Download "Trends in the VOD market in the EU 28" free here

This new report finds (for the period 2010 – 2020, so still EU28 including UK data):

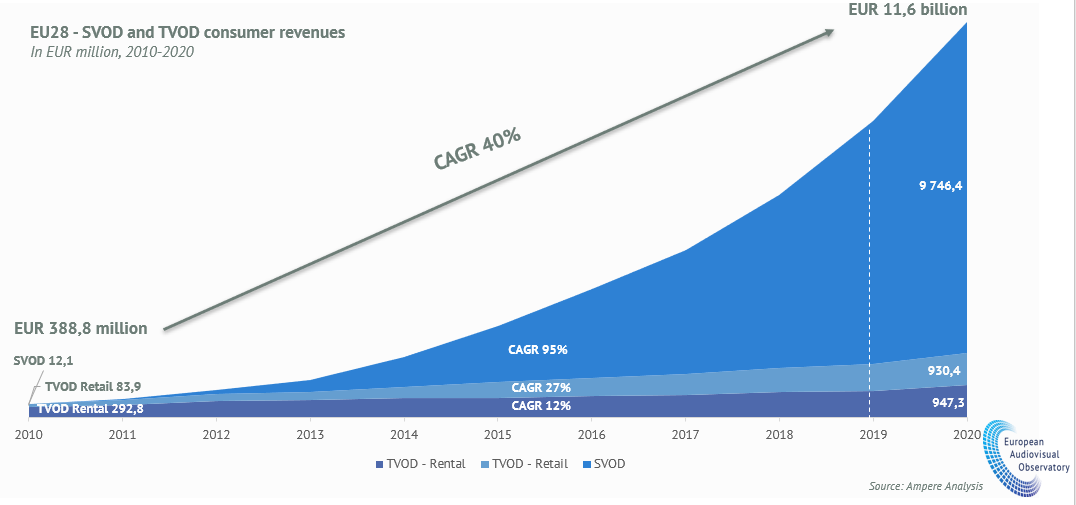

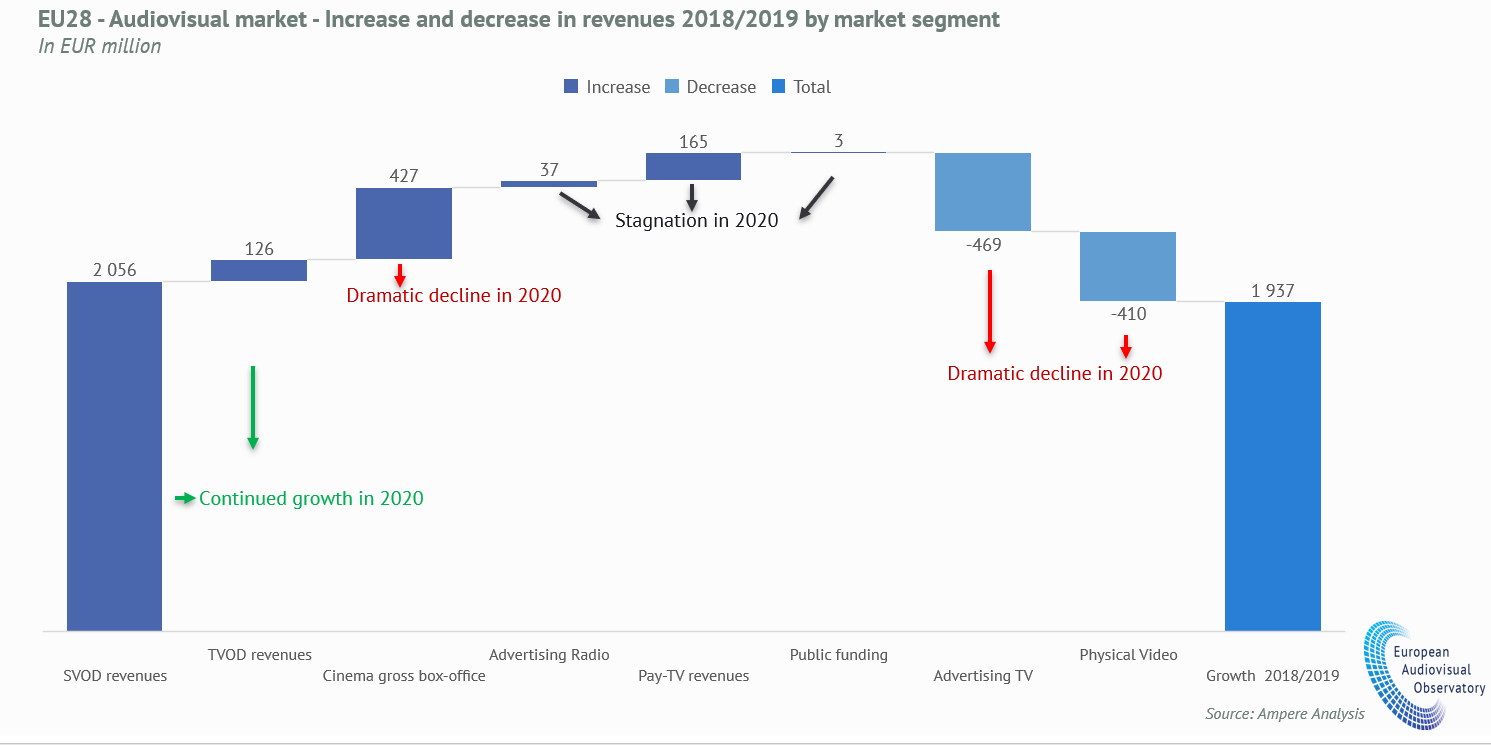

- The paid VOD market (SVOD and TVOD) revenues increased from EUR 388.8 million in 2010 to EUR 11.6 billion in 2020

- SVOD market revenues in Europe mainly drove this trend, exploding from EUR 12 million in 2010 to EUR 9.7 billion in 2020

