Download it here

This new report finds that:

- On the pay per view market (TVOD), the average iTunes catalogue includes around 24% of EU films of which 4% only are purely national productions. By comparison, the share of EU films on average in Microsoft catalogues is 17%, of which 35% are national;

- For subscription VOD (SVOD), EU films have a share of 20% of the SVOD catalogues. For EU films, national films represent only 15% vs. 85% for EU non-national films;

- On pan-European services the catalogues available in the five biggest European countries (DE, ES, FR, GB, IT) have higher shares of national films.

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has just released this new report which gives a valuable overview of the composition of VOD catalogues in the EU. In total, 74 TVOD and SVOD catalogues are covered by this year’s report, with a focus on pan-European and multi-country services for TVOD catalogues:

- 4 pan-European and multi-country TVOD services corresponding to 47 different catalogues (Apple iTunes in 25 countries, Chili TV in 5 countries, Microsoft Film & TV series in 12 countries and Rakuten in 5 countries);

- 9 SVOD services corresponding to 37 different catalogues (Netflix in 27 countries, C More in 3 countries, Canal Play in France, Flimmit SVOD in Austria, HBO in Bulgaria, Horizon Go in the Czech Republic, Sky Now in the United Kingdom, Timvision in Italy and Horizon/ UPC Prime in Poland).

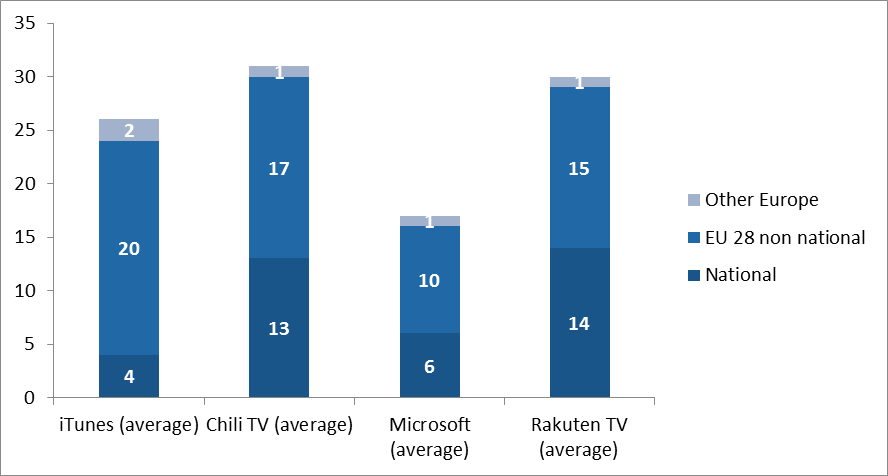

1. Pay per view video (TVOD)

Figure 1 – Share of EU28, national and other European films on the 4 TVOD services

The share of EU films proposed by the 4 TVOD services analysed ranges from 17% (Microsoft) to 30% (Chili TV). Each service offers a different share of EU national and EU non-national films. (see figure 1)

- Chili TV and Rakuten TV present similar characteristics as regards both the share of EU films (respectively 30% and 29%) and the weight of national films among these EU films (respectively 45% and 48%);

- The average iTunes catalogue includes a lower share of EU films (24%), of which 4% only are national films;

- The share of EU films on average in Microsoft catalogues is 17%, of which 35% are national films;

- The % of national films included in the total number of EU films shows that Chili TV and Rakuten tend to adapt their catalogues to each national market. It also indicates that a service covering a large number of countries, such as iTunes, can reach a certain level of EU films by including films from a given EU country in several catalogues – thus achieving a high rate of circulation of EU non-national films..

