|

The figures in this press release are taken from the 2021 edition of FOCUS – World Film Market Trends, a report which is prepared each year for the Marché du Film. Journalists may request a PDF press copy from [email protected]. FOCUS is available free of charge online in the market bag for all Marché du film participants. It can be purchased after the Marché from the Council of Europe bookshop.

COVID pandemic causes theatrical markets across Europe to plummet by over 70% in 2020

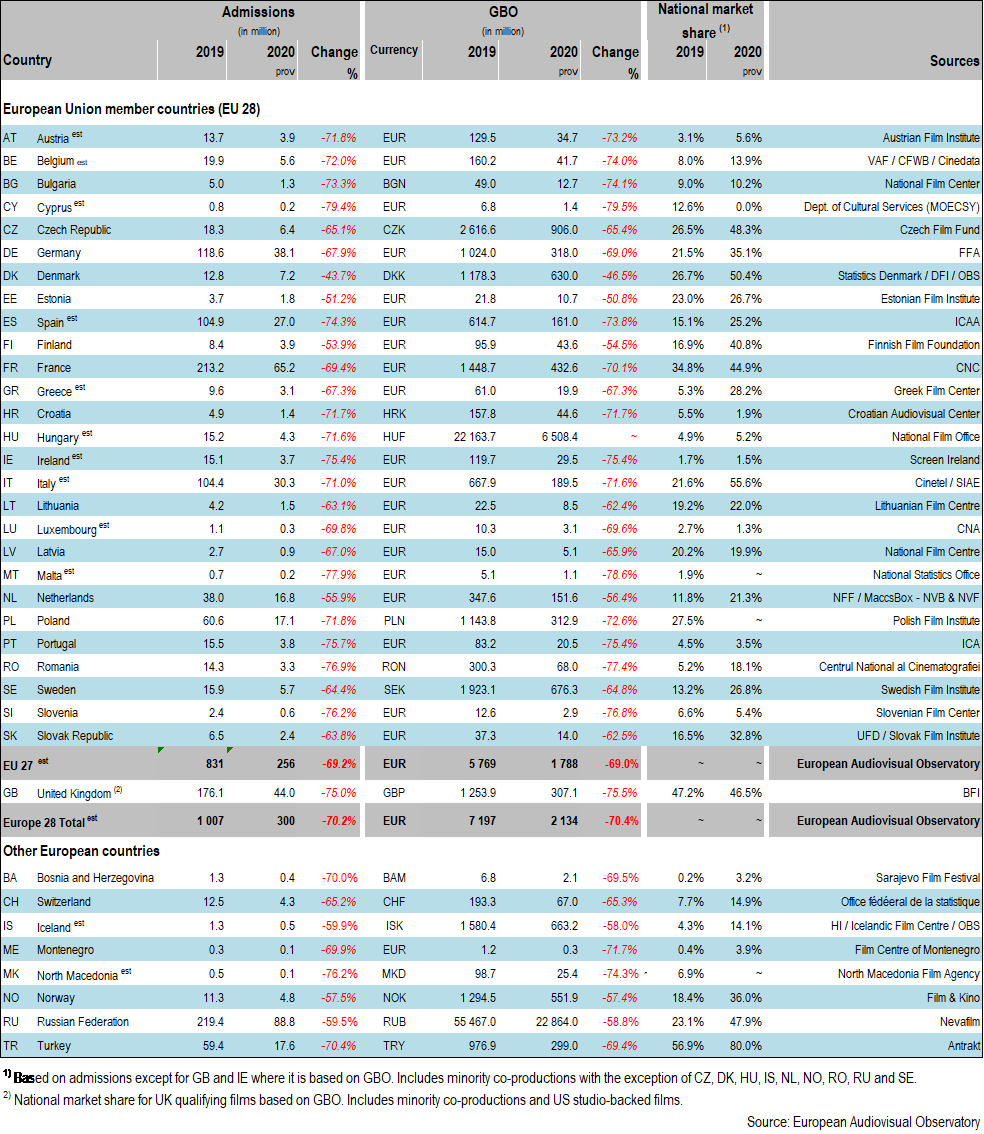

Cinemas throughout most of Europe had to close in response to COVID restrictions in March 2020. While most theatres were allowed to reopen from mid-May / June onwards, they could only operate under strict restrictions including capacity limits and had to close again during the second wave in late autumn. On top of this, most blockbuster films planned for release in 2020 rescheduled their theatrical release or – in some cases - were directly released on premium VOD. As a result, the theatrical market collapsed in 2020 with cinema attendance in the EU and the UK plummeting by 70.2% to an estimated 300 million tickets, down from over one billion admissions in 2019 (the highest level since 2004). Gross box office earnings dropped correspondingly from EUR 7.20 billion to EUR 2.13 billion (USD 2.4 billion), down by 70.4% from 2019, as the average ticket price in the EU remained stable at EUR 7.1 (USD 8.1).

