|

The figures in this press release are taken from the 2022 edition of FOCUS – World Film Market Trends, a report which is prepared each year for the Marché du Film. Journalists may request a PDF press copy from [email protected]. FOCUS is available as a free print copy to all Marché attendees from the administrative offices of the Marché in the Palais at level -1, aisle 11). It’s also free online for all Marché participants on the online platform. It can be purchased after the Marché from the Council of Europe bookshop.

Download the data as an Excel table

Admissions in the EU and the UK increased by 31.5% in 2021

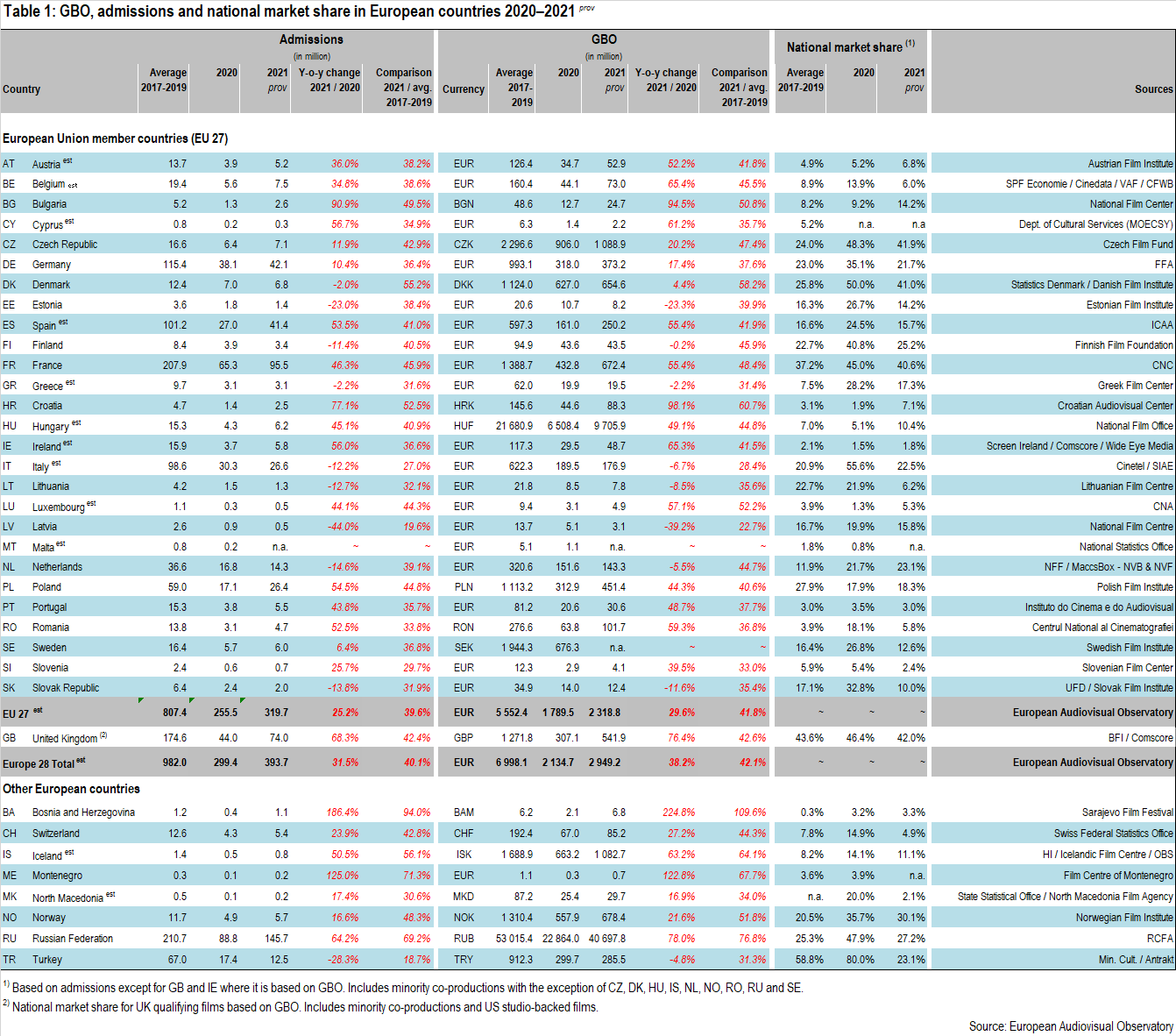

2021 turned out to be another difficult year for cinema going in Europe. Multiple factors, like the ongoing closures of cinemas, particularly in the first half of the year, the negative effect of attendance restrictions, possible hesitancy among audiences to return to cinemas, the return of US studio blockbusters and the differing strength of local films, contributed to the European theatrical markets making progress, but rather slow progress, in returning to pre-pandemic levels. Cinema attendance in the EU and the UK increased by 31.5% from 299 million in 2020 to 394 million in 2021. However, this level accounts for only 40% of the average pre-pandemic admission level registered between 2017 and 2019. Similarly, GBO grew by 38.2% from EUR 2.1 billion to an estimated EUR 2.9 billion, accounting for only 42% of pre-pandemic box office levels.

There were significant differences in box office development across the individual European markets, which evidently need to be interpreted in light of the differing degrees to which the individual markets had collapsed in 2020 as well as differences in cinema closures. Overall admissions in 2021 increased in 17, decreased in eight and stagnated in two out of the 26 EU member states and the UK for which 2021 data were available. The highest year-on-year increase was registered in Bulgaria (+91%), Croatia (+77%), the UK (+68%), Cyprus (+57%), Ireland (+56%), Poland (+55%), Spain (+53%) and Romania (+53%). In contrast admissions declined particularly in Estonia (-23%), the Netherlands (-15%), Slovakia (-14%), Lithuania (-13%), Italy (-12%) and Finland (11%).

Outside the EU and the UK, theatrical markets grew strongly on a year-to-year basis in Bosnia-Herzegovina (+186%), Montenegro (+125%), the Russian Federation (+64%) and Iceland (+51%). Cinema attendance however continued to drop by -28% in Turkey, which registered the lowest admissions level in recent history.

No Time To Die and Spider Man: No Way Home led the box office charts in Europe 28 in 2021

