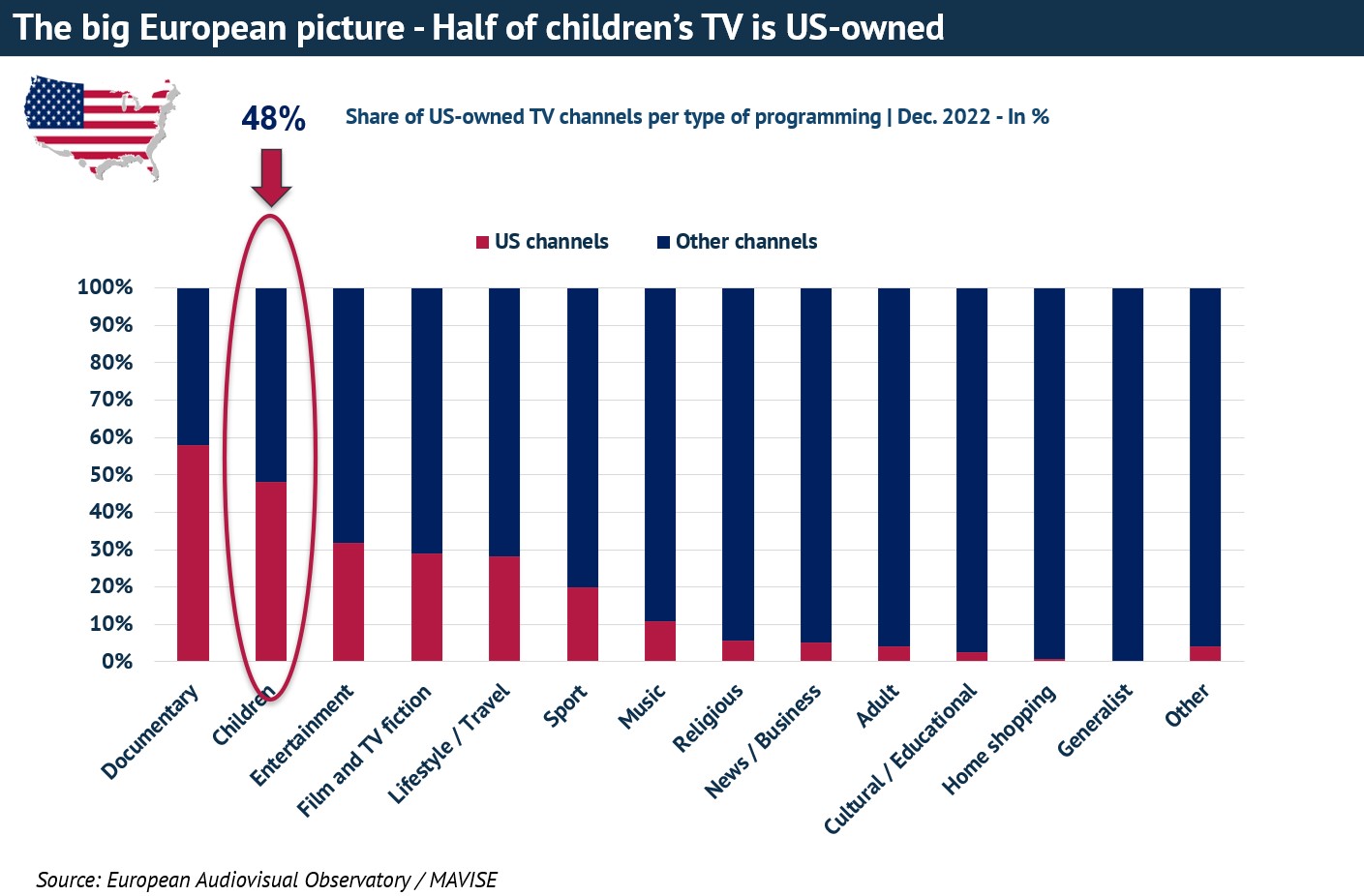

- US players dominate kids TV and entertainment SVOD. Around half of all children’s TV channels in Europe are US-owned (48%) and the same goes for 59% of entertainment subscription video-on-demand services.

To map the ever-changing European audiovisual sector the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has published a new edition of its annual report on TV channels and on-demand services in Europe. This report – Audiovisual Media Services in Europe – was authored by Dr. Agnes Schneeberger, Analyst within the Observatory’s Department for Market Information.

One in four audiovisual media services in Europe is an on-demand service

The European audiovisual media services sector has been shaped by the development of its unique national media ecosystems. This diversity is reflected in a sector boasting a total of 12 664 audiovisual media services which are available in wider Europe (Dec. 2022). Around three quarters of these are linear services (9 349 TV channels) and one quarter are non-linear services (3 315 VOD services and video-sharing platforms).

The content of AV services in Europe reveals significant differences between linear and non-linear services. While TV programming is largely defined by thematic fragmentation, on-demand services have a clear focus on film and TV fiction content.

With regards to ownership, the European TV market is divided into a public sector with mainly generalist programming available on DTT networks and a private sector which has expanded into thematic cable, IPTV, and satellite channels. Almost all on-demand services are privately owned (97%). Public service media have entered the market as well, mostly offering catch-up of their linear programming. One in five public on-demand services are paying services, for example the international version of the BBC iPlayer.

