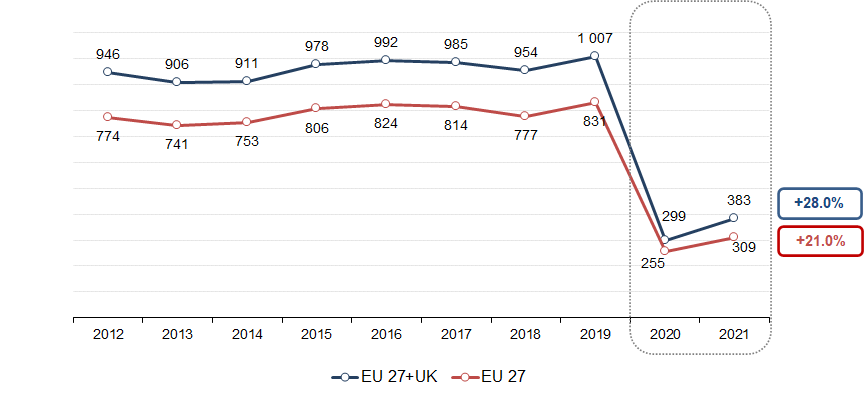

Based on preliminary data the European Audiovisual Observatory estimates that the cinema attendance in the European Union and the United Kingdom increased to 383.2 million tickets sold in 2021. This is 83.8 million admissions more than in 2020, representing a year-on-year growth of 28%. The rebound was less pronounced in the European Union only (EU27), where ticket sales increased by 21% to 309.2 million admissions, 53.8 million visits more than in the previous year.

These results represent a clear sign of recovery for the exhibition sector after the massive crush registered in 2020, when admissions in the EU and the UK nosedived by 70% in 2020 due to the coronavirus crisis.

In spite of the upswing, these figures are still well below pre-pandemic levels, as the prolonged closures of cinemas in the first half of the year, coupled with other restrictive measures, had a significant impact on the annual cinema attendance. Admissions for 2021 are still 61.9% below the figures registered in 2019, when cinema attendance in the EU and UK topped 1 billion admissions, representing a total loss of 623.5 million tickets. A similar decline on 2019 (-62.8%) was observed for the European Union only (EU27).

Signs of recovery were observed in the majority of markets for which data are available, with significant differences across territories. These geographical variations are most likely linked to the number of days in which theatres were allow to operate and to the different restrictive measures applied in each market.