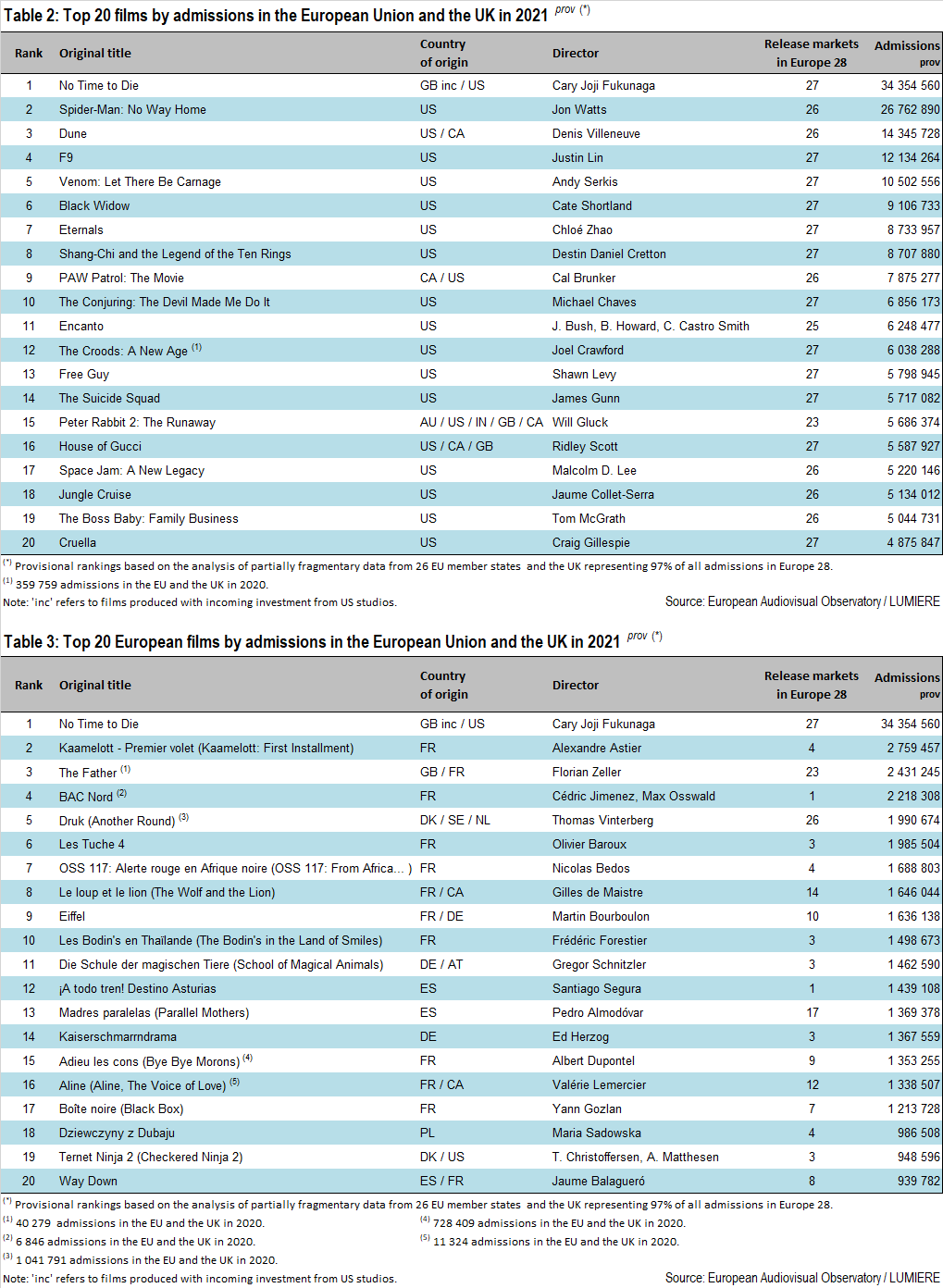

US studio titles returned to European cinemas in 2021 and accounted for all the top 20 titles in terms of admissions. Two films stood out, No Time To Die (GB INC / US) topped the charts and was the only films to sell more than 30 million tickets in the EU and the UK. It was followed by Spider Man: No Way Home (US) which sold 27 million tickets in 2021. Three other films managed to sell more than 10 million tickets: Dune (US; 14.3 million), Fast and Furious 9 (US; 12.1 million) and Venom: Let There Be Carnage (US; 10.5 million). A total of five films therefore sold more than 10 million tickets in 2021, compared to 18 films in 2019. Film franchise titles once more dominated the European box office, with 17 out of the top 20 films being sequels, prequels, spin-offs or reboots, compared to only seven in 2020 and 18 in 2019. Apart from the EUR inc production No Time To Die (“EUR inc” refers to films produced in Europe with incoming investments from US studios), no European film featured among the top 20 titles. The French comedy Kaamelott - Premier volet became the most successful European film selling 2.8 million tickets, ahead of psychological drama The Father (GB/FR; 2.4 million) and French crime thriller BAC Nord (2.2 million).

European market share dropped again to 26.5%

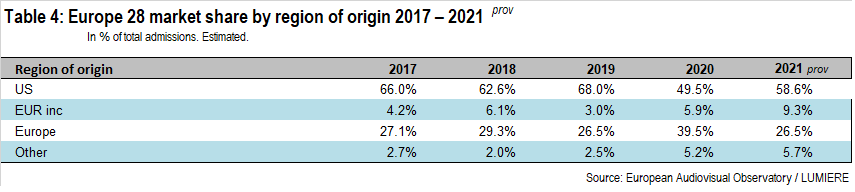

While European films benefitted from the absence of US blockbusters in 2020, admissions growth in 2021 was primarily driven by the return of US blockbusters. US films are estimated to have sold around 230 million tickets in 2021, 82 million more than in 2020, while admissions to European films actually declined from an estimated 118 million in 2020 to 104 million in 2021. This compares to a pre-pandemic average of 644 million and 271 million tickets sold to US and European films, respectively. The market share of European films therefore dropped from its exceptional record high of 39.5% in 2020 to 26.5%, which is well within its normal range. US market share on the other hand jumped back from its record low of 49.5% in 2020 to 58.6%, which is still below its pre-pandemic levels while European films with incoming investment from US studios, led by No Time To Die (GB inc /US), and films from the rest of the world, captured above average market shares of 9.3% and 5.7%, respectively.

After reaching exceptional record highs in several European countries in 2020, market share of national films declined again in most European markets, but remained high in several of them. Within Europe 28 four countries stood out in terms of national market share: the UK and the Czech Republic which registered the highest national market share with 42% of total admissions, marginally ahead of Denmark and France (both 41%). Outside the EU, Turkey’s national market share plummeted from 80% in 2020 to 23%, the lowest level in recent history. With 30% Norway registered the highest national market share outside Europe 28, ahead of Russia (27%).