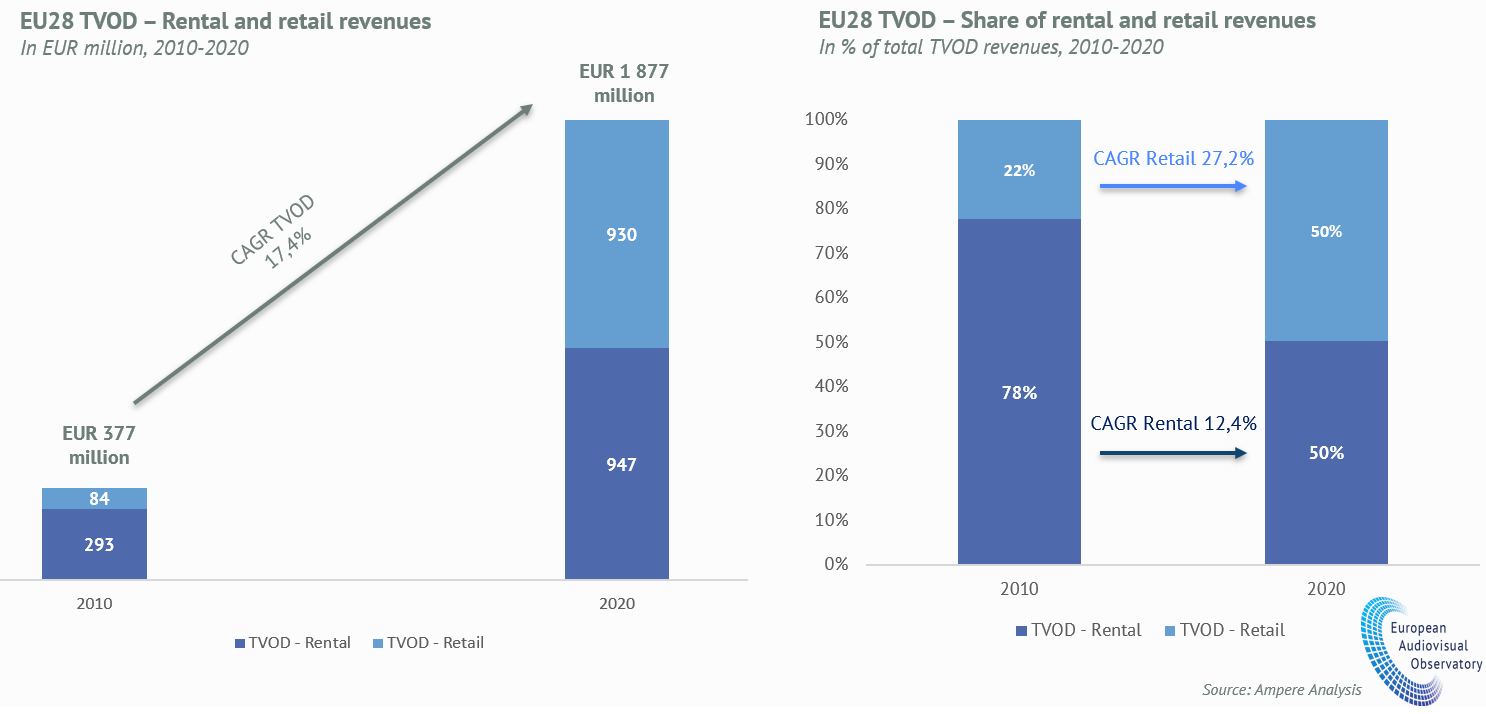

- TVOD market revenues also rocketed from EUR 377 million in 2010 to EUR 1.87 billion in 2020

This new European Audiovisual Observatory report focuses on the evolution of the subscription video-on-demand (SVOD), transactional video-on-demand (TVOD) and advertising-financed and broadcaster video-on-demand markets (AVOD/BVOD) markets in the European Union (EU28) and their impact on the traditional audiovisual markets.

The first section of the report explores the evolution of paid VOD services in the EU and their place in the overall EU audiovisual market. The second section focuses on SVOD services, on the changes the shift to direct-to-consumer streaming services has provoked on the audiovisual market and the potential impact for incumbent players. The third section of the report gives a snapshot of the TVOD market and its impact on the home entertainment market in the EU. Section four summarizes the content offer of TVOD and SVOD services in the EU and Section five gives a short overview of the advertising sector and BVOD revenues.

Key findings of this report:

Explosion of paid VOD in Europe

- The paid VOD market (SVOD and TVOD) exploded in the past 10 years, with revenues increasing from EUR 388.8 million in 2010 to EUR 11.6 billion in 2020, mainly driven by an astonishing growth in SVOD revenues, from EUR 12 million in 2010 to EUR 9.7 billion in 2020.

