Download it here

Admissions to European films outside Europe rose by 18.7% in 2017 driven by growth in Chinese market

- 671 European films were released outside Europe in 2017

- Due to a surge in tickets sales for European films in China, admissions to European films outside Europe rose by 18.7% to 97 million in 2017, the second-best result in the last five years

- Admissions generated outside Europe accounted for 50% of total non-national admissions to European films

- China became the largest export market for European films in terms of admissions, ahead of North America

The European Audiovisual Observatory has released an updated edition of the report "The Circulation of European films outside Europe". The study looks at the volume and the theatrical performance of European films in 12 non-European sample markets, including North America, six Latin American markets, China and South Korea, as well as Australia and New Zealand. The analysis is based on 2017 data and complemented by a five-year data series for the period 2013 to 2017.

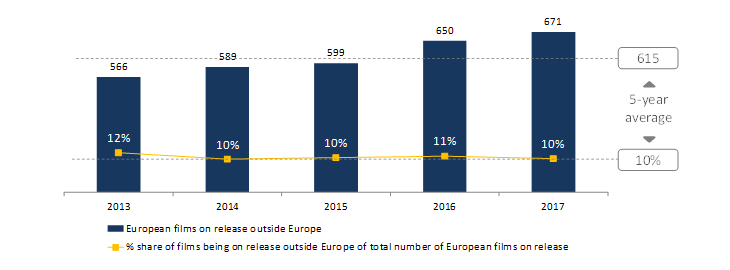

The number of European films released outside Europe kept rising in 2017

In 2017, a total of 671 European films were theatrically released in at least one of the 12 non-European markets covered in the report. This is the largest number of European films released outside Europe in the past five years and represents about 10% of the total number of European films on release worldwide (see Figure 1 below). In line with previous years, European films represented 19% of the tracked number of films on release in the 12 non-European sample markets.

Figure 1. European films on release outside Europe (2013-2017)

Estimated, as tracked in LUMIERE

Source: European Audiovisual Observatory / LUMIERE, Comscore

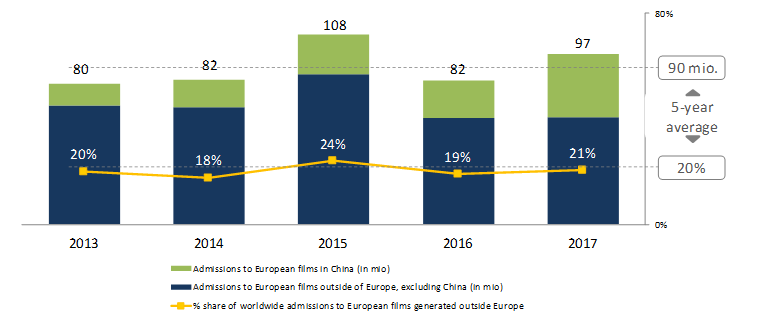

Admissions to European films rose by 18.7% to 97 million

In 2017 European films cumulatively sold about 97 million tickets in the 12 sample markets, up 18.7% on the previous year, and generated an estimated gross box office (GBO) of EUR 528 million.

European films accounted for 3% of the admissions generated in the 12 non-European sample markets. Admissions generated in non-European markets represented 21% of estimated global admissions to European films and 50% of total non-national admissions in 2017.

This is the second highest result in the past five years in terms of admissions, and is well above the median value of around 80 million admissions (see Figure 2). However, this year-on-year growth must be entirely attributed to a spike in admissions in the Chinese market, where the number of tickets sold to European films grew from 21.2 million in 2016 to 35.8 million in 2017. This occurred in spite of the fact that only a limited number of European films have access to the Chinese market (49 films of which 26 were first releases). When excluding China, the market volume for European films outside Europe was 61 million admissions in 2017, the second lowest value in the past five years after 2016.

French science-fiction feature Valerian and the City of a Thousand Planets became the most successful European film in China, taking 11.3 million admissions alone.

Figure 2. Admissions to European films outside Europe (2013-2017)

In million; As tracked in LUMIERE; Pro-forma estimates for China for 2013

Source: European Audiovisual Observatory / LUMIERE, Comscore

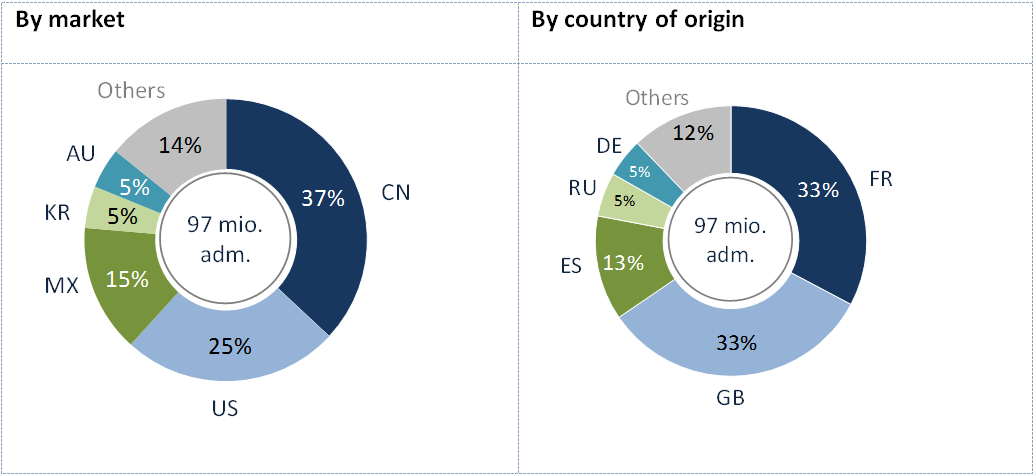

China became the largest market for European films

In 2017, China became for the first time the largest export market for European films in terms of admissions, representing 37% of cumulative admissions to European films outside Europe.

In turn, admissions to European films declined from 29.8 to 27.1 million tickets sold in North America, representing 28% of total international admissions, slightly ahead of Latin America (24%) as shown in Figure 3. However, the US and Canada remained the most significant export market for European films in terms of GBO, accounting for an estimated 41% of the global GBO revenues.

French and UK films dominate the export of European films

As illustrated in Figure 3, French and UK productions continued to dominate the export of European films outside Europe in 2017, selling 31.8 and 31.7 million tickets respectively which cumulatively accounted for 66% of total admissions to European films. Spanish films followed at a distance, selling 12.1 million tickets outside Europe, well ahead of Russia (5.1 million) and Germany (4.5 million).

Valerian and the City of a Thousand Planets was the most successful European films in the 12 sampled non-European markets cumulatively taking 19.4 million admissions, ahead of 47 Meters Down (7.4 million) and Paddington 2 (6.5 million).

Figure 3. Admissions to European films outside Europe by market and origin (2017)

Estimated; as tracked in LUMIERE

Source: European Audiovisual Observatory / LUMIERE, Comscore