- EU gross box office bounced back and grew by 6.3% to a total of EUR 7.20 billion in 2019

- The Lion King and Avengers: Endgame topped the EU charts, selling more than 40 million tickets throughout the calendar year

- Market share for European films dropped to 26.9% as US blockbusters surged

- EU film production continued to grow to a total of 1 881 films produced

The figures in this press release are taken from the 2020 edition of FOCUS – World Film Market Trends, a report which is prepared each year for the Marché du Film. Journalists may request a PDF copy from Alison Hindhaugh

EU gross box office grew by 6.3% to EUR 7.20 billion in 2019

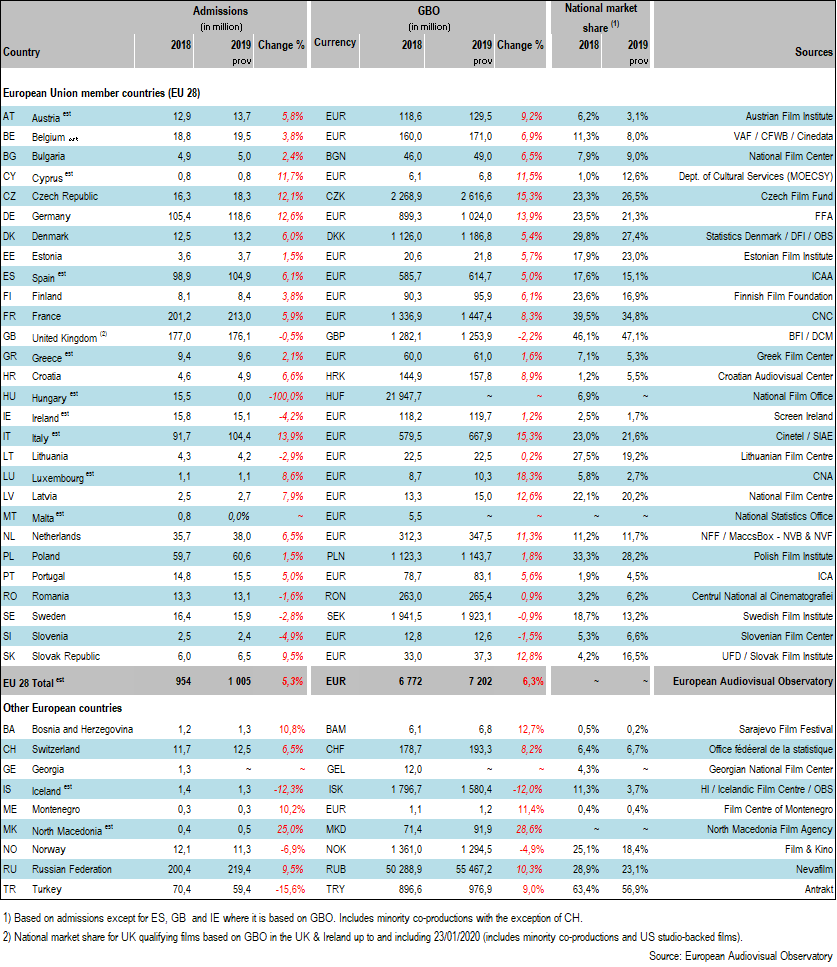

Having failed to pass the EUR 7 billion benchmark for the first time in four years in 2018, cumulative GBO in the EU Member States bounced back, growing by an estimated 6.3% to EUR 7.20 billion. That is EUR 430 million more than in 2018 and this figure– not adjusted for inflation - represents the second highest result since 2015. The increase in GBO was primarily driven by underlying growth in cinema attendance, which is estimated to have jumped by 5.3% from 954 million to over one billion tickets sold, as the average ticket price increased by 1.0% to EUR 7.2.