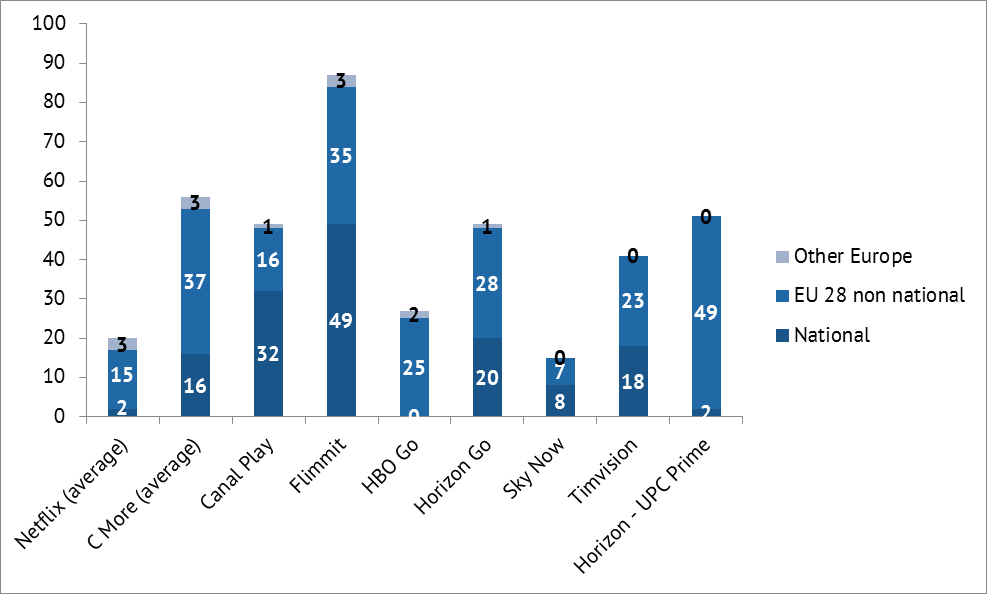

2. Subscription VOD (SVOD)

Figure 2 – Share of EU28, national and other European films on the 9 SVOD services

On average, EU films have a share of 20% of the SVOD catalogues. Out of all EU films, national films represent only 15% vs. 85% for EU non-national films. But the structure of each catalogue differs considerably.

- As regards the share of EU works: 15% for Sky Now and 17% for Netflix but 53% for C More, 48% for Canal Play or 84% for Flimmit

- As regards the weight of national films out of the total number of EU films: 12% on average for Netflix, 30% for C More, 67% for Canal Play or 49% for Flimmit.

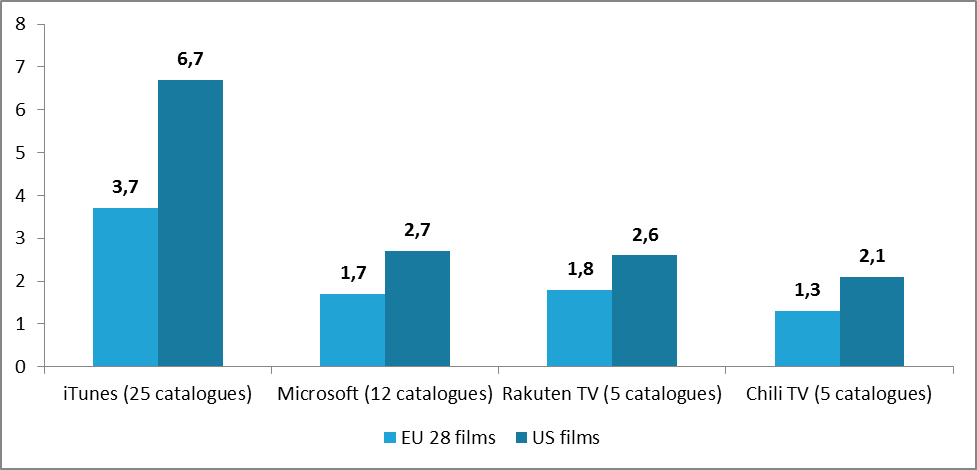

3. Pan-European and multi-country TVOD services:

Logically, the catalogues available in the five biggest European countries (DE, ES, FR, GB, IT) have higher shares of national films – showing that higher film production countries with a developed film industry rely more on national productions - while the smaller countries rely more on imports for their consumption of EU 28 films.

