Download "Fiction film financing in Europe: A sample analysis of films released in 2021" here

This new report finds that:

- While direct public funding remained the single most important financing source of European fiction films, contributing 26% of the total financing volume, production incentives became – for the first time – the second most financing source, accounting for 21% of total financing volume. (The report defines direct public funding as public funding from national, regional and local bodies in the country of origin as well as from minority financing countries and supra-national sources. Production incentives include both national as well as foreign production incentives).

- The median average budget of a European theatrical fiction film released / scheduled to be released in 2021 was EUR 2.12 million.

- Both average budgets as well as financing structures differ significantly between markets. In particular, the percentage share of direct public funding in film financing decreases with increasing market size and budget volume.

Background to this report

This annual report is the fruit of a major collaboration project between the European Audiovisual Observatory, part of the Council of Europe in Strasbourg, and the European Film Agency Research Network (EFARN). It aims at providing concrete figures on how European theatrical fiction films are being financed, offering a big-picture, pan-European perspective, and complementing work done at national levels.

Based on the actual budget analysis of 448 European live-action fiction films released / scheduled for in 2021, this is probably the largest pan-European data sample available to date on the financing of European fiction films for this year. The report provides unique fact-based insights on a wide variety of research questions, from the quantification of the average budget of theatrical European fiction films, to the importance of individual financing sources.

Financing structure of European theatrical fiction films

In 2021, the financing of European theatrical fiction films continues to be primarily based on five different financing sources: direct public funding; production incentives; broadcaster investments; producer investments; and pre-sales (Broadcaster investments combine co-production investments by broadcasters with pre-sales made to broadcasters based in any of the co-producing countries. Pre-sales combine national and international pre-sales; pre-sales in the country of origin).

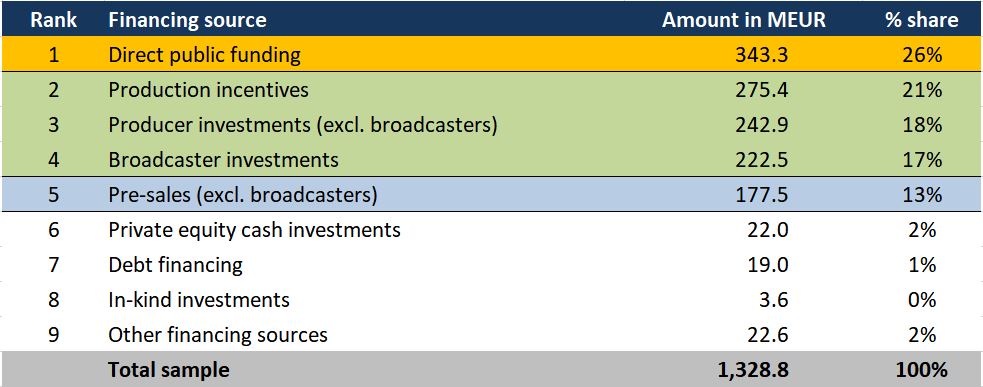

The single most important financing source clearly was direct public funding, which accounted for 26% of the total financing volume tracked in the analysis. Direct public funding was followed by production incentives which accounted for 21% of total financing while producer investments (excl. broadcasters) accounted for 18% of total financing slightly ahead of broadcaster investments (17%). Pre-sales (excl. broadcasting rights) accounted for 13% of total financing. Other financing sources, including private equity, debt financing or in-kind investments are negligible from a cumulative perspective.

However, there appear to be significant structural differences among countries concerning how theatrical fiction films are financed. Some of these differences are apparently linked to market size. Two obvious differences concern direct public funding and production incentives. The data clearly suggests that the weight of direct public funding in film financing decreases with increasing market size and vice versa. While comprising only 18% of total financing in the four large sample markets, direct public funding accounted for 44% in medium-sized and 63% in small sample markets.

In contrast, the financing weight of production incentives seems to increase with market size, growing from only 3% in small markets, to 14% in medium-sized markets up to 24% in large markets (25% excl. French films). Also, the significance of producer investments as well as pre-sales appears to be comparatively low in small and medium-sized markets when compared to large markets.

Breakdown of cumulative financing volume by source (2021)

Ranked by percentage share; based on all 482 sample films

Source: European Audiovisual Observatory

Theatrical fiction budgets in Europe

The data sample studied [see methodological notes below] suggests that the mean budget of a European theatrical fiction film released in 2021 represented EUR 2.97 million while the median sample budget amounted to EUR 2.12 million.

However, average budgets differ widely among countries. Not surprisingly, average budgets are higher in larger markets and lower in countries with lower box-office potential, as exploitation in national markets remains key for most films. The median budget of a European fiction film originating in France, Germany, Italy or the UK (the large markets included in the sample) amounted to EUR 2.7 million in 2021 compared to EUR 1.8 million for fiction films produced in a medium-sized European market and EUR 0.7 million for fiction films from small markets.

Methodology

The analysis is based on a data sample comprising detailed financing plans for 448 European live-action fiction films - theatrically released / scheduled for release in 2021 from 22 European countries. The data sample includes both 100% national as well as European-majority-led co-productions. It covers a cumulative financing volume of EUR 1.33 billion. The data sample is estimated to cover 43% of the total number of European fiction films released in 2021.