Download "Fiction film financing in Europe: Overview and trends 2016-2020" here

How are film budgets and financing structures of European fiction films evolving over time?

How did the key financing sources develop between 2016 and 2020?

The answers to these questions and more analytical insights are available in the latest Observatory report Fiction film financing in Europe: Overview and trends 2016-2020, which offers a first-time pan-European analysis of the year-by-year development of financing structures for the years 2016-2020.

Key findings include:

- Close to two-thirds of European films released between 2016 and 2020 had a budget of less than EUR 3 million.

- Median budgets of films produced in small markets increased noticeably over time, significantly reducing their gap with median budgets of films produced in medium markets.

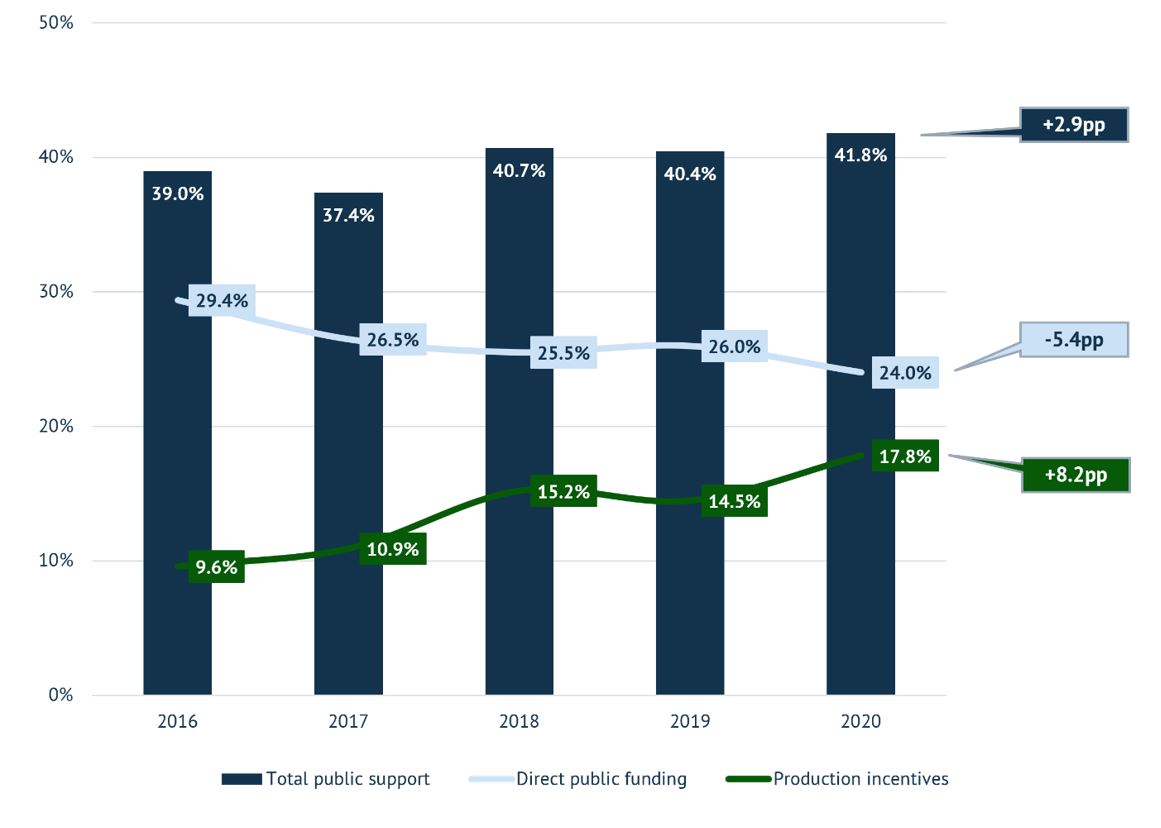

- Despite being the largest source of film financing for European fiction feature films, the share of direct public funding consistently decreased over the time period covered, accounting for 24.0% in 2020, compared to 29.4% in 2016.

- In contrast, the share of production incentives increased significantly, from 9.6% of total financing in 2016 to 17.8% in 2020. This increase stemmed primarily from the growing role of production incentives in medium and large markets.

- The growth in the importance of production incentives as a financing source of European films outweighed the decrease in the share of direct public funding. As a result, the financing share of total public support slightly increased from 39.0% in 2106 to 41.8% in 2020. Films with budgets over EUR 5 million (super-high-budget films) registered the highest increase in public support.

- The importance of broadcaster investments as a financing source declined in large markets. The drop affected first and foremost films with budgets over EUR 3 million.

- The importance of pre-sales and producer investments remained comparatively steady over time.

The sharp increase of production incentives offset the decrease of direct public funding, causing total public support to slightly increase between 2016 and 2020.

Development of shares of total public support by financing source: 2016-2020

In % shares of annual aggregate financing volumes

Source: European Audiovisual Observatory

Methodology

This analysis is based on a data sample comprising detailed financing plans for 2 490 European live-action fiction films - theatrically released / scheduled for release between 2016 and 2020 from 18 European countries. The data sample includes both 100% national films as well as European-majority-led co-productions. It covers a cumulative financing volume of EUR 8.12 billion. The data sample is estimated to cover 48% of the total number of European fiction films released between 2016 and 2020.