Download it here

This new report - Audiovisual media services in Europe: Supply figures and AVMSD jurisdiction claims – 2020 edition - provides an overview of the supply of services in the European audiovisual media landscape.

Based on the analyses of 2020 figures from the Observatory’s MAVISE database, this publication offers insights from two perspectives.

The first focuses on the supply of audiovisual media (AV) services in Europe, presenting figures for television (TV), on-demand services and video-sharing platforms available in and originating from the European markets. It also includes information on AV services aimed at non-domestic markets.

The second perspective looks at which countries and which legislation cover these services, in other words the jurisdiction claims made under the revised European Audiovisual Media Services Directive (AVMSD), including the criteria on which these claims are based.

The data available in MAVISE and used for this report are based on the contributions of the audiovisual regulatory authorities in the EU27, Albania, Armenia, Bosnia and Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, Norway, the Republic of Serbia, the Russian Federation, Switzerland, Turkey, the United Kingdom and Morocco.

Our report finds that, for 2020:

- 13 638 audiovisual media services were available in Europe. This included 10 839 TV channels, 4 803 (44%) of which were local TV services. This total figure also includes 2 799 on-demand services, 1 179 (42%) of which were pay on-demand services.

- More than half of all TV channels studied, including local TV, were freely available and one in three was accessible via terrestrial television. Two out of three pay on-demand services were subscription-based.

- One in ten TV channels originating from Europe was publicly owned or had a mixed ownership, while 3% of pay on-demand services were public.

- The United Kingdom, with 586 TV channels, remains the most prominent television market in Europe albeit with a small margin over the Russian Federation (524 TV channels) and the Netherlands (515 TV channels). Together, these three audiovisual markets account for over a quarter (28%) of the total share of TV channels (excluding local) originating from Europe.

- The leading European supplier of pay on-demand services was Ireland, with 188 services, leaving second and third place to France (141 services) and the United Kingdom (140 services). The concentration of these three market leaders in pay on-demand (a 41% share) was higher than in television (28% as mentioned above).

- Almost a quarter (24%) of all television services based in Europe were aimed at non-domestic markets. These were mostly based in the Netherlands, the United Kingdom, Spain and Luxembourg, with over 100 services in each territory. Two out of three of all TV services aimed at other markets came from one of these four countries.

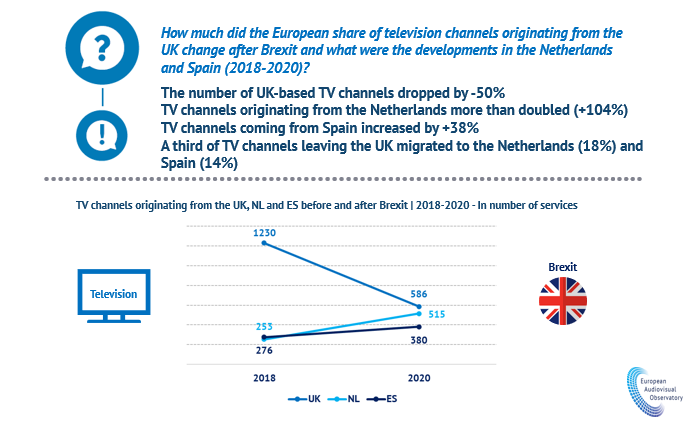

- Among the main hubs for TV channels serving other markets, the United Kingdom was the country most heavily affected by a migration of TV channels post-Brexit. Whilst the overall number of TV channels based in the United Kingdom more than halved between 2018 and 2020, the number of channels aimed at non-domestic markets dropped even more (e.g. -58%), suggesting that the migration of TV channels largely focused on these services.

- The biggest winners in the migration of TV channels were the Netherlands whose numbers more than doubled and Spain, whose TV channels rose by +38% from 2018 to 2020. A third of all TV channels migrating from the UK between 2018 and 2020 went to the Netherlands (18%) and Spain (14%).

- Among the European Economic Member States, the highest number of jurisdiction claims were made under AVMSD Article 2 (3) lit. a) with a total of 8 755 claims. Italy was by and large the country with the highest number of jurisdiction claims (1 707) for audiovisual media services and video-sharing platforms made under AVMSD jurisdiction. Together with the Netherlands (882 claims) and Spain (816 claims), the three countries accounted for 38% of all claims made under AVMSD jurisdiction.

MAVISE is a free access database on audiovisual services in 41 European countries and Morocco. It allows interactive searches of the registries of the European audiovisual regulatory authorities and the exporting of results. Moreover, MAVISE serves as a centralized database providing information on the country of jurisdiction of television channels, on-demand services and video sharing platforms available in the European Union, pursuant to the Audiovisual Media Services Directive 2018/1808.

The MAVISE database, managed by the European Audiovisual Observatory, is supported by the CREATIVE EUROPE programme of the European Union.