Figure 3: Average country catalogues circulation of film titles per region of origin

- EU 28 film titles got the lowest circulation in the 4 TVOD services’ catalogues: 3.7 country catalogues for EU28 titles in iTunes catalogues (total of 25 country catalogues), 1.7 for Microsoft (12 catalogues), 1.8 for Rakuten TV (5 catalogues) and 1.3 for Chili TV (5 catalogues). (Figure 3);

- US films circulated better: 6.7 for iTunes, 2.7 for Microsoft, 2.6 for Rakuten TV and 2.1 for Chili TV. (Figure 3).

4. Pan-European SVOD service, Netflix:

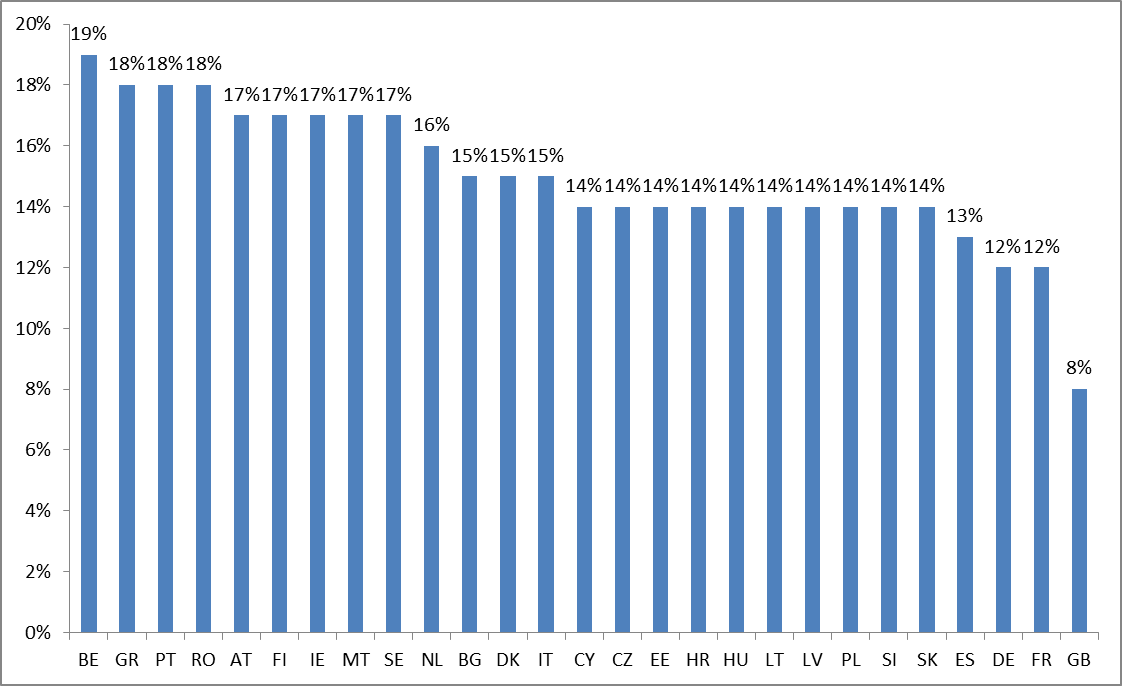

Figure 4: Netflix – Share of EU Non-national by country, in %

Source: European Audiovisual Observatory

On average, the % of national films out of all EU films shows that a service covering a large number of countries, such as Netflix, can reach a certain level of EU films by including films from a given EU country in several catalogues – de facto achieving a high rate of circulation of EU non-national films. (Figure 4)

