Download "Fiction film financing in Europe: A sample analysis of films released in 2020" here

This new report finds that:

- The median average budget of a European theatrical fiction film released / scheduled to be released in 2020 was EUR 2.06 million.

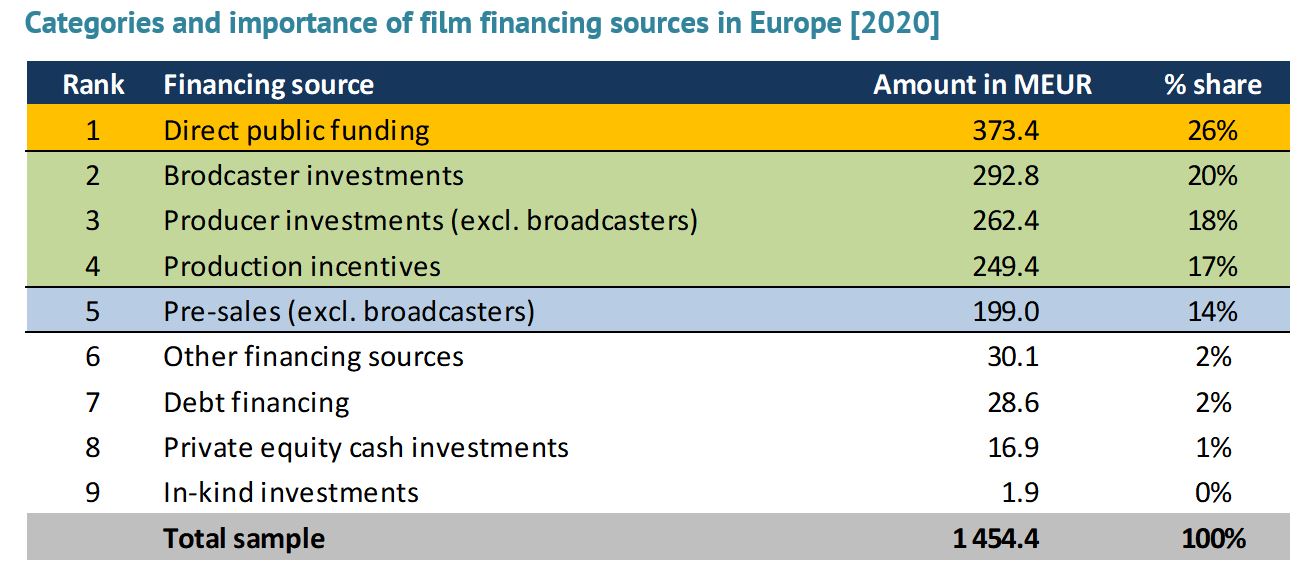

- The largest financing source was clearly direct public funding which contributed 26% of the total financing volume, followed by broadcaster investments (20%) and producer investments (18%) (this text was corrected on 10.2.2023 in order to align it with the correct information given below in the excel table. We had previously written: The largest financing source was clearly direct public funding which contributed 26% of the total financing volume, followed by producer investments and broadcaster investments, both of which accounted for 18% of total financing).

- The percentage share of direct public funding in film financing decreases with increasing market size and budget volume.

This report is the fruit of a major collaboration project between the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, and the European Film Agency Research Network (EFARN). It was authored by Martin Kanzler, Deputy Head of the Observatory’s Department for Market Information.

This annual report aims at providing concrete figures on how European theatrical fiction films are being financed, offering a big-picture, pan-European perspective, and complementing work done at national levels. Based on the actual budget analysis of 482 European live-action fiction films released / scheduled for in 2020, this is probably the largest pan-European data sample available to date on the financing of European fiction films for this year. The report provides unique fact-based insights on a wide variety of research questions, from the quantification of the average budget of theatrical European fiction films, to the importance of individual financing sources.

While the number of sample films dropped significantly in 2020, namely from 651 films released in 2019 to 482 films released in 2020, clearly reflecting the decrease in releases due to cinema closures in 2020, no significant changes in the financing structure of films could be observed. This is most likely due to the fact that films released in 2020 had been financed before the pandemic hit. Potential impacts on financing assumedly only become visible in data sets on films released in 2021 to 2023.

Theatrical fiction budgets in Europe

The data sample studied [see methodological notes below] suggests that the mean budget of a European theatrical fiction film released in 2020 represented EUR 3.02 million while the median sample budget amounted to EUR 2.06 million. However, average budgets differ widely among countries. Not surprisingly, average budgets are higher in larger markets and lower in countries with lower box-office potential, as exploitation in national markets remains key for most films. The median budget of a European fiction film originating in France, Germany, Italy, Poland or the UK (the large markets included in the sample) amounted to EUR 2.7 million in 2020 compared to EUR 1.8 million for fiction films produced in a medium-sized European market and EUR 1.1 million for fiction films from small markets.

Financing structures for theatrical fiction films in Europe

Source: European Audiovisual Observatory

In 2020, the financing of European theatrical fiction films was primarily based on five different financing sources: direct public funding; broadcaster investment; producer investment; pre-sales; and fiscal incentives. The single most significant financing source clearly was direct public funding, which accounted for 26%. Direct public funding was followed by broadcaster investments which accounted for 20% of total financing while producer investments (excl. broadcasters) accounted for 18% of total financing slightly ahead of production incentives (17%). Pre-sales (excl. broadcasting rights) accounted for 14% of total financing. Other financing sources, including private equity, debt financing or in-kind investments are negligible from a cumulative perspective.

However, there appear to be significant structural differences among countries concerning how theatrical fiction films are financed. Some of these differences are apparently linked to market size.

The two most obvious differences concern direct public funding and pre-sales. The data clearly suggests that the weight of direct public funding in film financing decreases with increasing market size and vice versa. While comprising only 20% of total financing in the five large sample markets, public funding accounted for 44% in medium-sized and 58% in small sample markets.

In contrast, the importance of pre-sales (other than those to broadcasters) as a financing source decreases with market size. Pre-sales tend to be most important in large markets, where they in 2020 accounted for 15% (18% excluding French films), compared to ‘only’ 10% in medium-sized and 9% in small sample markets.

Methodology

The analysis is based on a data sample comprising detailed financing plans for 482 European live-action fiction films - theatrically released / scheduled for release in 2020 from 27 European countries. The data sample includes both 100% national as well as European-majority-led co-productions. It covers a cumulative financing volume of EUR 1.45 billion. The data sample is estimated to cover 64% of the total number of European fiction films released in 2020.