Download "An analysis of European box office structure 2010-2022" here

How many US blockbusters and mid-tier films were on release in Europe in 2022 and how much lower was that number when compared to the past decade? How important are US blockbusters and mid-tier films for the European box office markets, i.e., which share of admissions is generated by these films? These are some of the questions addressed by the brand new Observatory report "An analysis of European box office structure 2010-2022", which analyses for the first time the composition of the European box office in terms of four film types: blockbusters, high-grossing films, mid-tier films and low-grossing films.

Key findings include:

- Fewer than 100 films sold more than one million tickets across Europe in 2022.

- The film offering in Europe is very diverse with over 12 000 films being registered to be on release in Europe (Europe refers to the 28 European markets for which there was a sufficiently high data coverage rate. Cumulatively these 28 markets are estimated to account for 99% of total estimated admissions in Europe) , 96% of which can be categorised as low-grossing films. (For the purposes of this report films have been categorised – based on the number of tickets sold per year – as one of the four following film types: blockbusters, high-grossing films, mid-tier films or low-grossing films.)

- However, the European box office is highly concentrated in terms of admissions, with the top 10 and top 20 films alone accounting for 34% and 48% of total admissions in 2022, respectively.

- Concentration levels were comparatively high in 2022, when compared to the past decade.

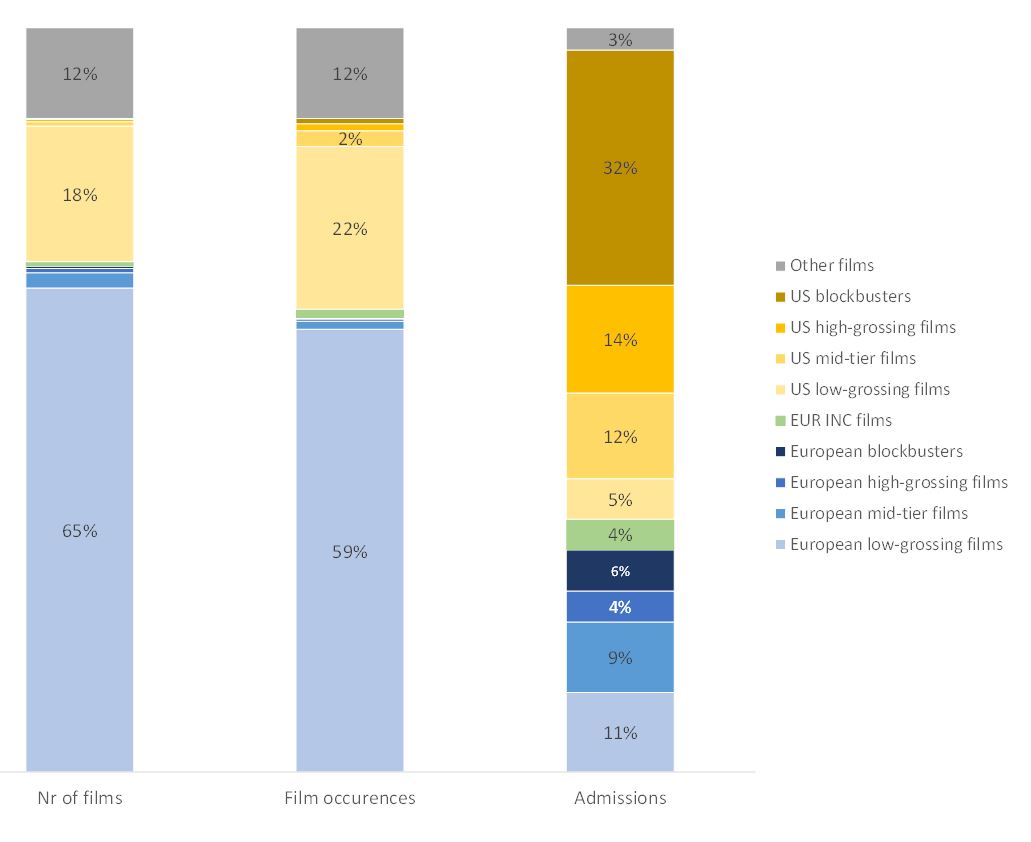

- US blockbusters stand out as single most important driver of admissions in Europe, accounting for an estimated 32% of all the cinema tickets sold in Europe in 2022.

- There are significant differences in both the box office composition as well as admissions concentration among individual European markets. For instance, in the UK and Ireland US blockbusters – also due their shared language - took 51% of total admissions, while in France they only accounted for 31%.

- Decreasing number of US mid-tier films causes admissions to mid-tier films to decline over time, as US films increasingly focus on blockbusters

- Almost 70% of admissions to European films stem from low-grossing and mid-tier films

- A total of 75% of cumulative admissions to European films were generated in their home markets, and 25% in other – non-national – European markets. While almost all admissions to European films qualifying as blockbusters or high-grossing films were generated in their home markets (93% and 95% respectively), almost half of the cumulative admissions to European low-grossing films were generated on non-national markets.

European low-grossing films dominate film offering, US blockbusters stand out in terms of admissions share

Composition of European box office market by film types and origin – 2022

Estimated; refers to the 27 European sample markets

Source : European Audiovisual Observatory