In contrast to previous years, GBO revenues developed fairly homogeneously across the EU, increasing in 21 and decreasing in only three EU territories, while remaining practically stable in two EU markets for which provisional data were available. Geographically speaking the growth in EU GBO was primarily caused by significant increases in Germany (+EUR 125 million, +13.9%), France (+EUR 110 million, +8.3%), Italy (+ EUR 88 million, +15.3%), the Netherlands (+ EUR 35 million, +11.3% and Spain (+EUR 29 million, +5.0%). Conversely, GBO measured in EUR declined somewhat in the UK (-EUR 21 million, -1.4%), Sweden (-EUR 8 million, -4.0%) and Romania (-EUR 1 million, -1.0%).

Outside the EU, Russian GBO jumped by 10.3% to RUB 55.5 billion, the highest box office recorded. For the third year in a row Russia turned out to be the largest European market in terms of admissions, just ahead of France. In Turkey, GBO revenues rose by 9.0% to TRY 977 million, marking a new record high in spite of a strong decline in cinema attendance (-15.6%), due to a strong increase in the average ticket price and high inflation.

The Lion King and Avengers: Endgame led the EU box office charts in 2019

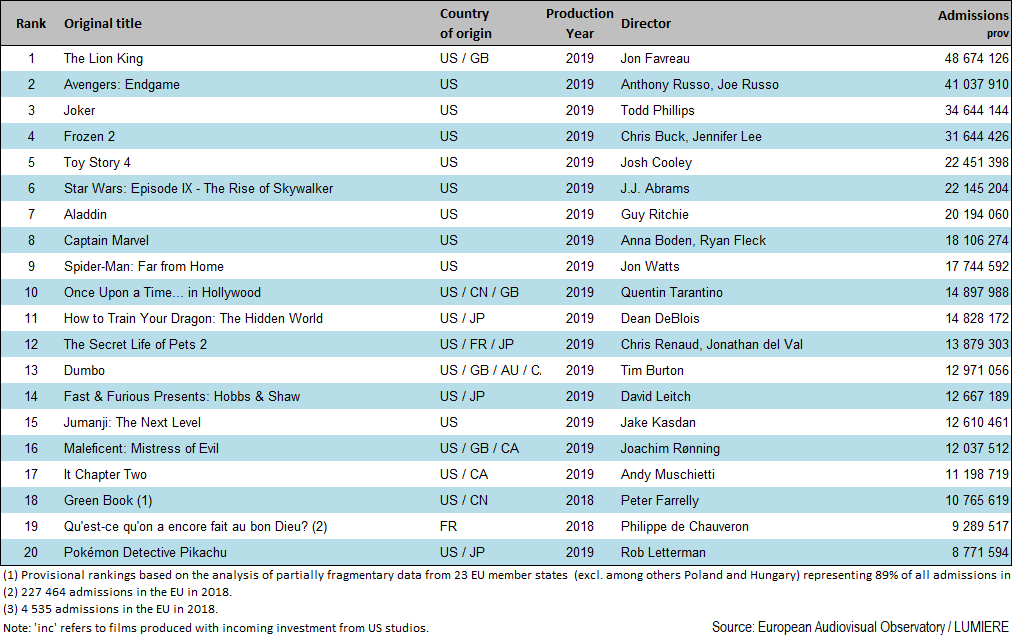

US studio titles performed particularly well in the EU in 2019, accounting for 19 out of the top 20 titles. Disney´s live-action remake of The Lion King topped the charts selling 48.7 million tickets in the 23 EU markets for which title-by-title admissions were available. It was followed by the latest instalment of Marvel´s Avenger franchise Avengers: Endgame with over 41 million admissions in the EU. In contrast to 2018, where only one title managed to sell more than 30 million tickets, there were therefore two blockbusters which passed the 40 million benchmark in 2019. Other successful titles include Joker (34.6 million), Frozen 2 (31.6 million), Toy Story 4 (22.5 million), Star Wars Episode IX (22.1million) and Aladdin (20.2 million). In line with previous years, 2019 saw a high prevalence of film franchises, with as many as 18 titles out of the top 20 (and 9 titles out of the top 10) being sequels, prequels, spin-off or reboots. Five films featured in the top 20 were family animation features, compared to four in 2018, six in 2017 and eight in 2016.7