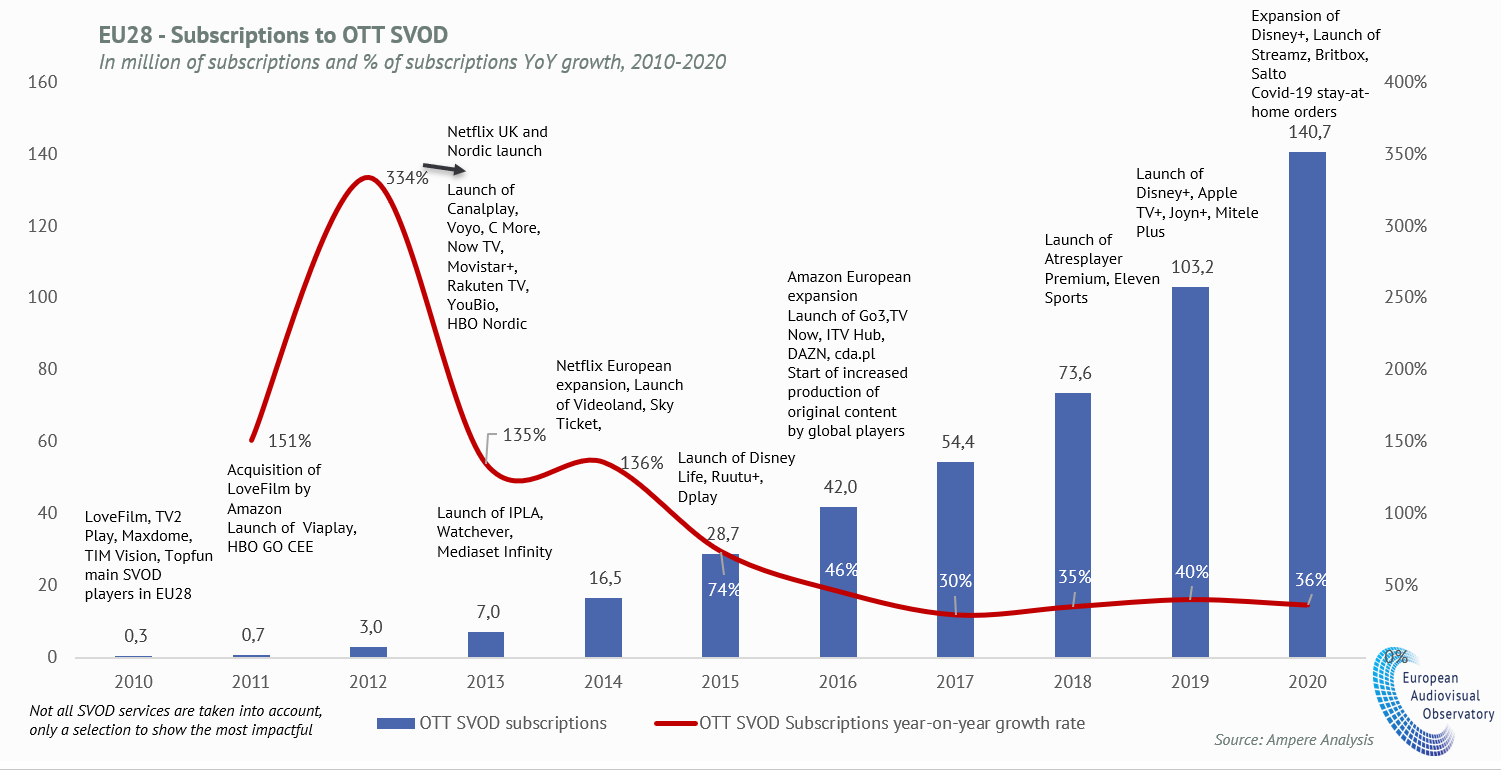

Multiple service launches over the past 10 years

- The growth in SVOD revenues was driven by multiple service launches over the past 10 years and rapid consumer adoption in Europe, with OTT SVOD subscriptions passing from 300 000 subscriptions in 2010 to over 140 million in 2020.