While admissions dropped sharply in every European country, there were differences in the magnitude of the box office catastrophe. The lowest year-on-year decrease was registered in Denmark (-44%), Estonia (-51%), Finland (-54%) and the Netherlands (-56%). In contrast admissions declined by over 75% in six markets: Cyprus (-79%), Romania (-77%), Slovenia (-76%), Portugal (/-76%), Ireland (-75%) and the UK (-75%). Outside the EU and the UK, theatrical markets suffered comparatively less in Norway (-57.5%), Russia (-59.5%) and Iceland (-59.9%).

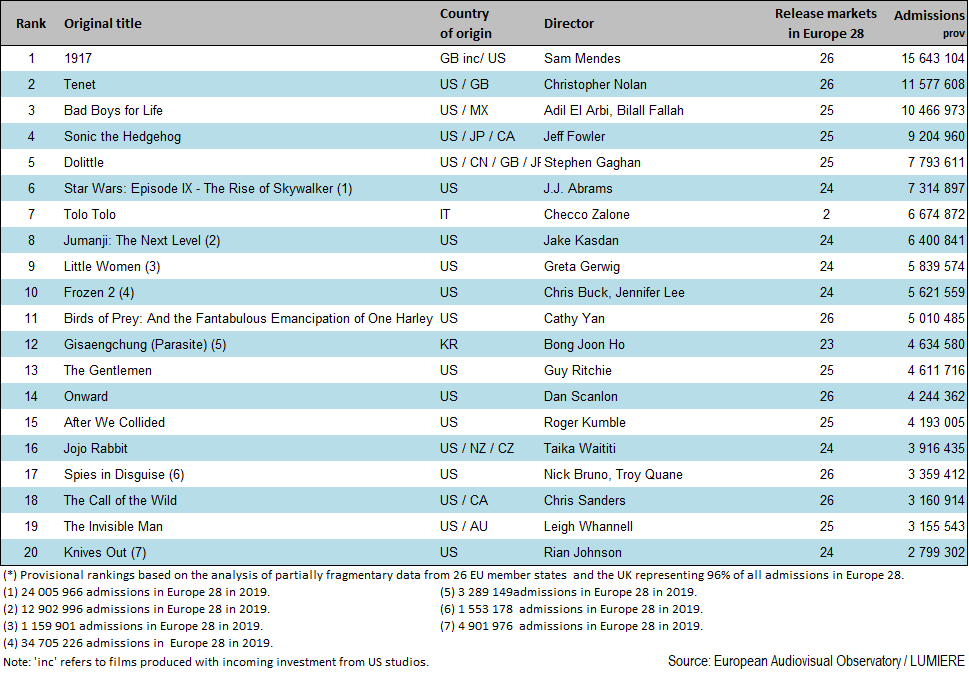

1917 and Tenet led the box office charts in Europe 28 in 2020

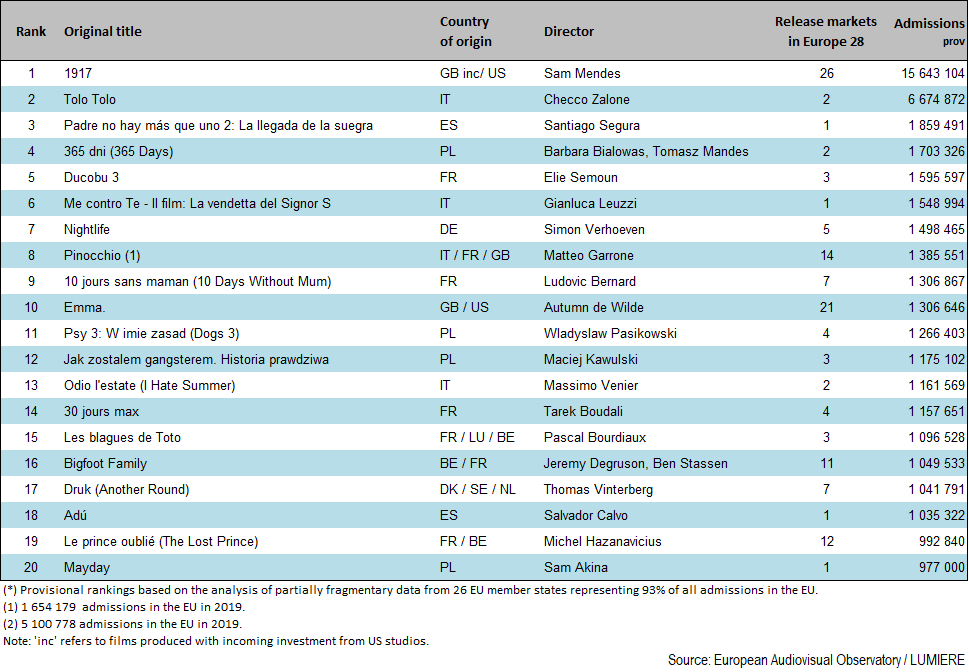

While US titles continued to dominate the charts in the European Union and the UK accounting for 17 out of the top 20 titles in 2020, they were almost exclusively films released either in 2019 or in in the first quarter of 2020 before the first lockdown. In fact, only two films among the top 20 films – Tenet (US/GB) and After We Collided (US) – were released later in the year. Not only was there a lack of US tentpole releases after the first lockdown, the top grossing films also sold significantly fewer tickets than in previous years. World war I drama 1917 (EUR inc[1]/US) became the most successful film selling 15.6 million tickets in the EU and the UK. In comparison, The Lion King (US/GB) which topped the charts in 2019 sold 51.6 million admissions. While a total of 18 films sold more than 10 million tickets in 2019, only three films managed to do so in 2020: apart from 1917, these were Tenet (11.6 million) and Bad Boys for Life (10.5 million). In contrast to previous years, 2020 saw a comparatively low number of film franchises with only seven titles out of the top 20 being sequels, prequels, spin-offs or reboots, compared to 18 in 2019. Apart from the EUR inc production 1917 (“EUR inc” refers to films produced in Europe with incoming investments from US studios), the Italian comedy Tolo Tolo was the only European film to feature among the top 20 titles, generating 6.7 million admissions. Other successful European films included the Spanish family comedy sequel Padre no hay más que uno 2: La llegada de la suegra (1.9 million), Polish erotic thriller 365 dni (365 Days) (1.7 million) and French family comedy sequel Ducobo 3 (1.6 million).

