Download “Top players in the European audiovisual industry – Concentration, statute, origin and profile (2024 figures)”

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has published a new edition of its annual report on key audiovisual (AV) players in Europe, authored by Laura Ene Iancu, Analyst within the Observatory’s Department for Market Information.

“Top players in the European audiovisual industry – Concentration, statute, origin and profile (2024 figures)” aims at shedding light on the role that top groups play in shaping the structure of the AV industry in Europe. This report explores the players’ performance in terms of revenue generated by the entire AV market, public funding, pay TV, SVOD, net TV advertising and in-video OTT advertising. The players are ranked and profiled with regards to each of these market segments.

The report finds that at the end of 2024:

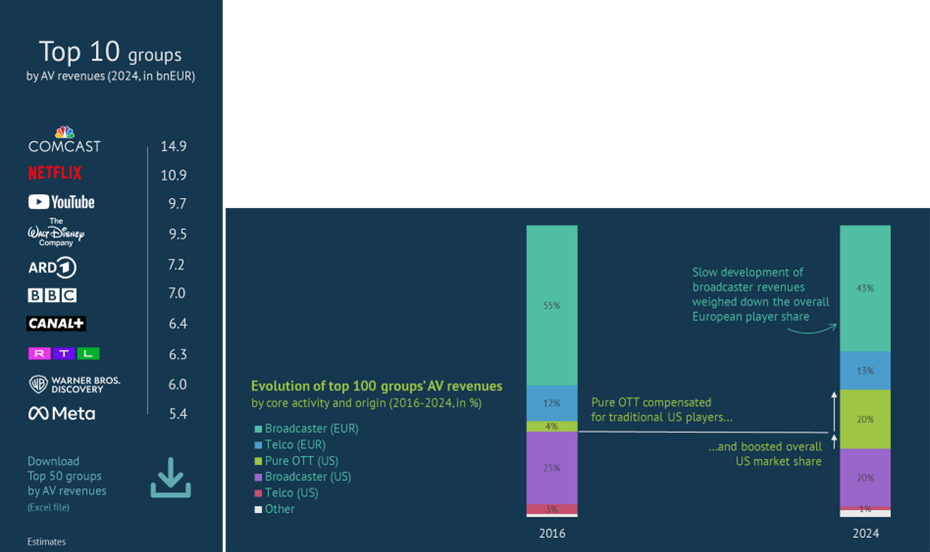

Comcast, Netflix and YouTube were the top three players in Europe in terms of operating audiovisual revenues

European players took the lion’s share of the operating audiovisual revenues cumulated by the top 100 AV groups. Although broadcasting-led companies generated most of the revenues, it was the telco-driven companies that helped European players achieve a majority share (56%).

However, the revenues cumulated by US-backed groups were concentrated among a relatively small number of large-scale players. Consequently, European interests accounted for only one-third of the top 10 groups' AV revenues.

Between 2016 and 2024, the market share of US-backed players increased by 9%, driven by the rise of pure streamers and VSPs. Thus, pure OTT platforms offset the market share decline experienced by US broadcasters.

The drop in the European weight was cushioned by European telcos, which grew three times faster than broadcasters during the period analysed.

Source: European Audiovisual Observatory

Netflix topped the pay-AV service market, while YouTube led the AV advertising market

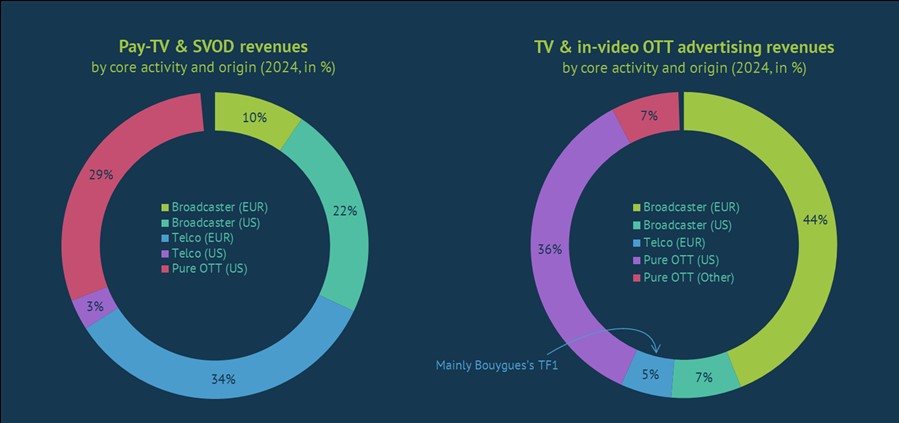

In 2024, Netflix overtook Sky to become the frontrunner of the pay-AV service market, and together they controlled third of the cumulative pay-TV and SVOD revenues.

The SVOD market accounted for around 40% of combined pay-TV & SVOD revenues and was primarily represented by US streamers. Within the overall pay-AV service market, however, it was traditional players, driven either by their telecoms or broadcasting arm, that earned 70% of the revenues.

European-owned groups were chiefly represented by telcos, due to their dominance in the pay-TV market, and cumulated almost half (45%) of the total pay-AV service market revenues.

Google’s YouTube remained the leader of the AV advertising market in terms of cumulative TV and in-video OTT advertising revenues. Chiefly represented by non-European VSPs, OTT advertising was almost on a par with the TV advertising market. A similar split of the market was seen between traditional and new media players, with the former getting over 55% of the TV & in-video OTT advertising revenues. European broadcasters received around half of the total AV advertising revenues due to their dominance of the traditional TV advertising market.

Source: European Audiovisual Observatory

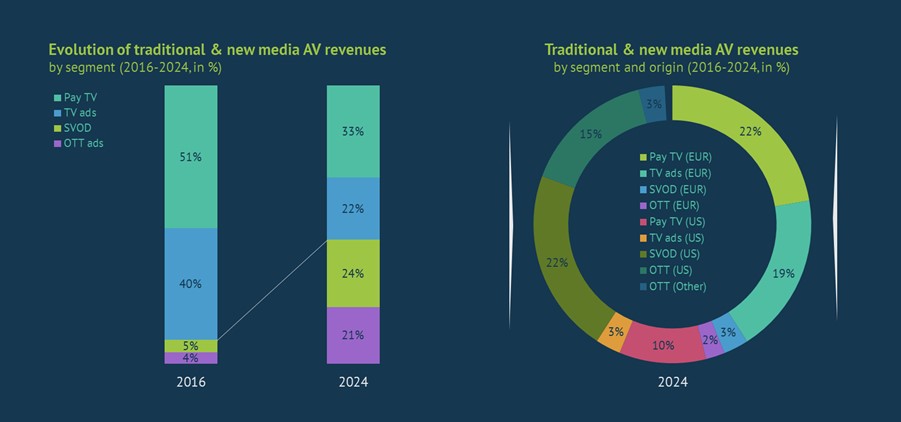

European groups control traditional media, whilst US-backed groups dominate new media

In 2016, the pay-AV service market was almost entirely made up of pay TV, and AV advertising was essentially synonymous with TV advertising. These traditional media segments were banking nine out of every ten euros spent on AV services or advertising. By 2024, SVOD and in-video OTT advertising had become significant new media segments, cumulating nearly half of the audiovisual market. Non-European streamers and VSPs made up the vast majority of this.

Meanwhile, European groups remained dominant in a traditional market that lost significant weight. Consequently, European interests accounted for less than half of the combined traditional and new media AV revenues in 2024.