Download it here

This new report finds that

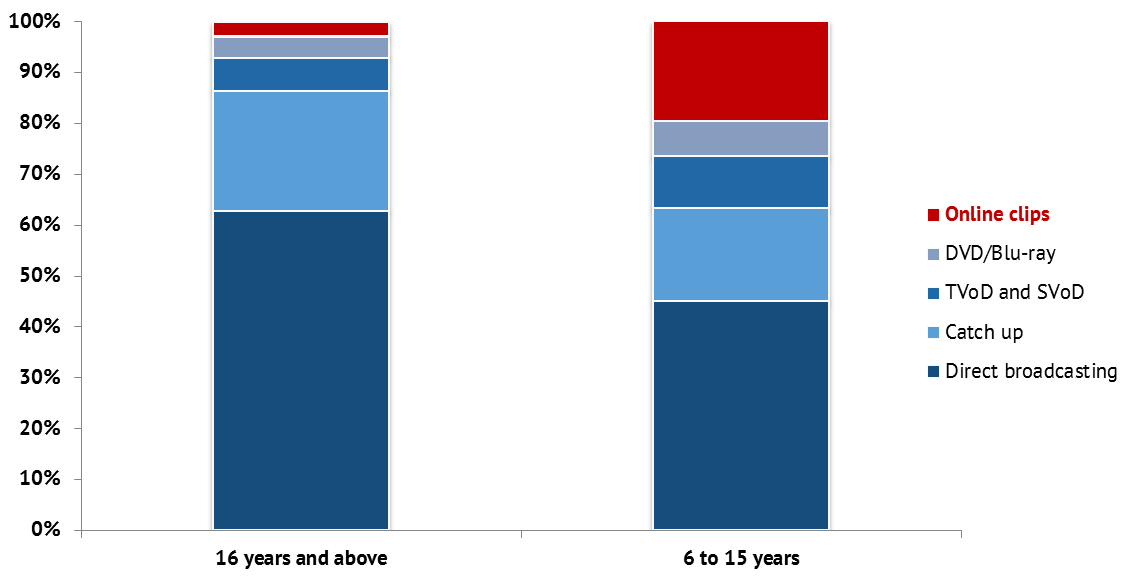

- 6 to 15 year olds spend about 20% of their screen time watching on line video clips

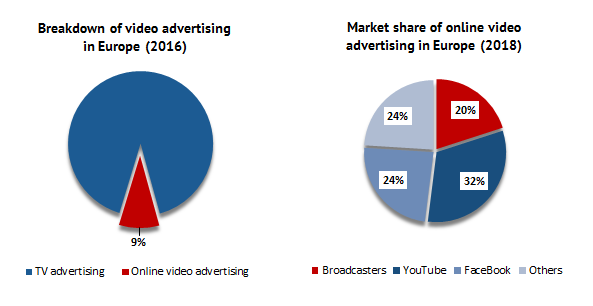

- Video adverts on line only represent 9% of all video advertising, 91% of video advertising is still going to television

- In spite of this YouTube and Facebook together take a massive 56% market share of online video advertising in Europe.

This new report Online video sharing: Offerings, audiences, economic aspects presents the evolution of online video sharing platforms (such as YouTube or Facebook, for example), the main players, and their relationships with the programme creators. Author Gilles Fontaine, Head of the European Audiovisual Observatory’s Department for Market information focuses on the use of video sharing platforms and their business models. Fontaine also analyses the potential impact of these platforms on the audiovisual sector. The findings of this report were first presented in Paris in June of this year at a conference on video sharing platforms organised under the Observatory’s French Presidency for 2018.

Key Findings :

A. The video platform sector is undergoing rapid and constant change:

- Through the introduction of new services (live streaming, video on demand, distribution of TV channels)

- Through new ways to remunerate the various content creators

- By giving rise to new content creators

B. Modest investment in content creation

Although video sharing platforms are investing in original content creation, it’s not so sure that they are aiming at competing with audiovisual services in this field. The amounts invested are relatively small and aim above all at attracting content creators and media groups.

C. Massive use, the younger generations are main consumers…

Video sharing platforms are massively used nowadays, however actual time spent watching them is still relatively limited, apart from the under 15s age bracket.

Breakdown of time spent watching on line videos in Great Britain (2017)

D. Increased competition for TV advertising from on line adverts

Video sharing generates direct revenue for the platforms themselves (advertising, commission, subscriptions). It also generates indirect revenue by generally increasing traffic to the platforms and allowing the collection of user data. Online video advertising probably represents a significant new source of competition for television advertising. At the moment YouTube and Facebook together dominate over 50% of this market.

Breakdown of video advertising in Europe (2016)

Source: IAB/IHS Adex Benchmark, WARC, 2016 Source: IHS, 2018