This new report finds that:

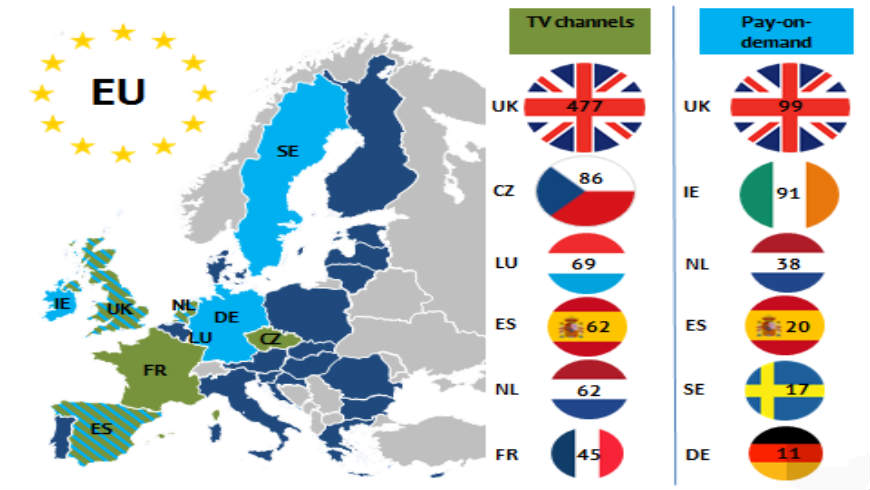

- The United Kingdom was still by and large in 2018 the most prominent audiovisual market in greater Europe (EU28 plus countries listed in the foonote)[1] with 1 230 TV channels and 201 pay-on-demand services established in the country, many of which were targeting other European audiovisual markets.

- The UK was also found to be the biggest contributor to the overall audiovisual services supply in the EU28. Around one quarter of all TV channels (28%) and pay-on-demand- services (24%) were established there.

- At the end of 2018, there were 11 123 TV channels (including 5 039 local channels) and 2 917 on-demand services[2] available in greater Europe.

- A total of 5 880 TV channels were established in greater Europe (excluding local channels), of which 4 470 were based in the EU28 and so were 968 pay-on-demand services (i.e. 853 in the EU28). Overall 4 838 TV broadcasting licences (excluding local licences) were issued (i.e. 3 555 in the EU28).

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has just published a brand new publication “Audiovisual media services in Europe: Market insights”. Based on data analyses of 2018 data from the MAVISE database, this publication provides an overview of the European audiovisual media landscape from three different perspectives. The first focuses on the supply of audiovisual media services in Europe, presenting figures for television and on-demand services available and established in the European markets. The second perspective looks at the access and distribution of AV services in Europe, noting the dominance of pay business models in the sector. The third perspective highlights the growing footprint of targeting audiovisual media services in Europe that serve non-domestic markets.

1. The United Kingdom is still the largest audiovisual market in greater Europe

- The United Kingdom was still by and large the most prominent audiovisual market in wider Europe with 1 230 TV channels and 201 pay-on-demand services established in the country, many of which were targeting other European audiovisual markets.

- The UK was also found to be the biggest contributor to the overall audiovisual services supply in the EU28. Around one quarter of all TV channels (28%) and pay-on-demand- services (24%) were established there.

- At the end of 2018, there were 11 123 TV channels available in Europe[3] of which 5 039 were local TV channels. Further, there were 2 917 on-demand services[4] available in Europe including services established outside of Europe which target the European markets; among these were

- 1 624 catch-up TV services, 1 081 pay-on-demand services and 212 free on-demand services.

- There were 5 880 TV channels established in Europe (excluding local channels) at the end of 2018, of which 4 470 were based in the EU28. European regulatory authorities issued 4 838 TV broadcasting licences (excluding local licences) of which 3 555 were issued in the EU28. Of the TV channels established in Europe 8% were publicly owned while 91% belonged to a private company and 1% had a mixed ownership (similar figures for the EU28); around 28% of TV channels were available in HD format and the same percentage had a catch-up TV service on offer; around 4% of TV channels had a time-shifted version (identical figures for the EU28).

- Of the 968 pay-on-demand services established in Europe 853 were based in the EU28; among these, just 2% were owned by public service broadcasting organisations and 1% had a mixed ownership.