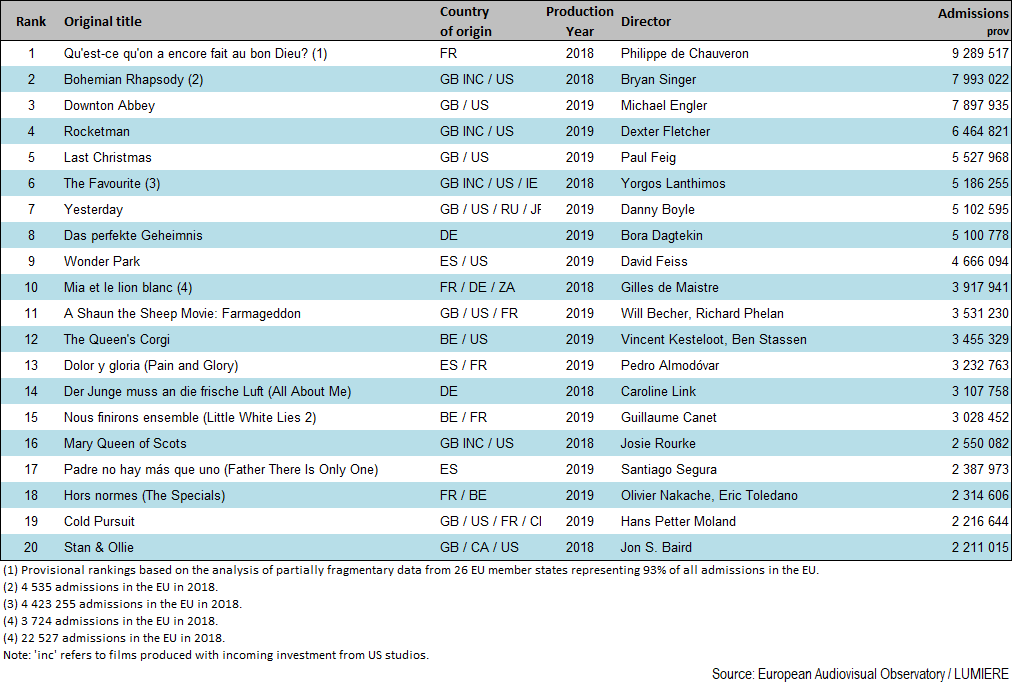

The French comedy sequel Qu'est-ce qu'on a encore fait au bon Dieu was the only non US films to feature among the top 20 titles, generating 9.3 million admissions and was the top European title in the EU for the year. It was followed by biopic Bohemian Rhapsody (produced with incoming US studio investment (EUR inc) which sold 8.0 million tickets), Downton Abbey (7.9 million) and biopic Rocketman (6.5 million).

Table 1: GBO, admissions and national market share in European countries 2018 – 2019 prov

Table 2: Top 20 films by admissions in the European Union in 2019 prov (1)

Table 3: Top 20 European films by admissions in the European Union in 2019 (incl. “EUR inc”) prov (1)

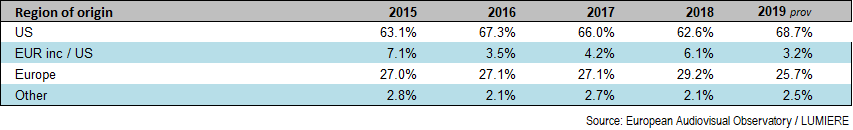

European market share dropped to 25.7% as US share surged

The surge in EU admissions was almost entirely driven by the comparatively strong performance of US blockbusters as admissions to European films produced in Europe with incoming US investment (EUR inc) actually declined. The estimated market share for US films therefore increased from 62.6% to 68.7%, the highest level observed since 2013, while the market share for European films in the EU decreased from 29.2% to 25.7%, the lowest level since 2005. Market share for films produced with incoming US investment (EUR inc) decreased from 6.1% to 3.2% while the estimated share for films from other parts of the world increased from 2.1% to 2.5%.