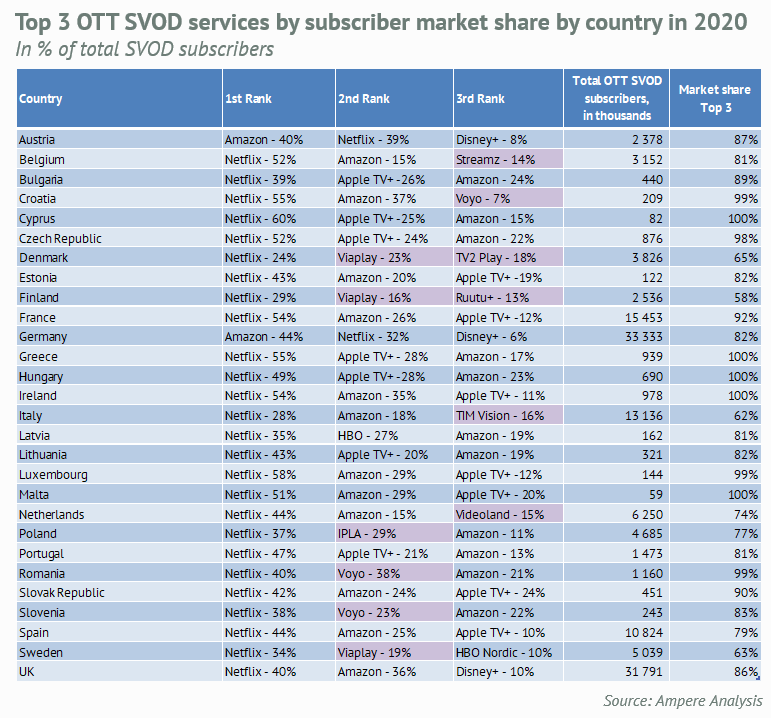

Non-European players dominate the SVOD market, as opposed to legacy landscape

- On the traditional audiovisual sector, European TV players dominated their national market. With the shift to direct-to-consumer SVOD streaming services, and the entry of global tech, US studios and entertainment players into EU national markets, the old market equilibrium is changing and new entrants dominate the EU SVOD market.

Purchase of films online will overtake rentals

- The growth on the TVOD market was driven by an steady increase in retail and rental revenues, from EUR 377 million in 2010 to EUR 1.87 billion in 2020, with retail revenues soon to surpass rental revenues in the coming years as digital purchases of recent theatrical films becoming more popular with EU consumers.

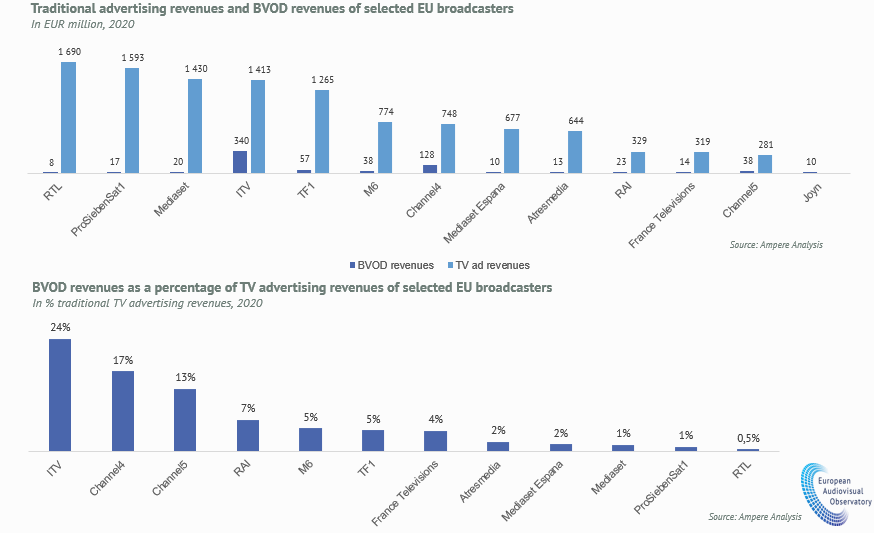

Advertising financed VOD (AVOD) set to skyrocket

- While the AVOD/BVOD market is still in its infancy in Europe and only represents a fraction of traditional TV advertising revenues for most commercial TV players, the sector is set to rapidly increase in revenues as new AVOD players enter the EU market and advertisers shift their advertising expenses online to reach consumers who are increasingly spending viewing time on advertising-financed services.

