Download "Audiovisual services spending in original European content - a 2012-2022 analysis" here

This brand new report: “Audiovisual services spending in original European content - a 2012-2022 analysis ” has just been published by the European Audiovisual Observatory, part of the Council of Europe in Strasbourg. This report provides an analysis of investments made by broadcasting groups and streamers in original European content.

Key findings include:

- Spending on original content has increased faster than European audiovisual sector revenues, while at the same time sports rights spending is increasing sharply.

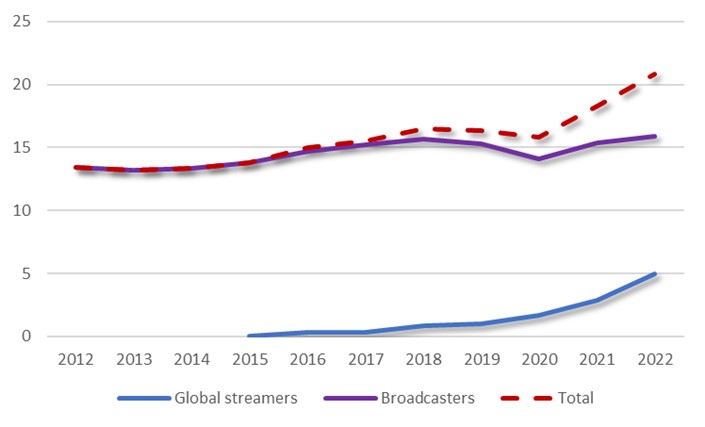

- Global streamers’ spending increased sharply in 2022 and accounted for 24% of all spending on European original content. But global streamer spending has not substituted broadcaster spending. On the contrary, broadcasters increased their spending, at least until the pandemic, faster than before the entry of the global streamers into the European market.

- Original content accounts for 35% of broadcaster spending, followed by sports rights and acquired programming, almost at par (28% and 26%, respectively). But sports rights are number one in terms of content spending for private broadcasters, and they grew significantly faster than any other category of programming.

- The share of scripted programming (excluding news) in streamers’ spending on original content has slightly decreased over time but scripted programming still accounts for the lion’s share (83%).

- The UK and Spain accounted together for 37% of global streamers’ spending on original European content. The share of global streamers in original content spending is particularly high in Spain (over 50%) and, to a lesser extent, in the United Kingdom, Italy, Denmark and Sweden.

Spending (excluding news) on European original content by category of players (EUR bn)

Source: European Audiovisual Observatory analysis of Ampere Analysis data