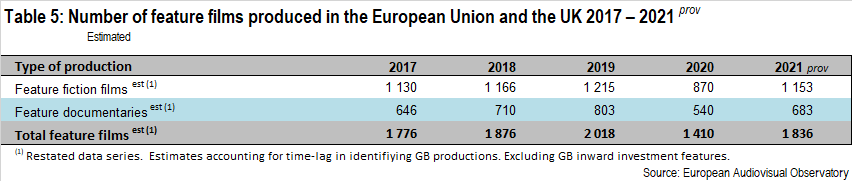

Film production in the EU and the UK back to pre-pandemic levels

Having reached a comparatively brief temporary standstill due to the lockdown measures taken all over Europe in March 2020, film production never collapsed in the same manner as box office did and indeed seems to have recovered fully by 2021 with a total of 1 836 feature films produced in the EU and the UK in 2021, up 426 films (+30%) from 2020. While this production level comes in shy of the record high of 2 018 feature film productions in 2019 it is the third highest level registered in recent history.

Trends differ widely between countries also due to different methodologies in counting productions: in those markets where film production is measured as films actually released, the closing of cinemas had a direct negative impact on film productions and 2021 figures still remained well below pre-pandemic figures. Whereas in markets where film production is measured e.g. in terms of films starting principal photography, receiving public funding or being certified, the 2021 production activity often exceeded its pre-pandemic levels. The question is whether this increase in production activity indicates indeed a sustainable return to previous production levels or whether represents a mere catch-up in 2021 of films whose production was interrupted or stopped during the crisis, i.e. a level that will not be sustainable as long as cinemas have not returned to their usual attendance levels.

More detailed information on European as well as international theatrical markets can be found in FOCUS 2022 World Film Market Trends prepared by the European Audiovisual Observatory for the Cannes Film Market.

Notes for Editors:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- All 2021 figures are provisional.

The European Audiovisual Observatory, Council of Europe

Set up in December 1992, the European Audiovisual Observatory's mission is to gather and distribute information on the audiovisual industry in Europe. The Observatory is a European public service body comprised of 40 member states and the European Union, represented by the European Commission. It operates within the legal framework of the Council of Europe and works alongside a number of partner and professional organisations from within the industry and with a network of correspondents. In addition to contributions to conferences, other major activities are the publication of a Yearbook, newsletters and reports, the compilation and management of databases and the provision of information through the Observatory's Internet site.

European Union admissions rankings (Tables 2 and 3)

The pan-European film rankings shown in tables 2 and 3 are based on data from all European Union countries and the UK for which results have been stored in the LUMIERE database as of 25th April 2022. This database on admissions to films released in Europe is available online and free-of-charge and is the result of collaboration between the European Audiovisual Observatory and various specialised national sources, primarily national film funds, as well as the MEDIA Programme of the European Union. LUMIERE provides country-by-country admission data for over 60 000 titles in distribution in Europe since 1996. Partial 2021 data for 34 European countries is now available.

Market shares (Table 4)

The market shares shown in this figure are based on an analysis of results of films released in member states of the European Union and the UK for which admissions data for individual films are made available to the European Audiovisual Observatory. In order to draw up such market shares, a single 'country of origin' must be attributed to each film, an attribution that can prove difficult in the case of international productions. In such cases the Observatory's aim is to attribute a country of origin corresponding to the source of the majority financial input and/or creative control of the project. Since 2005 the Observatory has identified specifically films that have been produced in one or more European countries (or elsewhere) with US investment by using the reference 'inc' (incoming investment) in the country of origin attribution. It should be noted, however, that the availability of further information may occasionally lead to changes in the attribution of country of origin and that the origin of a film as attributed in the LUMIERE database may not always be identical with that indicated by national sources.

The provisional data on market shares in Europe 28, i.e. the European Union and the UK, in 2021 shown in table 4 are based on the data on admissions to individual films as collected in the LUMIERE database on 25th April 2022. At this date the coverage rate of the database for admissions in 26 European Union countries and the UK for which data is available was of around 97%. Due to various gaps in data collection and delivery in various countries, coverage of 100% of admissions is currently unachievable.

Number of feature films produced in the European Union (Table 5)

Estimating the total volume of production of feature films in the European Union remains difficult, chiefly due to the risk of double counting of co-productions and to differing national methodologies for the collection of this data. Included in the total for the European Union are feature-length films intended for theatrical exploitation, excluding minority co-productions and US and foreign production in the United Kingdom. For some countries no separate data are available for feature fiction and feature documentary films.