On a national level, local European films performed particularly well in the United Kingdom (47.1%), France (34.8%), Poland (28.2%) and Denmark (27.4%) and the Czech Republic (26.5%). Outside the EU, Turkey was once again the European territory with highest national market share (56.9%).

Table 4: EU market share by country of origin 2015 – 2019 prov

In % of total admissions. Provisional estimates.

EU film production volume continued to grow in 2019

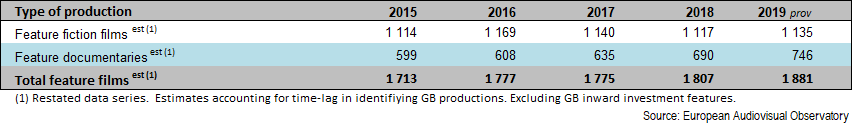

EU film production volume continued its longstanding growth trend as the estimated number of theatrical feature films produced in the EU increased from 1 807 to 1 881 films in 2019. EU film production volume broke down into an estimated

1 135 fiction films (60%) and 746 feature documentaries (40%). The increase in production activity continued to be driven by a growing number of international co-productions and feature documentaries.

Table 5: Number of feature films produced in the European Union 2015 – 2019 prov

Provisional estimates.

More detailed information on European as well as international theatrical markets can be found in FOCUS 2020 World Film Market Trends prepared by the European Audiovisual Observatory for the Cannes Film Market.

Notes for Editors:

- Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

- All 2019 figures are provisional.

European Union admissions rankings (Tables 2 and 3)

The pan-European film rankings shown in tables 2 and 3 are based on data from all European Union countries for which results have been stored in the LUMIERE database as of 31st May 2019. This database on admissions to films released in Europe is available online and free-of-charge, and is the result of collaboration between the European Audiovisual Observatory and various specialised national sources as well as the MEDIA Programme of the European Union. LUMIERE provides country-by-country admission data for about 49 000 films in distribution in Europe since 1996. Partial 2019 data for 33 European countries as well as the North American market is now available.

Market shares (Table 4)

The market shares shown in this figure are based on an analysis of results of films released in member states of the European Union for which admissions data for individual films are made available to the European Audiovisual Observatory. In order to draw up such market shares, a single 'country of origin' must be attributed to each film, an attribution that can prove difficult in the case of international productions. In these cases the Observatory's aim is to attribute a country of origin corresponding to the source of the majority financial input and/or creative control of the project. Since 2005 the Observatory has identified specifically films that have been produced in one or more European countries (or elsewhere) with US investment by using the reference 'inc' (incoming investment) in the country of origin attribution. It should be noted, however, that the availability of further information may occasionally lead to changes in the attribution of country of origin and that the origin of a film as attributed in the LUMIERE database may not always be identical with that indicated by national sources.

The provisional data on market shares in the European Union in 2019 shown in table 4 are based on the data on admissions to individual films as collected in the LUMIERE database on 31st May 2019. At this date the coverage rate of the database for admissions in the 23 European Union countries for which data is available was of around 89%. Due to various gaps in data collection and delivery in various countries, coverage of 100% of admissions is currently unachievable.

Number of feature films produced in the European Union (Table 5)

Estimating the total volume of production of feature films in the European Union remains difficult, chiefly due to the risk of double counting of co-productions and to differing national methodologies for the collection of this data. Included in the total for the European Union are feature-length films intended for theatrical exploitation, excluding minority co-productions and US and foreign production in the United Kingdom. For some countries no separate data are available for feature fiction and feature documentary films.

- The European Audiovisual Observatory has a virtual stand on this year’s Marché du Film online from 22 – 26 June and is organizing a live expert chat and showing a new documentary short on the subject: The audiovisual sector in the time of COVID- 19. This online panel takes place on Tuesday 23 June from 17.00 – 18.00 (CET).

- Register free online here