Table 1: GBO, admissions and national market share in European countries 2029 – 2020 prov

Table 2: Top 20 films by admissions in the European Union and the UK in 2020 prov (1)

Table 3: Top 20 European films by admissions in the European Union and the UK in 2020 (incl. “EUR inc”) prov (1)

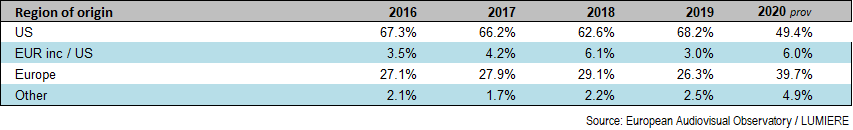

European market share reaches record high due to lack of US tentpole releases

The lack of US blockbuster releases in 2020 is clearly reflected in the breakdown of admissions in the EU and the UK by origin. While admissions to US films fell by an estimated 78%, admissions to European films dropped by “only” 55% and admissions to European films produced in Europe with incoming US investment (EUR inc) and films from other parts of the world decreased by “only” 41%. The market share of European films hence reached a record high of almost 40% of total admissions, mostly driven by often exceptionally high market shares of national films in the respective markets. This compares to 26.3% in 2019. US market share on the other hand dropped from 68.2% to 49.4%, the lowest level registered in recent history. EUR inc films captured 6.0% (compared to 3.0%) of total admissions in 2020 and films from other parts of the world represented 4.9% (compared to 2.5%).

On a national level, local European films reached record levels in several markets which were marked by the lack of US tentpoles. Within the EU and the UK it was Italy which registered the highest national market share with an incredible 55.6%, followed by Denmark (50.4%), the Czech Republic (48.3%), the United Kingdom (46.5%), France (44.9%), Finland (40.8%) and Germany (35.1%). Outside the EU, Turkey was once again the European territory with highest national market share reaching an unparalleled 80.0%. Russian films also capture a record market share of 47.9%.

Table 4: Europe 28 market share by country of origin 2016 – 2020 prov

In % of total admissions. Provisional estimates.