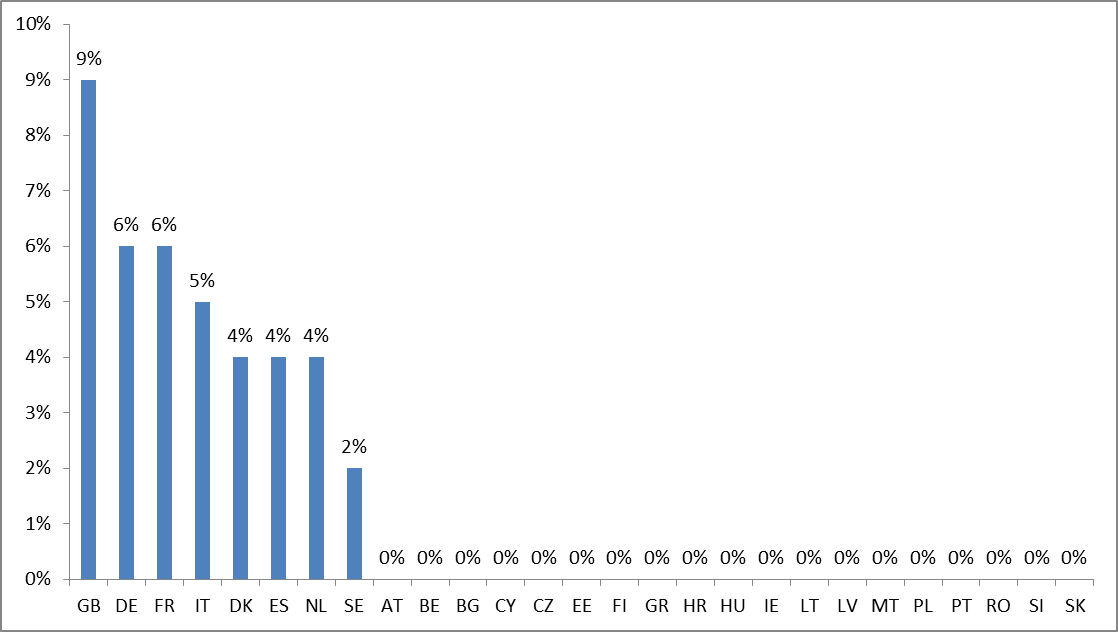

Figure 5: Netflix – Share of National films by country, in %

Source: European Audiovisual Observatory

Logically, the Netflix catalogues available in the five biggest European countries (DE, ES, FR, GB, IT) have higher shares of national films – showing that higher film production countries with a developed film industry rely more on national productions - while the smaller countries rely more on imports for their consumption of EU 28 films, with the notable exceptions of Denmark and the Netherlands. (Figure 5)

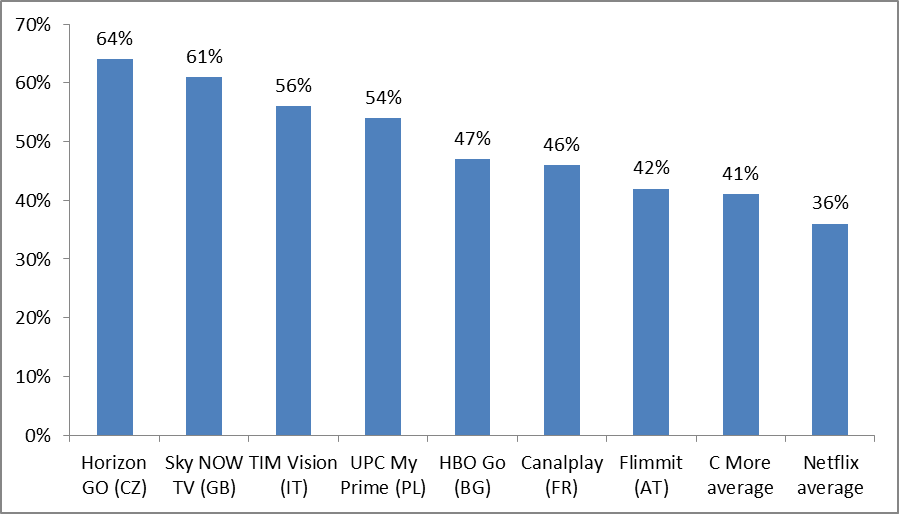

Figure 6: All SVOD services – Share of EU non-national co-productions, in %

Source: European Audiovisual Observatory

EU non-national films available on the SVOD catalogues are often co-productions. While co-productions represent 22% of films produced in Europe, they account from 24% (Flimmit) to 53% (Horizon – UPC Prime) of all EU films available. (Figure 6)