Considerable presence of US players in the European TV and on-demand sector

Non-European players have taken a strong foothold in the European AV market. One in five of the top 50 TV groups and more than a third of the top 50 groups for on-demand services has a non-European parent company.

US players represent the largest group of non-European parent companies of AV services in Europe. Around one in five (18%) of all private TV channels (excluding local TV) are US-owned and over one third of all SVOD (39%) and TVOD (33%) services in Europe belong to a US company.

US players lead in the field of kids TV and entertainment SVOD. Around half of all children’s TV channels in Europe are US-owned (48%). Paramount's Nickelodeon brand, Disney's Disney Channel, AT&T's Cartoon Network and AMC Networks JimJam are prominent examples. US players also dominate adult online entertainment with a 59% supply share of entertainment subscription video-on-demand services.

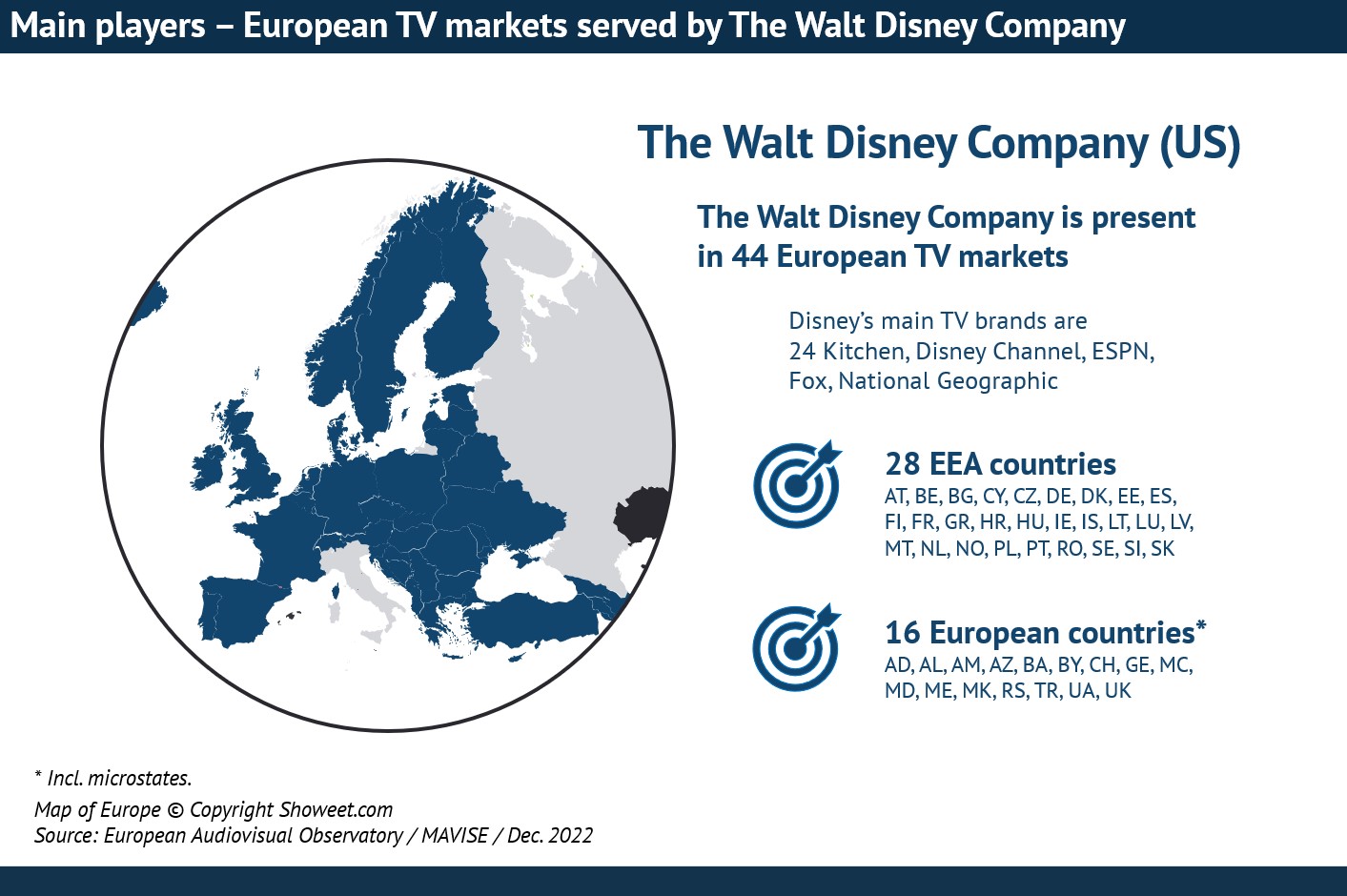

US players have by far the largest scope of operating markets across Europe. The Walt Disney Company, for example, has a virtual European omnipresence, operating in 44 European TV markets.

With regards to their establishment hubs, pan-European players employ different strategies. Netflix, for example, uses a centralized strategy with one main country of establishment from where it targets the European markets. A multi-country strategy is used by Vivendi, where typically a small number of countries serve as a basis to target various national markets. AT&T, by contrast, applies a decentralized strategy where a larger number of establishment hubs serve the European markets.