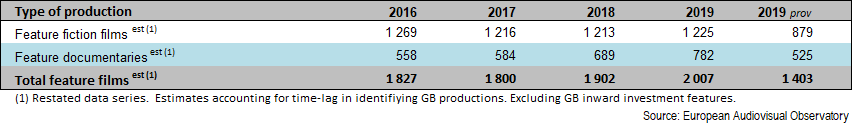

Film production in the EU and the UK drops by 30% in 2020

Having reached a temporary standstill all over Europe due to the lockdown measures taken in March 2020, film production was taken up again in early summer following strict sanitary protocols. In contrast to theatrical exhibition film shoots were largely allowed to continue throughout the second wave in autumn and winter, often at levels equal to or even higher than before the pandemic. Film production volume in the EU and the UK consequently did not collapse in the same manner as box office did. The Observatory estimated that a total of 1403 theatrical feature films were produced in the EU and the UK in 2020, down “only” 30% on the 2019 record level of 2 007 feature films.

Trends differ widely between countries also due to different methodologies in counting productions: in those markets where film production is measured as films actually released, the closing of cinemas had a direct negative impact on film productions whereas in markets where film production is measured in terms of films receiving public funding or being certified, the decline in production activity may only be seen in the upcoming years. It also remains to be seen which effect the significant loss of box office revenues in 2020 and 2021 will have on the European film production sector in the mid-term.

Table 5: Number of feature films produced in the European Union and the UK 2016 – 2020 prov

Provisional estimates.

More detailed information on European as well as international theatrical markets can be found in FOCUS 2021 World Film Market Trends prepared by the European Audiovisual Observatory for the Cannes Film Market.

Notes for Editors:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- All 2020 figures are provisional.

The European Audiovisual Observatory, Council of Europe

Set up in December 1992, the European Audiovisual Observatory's mission is to gather and distribute information on the audiovisual industry in Europe. The Observatory is a European public service body comprised of 41 member states and the European Union, represented by the European Commission. It operates within the legal framework of the Council of Europe and works alongside a number of partner and professional organisations from within the industry and with a network of correspondents. In addition to contributions to conferences, other major activities are the publication of a Yearbook, newsletters and reports, the compilation and management of databases and the provision of information through the Observatory's Internet site.

European Union admissions rankings (Tables 2 and 3)

The pan-European film rankings shown in tables 2 and 3 are based on data from all European Union countries and the UK for which results have been stored in the LUMIERE database as of 31st May 2020. This database on admissions to films released in Europe is available online and free-of-charge and is the result of collaboration between the European Audiovisual Observatory and various specialised national sources, primarily national film funds, as well as the MEDIA Programme of the European Union. LUMIERE provides country-by-country admission data for over 71 000 films in distribution in Europe since 1996. Partial 2020 data for 33 European countries as well as the North American market is now available.

Market shares (Table 4)

The market shares shown in this figure are based on an analysis of results of films released in member states of the European Union and the UK for which admissions data for individual films are made available to the European Audiovisual Observatory. In order to draw up such market shares, a single 'country of origin' must be attributed to each film, an attribution that can prove difficult in the case of international productions. In such cases the Observatory's aim is to attribute a country of origin corresponding to the source of the majority financial input and/or creative control of the project. Since 2005 the Observatory has identified specifically films that have been produced in one or more European countries (or elsewhere) with US investment by using the reference 'inc' (incoming investment) in the country of origin attribution. It should be noted, however, that the availability of further information may occasionally lead to changes in the attribution of country of origin and that the origin of a film as attributed in the LUMIERE database may not always be identical with that indicated by national sources.

The provisional data on market shares in Europe 28, i.e. the European Union and the UK, in 2020 shown in table 4 are based on the data on admissions to individual films as collected in the LUMIERE database on 31st May 2020. At this date the coverage rate of the database for admissions in 26 European Union countries and the UK for which data is available was of around 96%. Due to various gaps in data collection and delivery in various countries, coverage of 100% of admissions is currently unachievable.

Number of feature films produced in the European Union (Table 5)

Estimating the total volume of production of feature films in the European Union remains difficult, chiefly due to the risk of double counting of co-productions and to differing national methodologies for the collection of this data. Included in the total for the European Union are feature-length films intended for theatrical exploitation, excluding minority co-productions and US and foreign production in the United Kingdom. For some countries no separate data are available for feature fiction and feature documentary films.

Contacts at the European Audiovisual Observatory:

Alison Hindhaugh (Press Officer)

[email protected] - tel.: +33 (0) 684352743