Concentration of TV channels and pay-on-demand services established in the EU28 | 2018 - In number of services and % share

Source: MAVISE database 2018

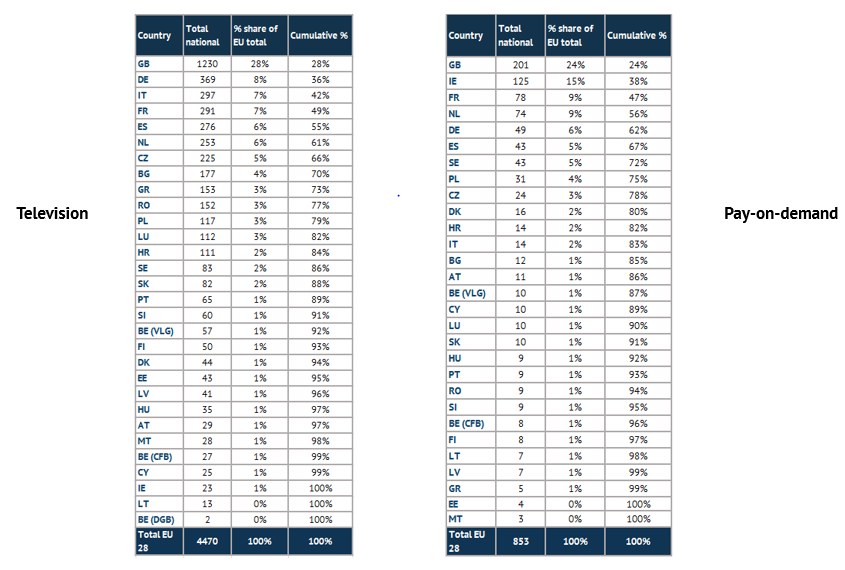

2. Pay business models dominate

- One out of five television services established in the Europe* by 2018 was accessible via digital terrestrial television (20%), and the rest could be accessed via cable, satellite, or Internet protocol television (IPTV).

- Most television channels were pay/or premium services while 41% established in Europe were available free-to-air. The results were similar for the EU28.

- The dominant business model for pay-on-demand services was subscription video-on-demand (SVOD) (59%), which came before transactional video-on-demand (TVOD) (41%).

Breakdown of TV channels established in EUR40 + Morocco by type of access and kind of licence | 2018 - In % share

Source: MAVISE database 2018

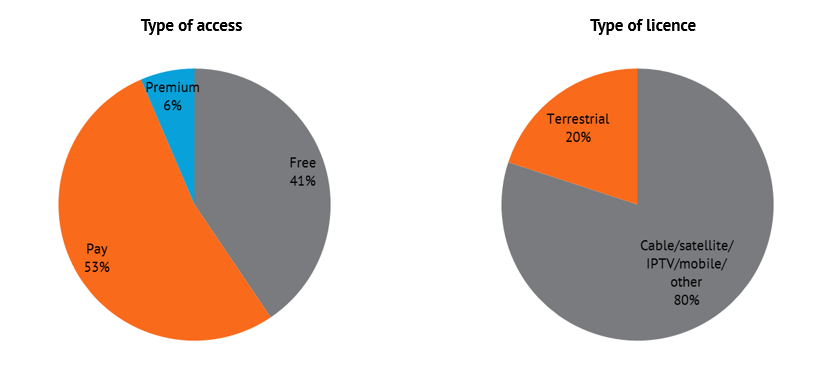

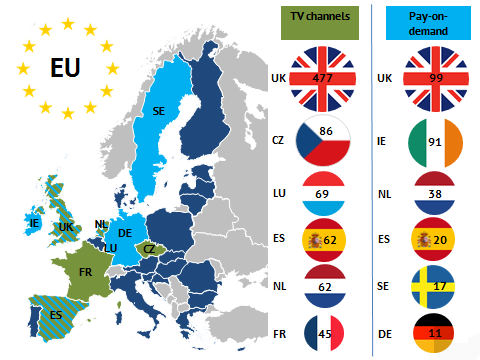

3. Growing footprint of audiovisual services targeting other markets

- As with television (i.e. Europe n=563; EU28 n=477), the United Kingdom was in 2018 by far the major hub for pay-on-demand services targeting foreign markets with a total of 130 services aimed at other European markets of which 99 were serving the EU28 alone.

- More than one fifth of all TV channels (21%; n=917) and over a third (36%; n=306) of pay-on-demand services based in the EU28 were specifically targeting other EU28 markets. In Europe* 19% (n=1136) of TV channels and 43% (n=413) of pay-on-demand services were serving non-domestic markets. They were predominantly owned by large broadcasting and entertainment corporations, the majority of which are of American origin.

- The United Kingdom, the Czech Republic and Luxembourg accounted for 69% of all TV channels targeting other EU28 markets, and so were 75% of pay-on-demand services based in the United Kingdom, Ireland and the Netherlands.

Top audiovisual media hubs primarily targeting other EU28 markets by country | 2018 - In number of services

Source: MAVISE database 2018