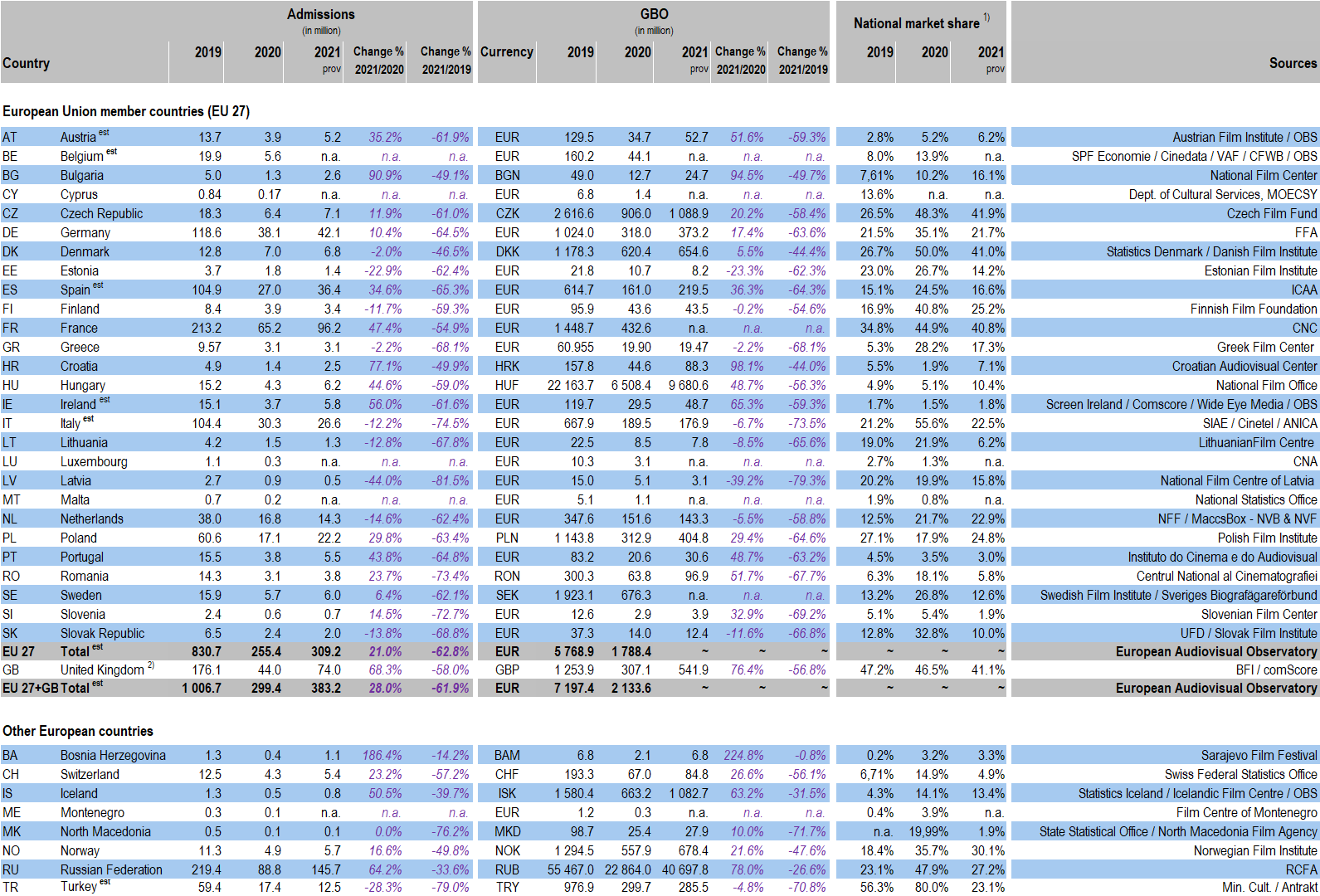

------------------------

Cinema attendance in the European Union and the UK, 2012-2021

In millions; estimated; calculated on a pro-forma basis for the 27 EU member states and the UK

------------------------

As regards EU countries, the year-on-year increase in cinema attendance was significantly above average in Bulgaria (+90.9%, +1.2 million admissions), Croatia (+77.1 %, 1.1 million), Ireland (+56.0%, 2.1 million), France (+47.4%, +30.9 million), Hungary (+44.6%, +1.9 million), Portugal (+43.8%, +1.7 million) and Spain (+34.6%, +9.4 million). Conversely, ticket sales declined in nine EU markets, including the Netherlands (-14.6%, -2.5 million admissions), Slovakia (-13.8%, -0.3 million), Italy (-12.2%, -3.7 million) and Finland (-11.7%, -0.5 million admissions).

Outside of the EU, ticket sales jumped by 68.3% to 74.0 million admissions in the UK, 30.0 million more than in 2020. Russia recorded by far the largest admissions volume in Europe for 2021 with 145.7 million tickets sold (+64.2% on 2020) as the majority of cinemas in the country were allowed to remain open for most of the year. Conversely, admissions fell from 17.4 million to 12.5 million in Turkey (-28.3%), as cinemas only reopened in July, for a total of 26 play weeks in 2021 (against 32 weeks in in 2020).

In most territories, the market share taken by national films decreased in comparison to 2020, when it had reached exceptionally high levels high due to the shortage of US blockbusters on release. However, in 2021 the share captured by domestic films was still above average in several markets, including the Czech Republic (41.9%), Denmark (41.0%), France (40.8%) Norway (30.1%) and the Netherlands (22.9%).

In the UK, the market share for national films (including US studio-backed productions) decreased to 41.1%, which compares to 46.5% in 2020 and 47.2% in 2019. In Turkey the domestic share dropped to 23.1%, an unusually low level compared to 80.0% in 2020 and 56.3% in 2019. Russia also saw its national market share decrease from 47.9% in 2020 to 27.2% in 2021, a figure which is well in line with previous years.

Preliminary data suggest that in the EU and the UK the box office was mainly driven by the success of US studio hits. The top-ranking films for the year include No Time to Die (GBinc/US), Spider-Man: No Way Home (US), Dune (US/CA) and Fast & Furious 9 – The Fast Saga (US).

------------------------

Key Cinema Data in European Countries 2019-2021 provisional

- Based on admissions except for GB and IE where it is based on GBO. Includes minority co-productions with the exception of CZ, DK, HU, NL, NO, RO, RU and SE.

- National market share for UK qualifying films based on GBO. Includes minority co-productions and US studio-backed films.

Source: European Audiovisual Observatory

Link to this data in the form of an Excel table.

Notes:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- All 2021 figures are provisional.

Our next cinema figures will be released just before the Cannes Film international du film.

To be added to our press listings, send an email to: [email protected]