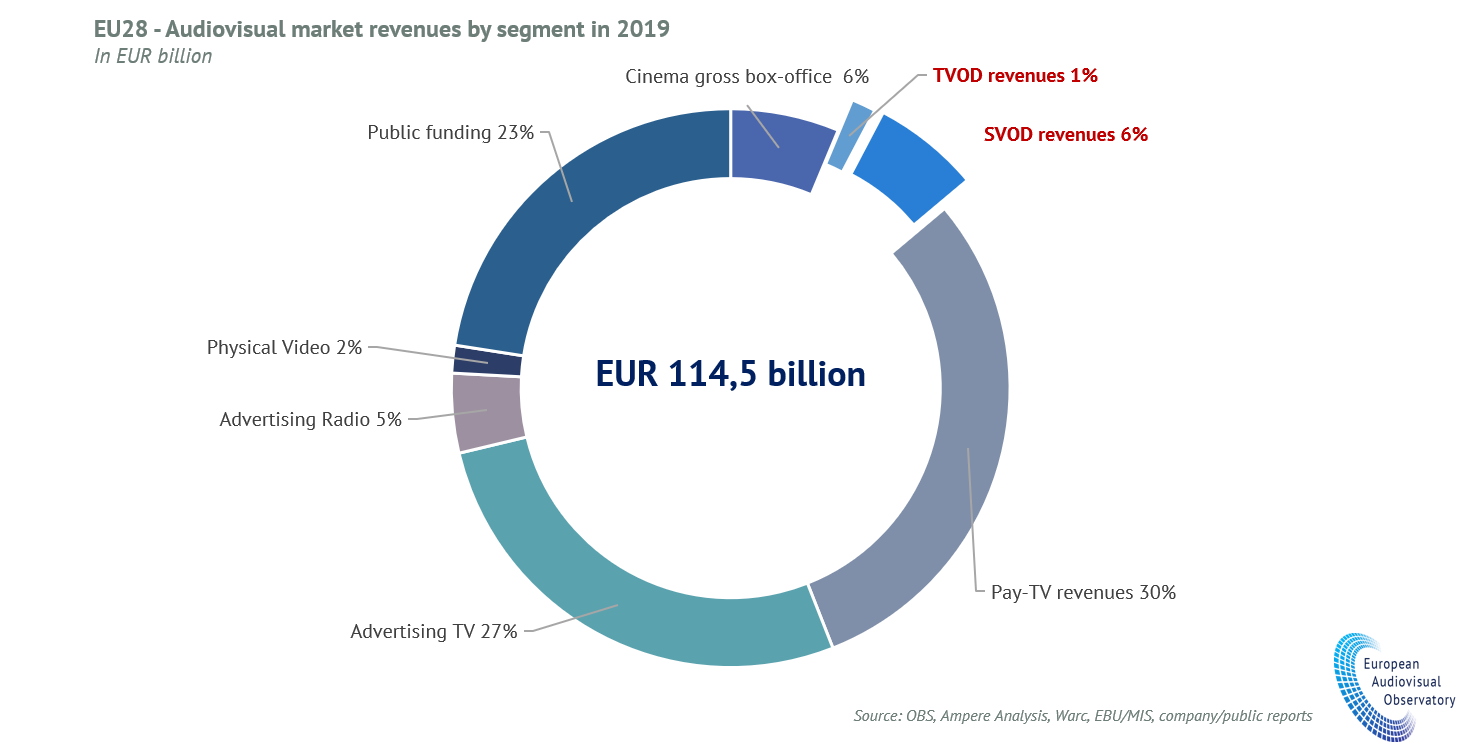

Paid VOD revenues set to increase as percentage of total European AV market

- While paid VOD revenues are still a small fraction of total audiovisual revenues in the EU (7% of EUR 114.5 billion in 2019), this share is set to increase with profound changes happening on the audiovisual sector. The report explores these changes on the audiovisual market and their impact on the audiovisual sector in the EU